Hello there, @fgorog.

Welcome aboard to the Community. I can help provide information about entering bad checks in QuickBooks Online.

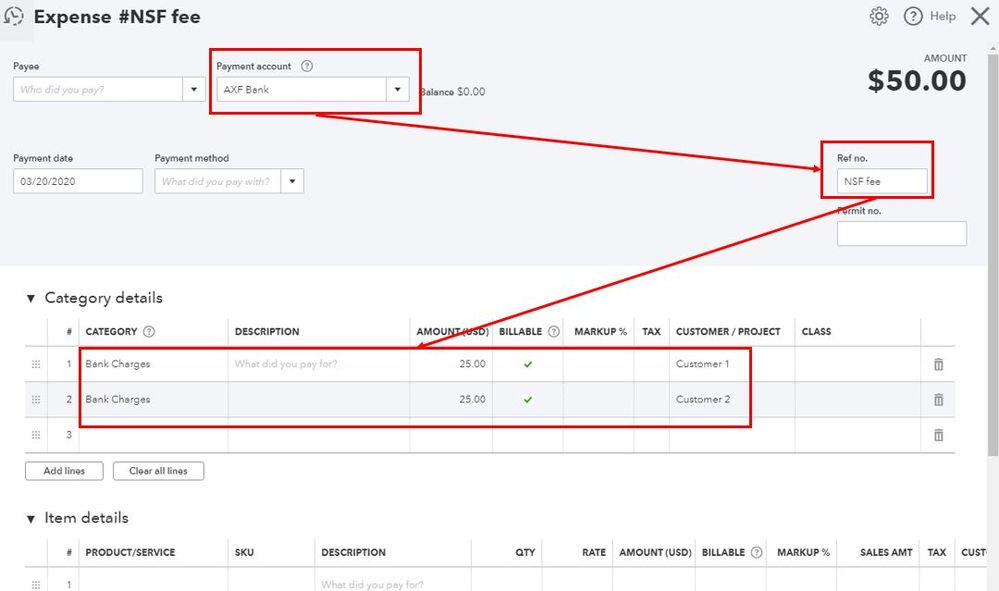

You can use the Expense feature to record the bank service charge for the bounced check. To answer your question, yes, you can add two separate for each customers and use the Bank Charges as your expense account.

Here's how:

- Click the + New button and select Expense under Vendors.

- Under Payment account, select your bank.

- In the Payment date field, enter the date the check bounced.

- Enter NSF fee in the Ref no. field.

- Under Account details, select the Bank Charges expense account from the drop-down list in the Account field.

- Enter the amount your bank charged you for the bounced check in the Amount column.

- Below the Customer/Project column, add the customer name.

- Repeat steps 5,6, and 7 for the other customers to split the charge.

- Select Save and close.

Since these fees are charged to your customers, you can mark each lines as billable. Also, I suggest seeking expert advice from an accountant to ensure they are recorded properly.

I've included an article you can use to handle returned or bounced check: How to enter a returned or bounced check using Write Check.

Please know that I'm just a post away if you have any other questions. Have a great day ahead.