Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen reconciling Jan. I realized a journal entry was a duplicate from Dec. With Dec being closed and not having access to open it, to clear out the duplicate, can I reverse the journey entry with Jan date and check both sides to clear out? Currently the JE is 12/16/24 Dr. Cr. Maint. $1000. Op Acct. $1000. When reconciling Jan to clear it out do I... 01/01/25 Dr. Cr . Op Acct $1000. Maint. $1000. Thank you in advance for your response

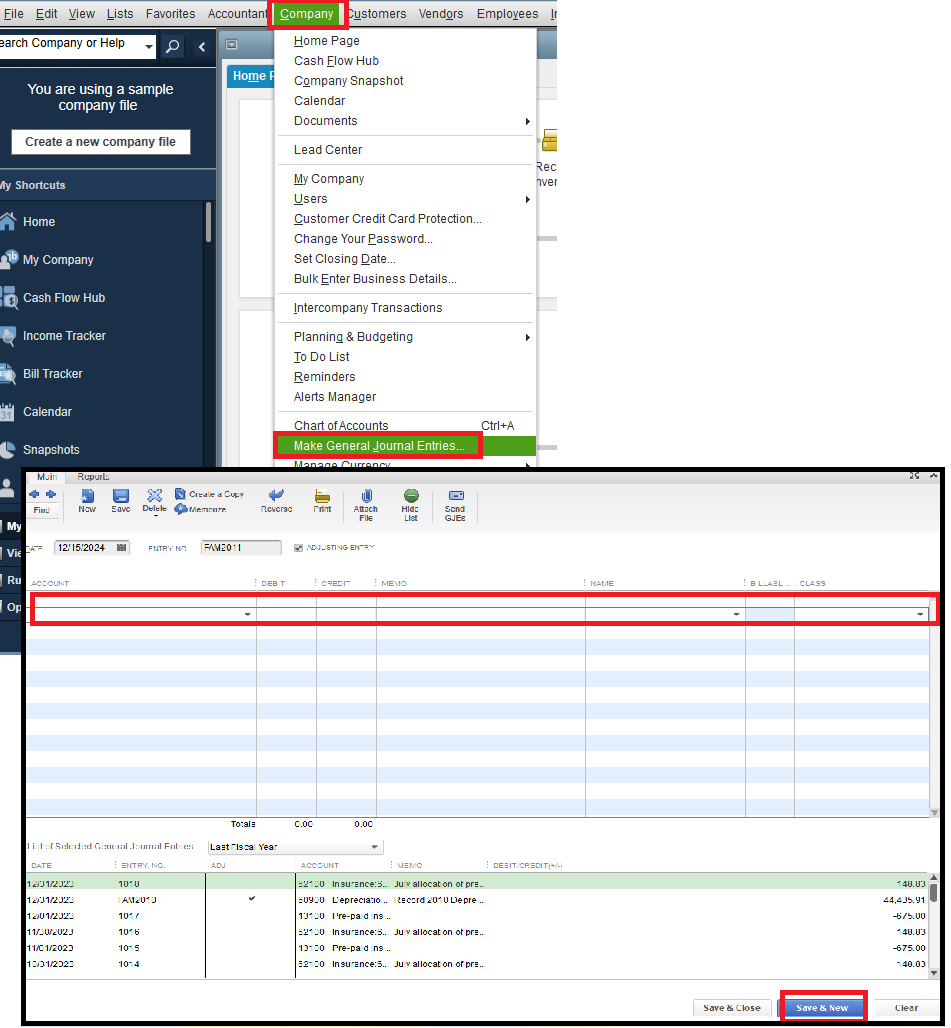

Yes, you can create a reversal journal entry to address the duplicate entry from last December, @KB001. Let's work together to explore this solution and optimize your journal entry records for efficiency.

To effectively address the double entry from December, you can create a reverse journal entry dated in January to ensure the accuracy of your financial records. Before proceeding, ensure that you back up your company file to keep a secure copy. It’s also advisable to consult your accountant to accurately manage the debits and credits, as well as any affected accounts.

Here's a step-by-step guide to assist you in reversing the entry:

For further guidance on managing the process, please refer to this article: Create a journal entry in QuickBooks Desktop for Windows or Mac.

Additionally, to assist you in reconciling your accounts seamlessly, consider using this resource: Reconcile an Account in QuickBooks Desktop.

Your commitment to accurately tracking and recording your financial data in QBDT is commendable, and I'm eager to assist you further in managing your business records, @KB001. If you have any questions about journal entries or account reconciliation, please click the Reply button below. Our Community is always ready to help.

"can I reverse the journey entry with Jan date and check both sides to clear out?"

Yes. Just go to the journal entry and click on 'Reverse' at the top. As long as you choose a date in the current, open period, you can save it.

Got it....thank you!

Great...thank you!

Great, thank you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here