Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm glad to see you in the Community @matt203.

I can help with this. You'll simply want to record the advance payment and leave it as a credit, so it can be recorded accurately when you need it. Here's how:

This will record payment, and it will stay as an available credit. As soon as your inventory arrives and you will create an invoice you can click apply credits in the upper right corner of the invoice, and apply it to the invoice.

I'd love to hear how this goes. I'm here if you have additional questions on this, or anything else. Take care!

Thanks for the reply.

The second part to this question would be, how can we create a vendor's invoice without adding product quantities to our inventory?

When our vendor invoices us, the products usually don't arrive for two months. We'd like to create an invoice that we can pay advance payments toward, but we don't want to add these products to our inventory until we receive them.

Any suggestions?

I'll be happy to help share how you're able to vendor's invoice without the inventory, @matt203.

You can create an expense with your Accounts Payable account as the source or line item in it. This way, it'll post the advance payment directly into your vendor's profile or account without adding any of your inventory products. I'll show you how.

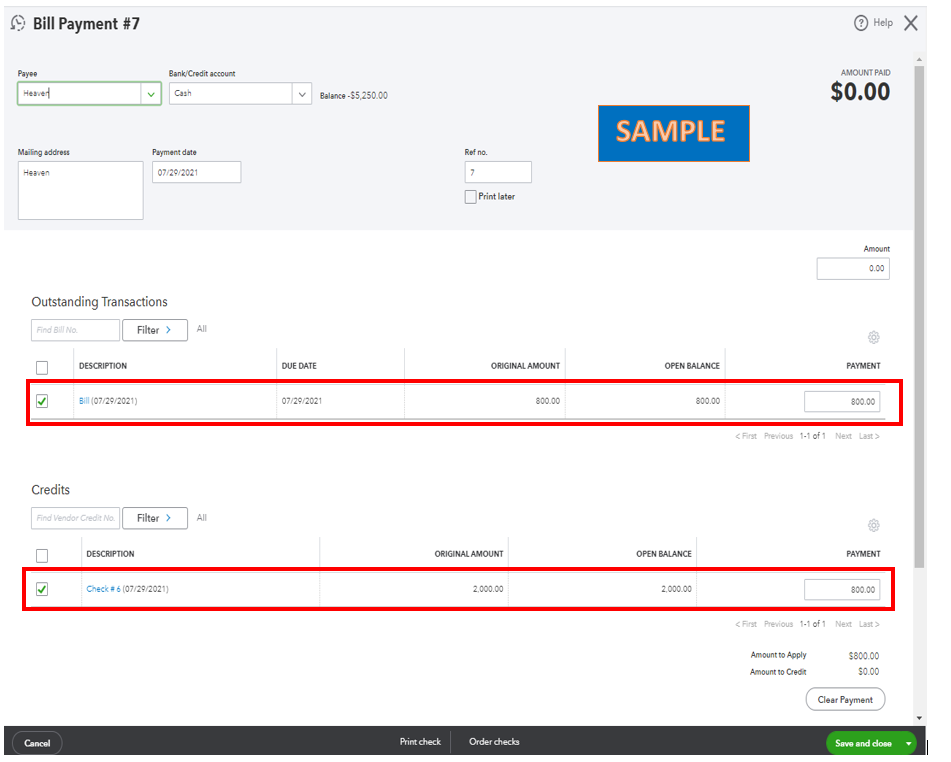

From here, create the vendor's invoice or bill accordingly once you need to receive the inventory products. Then, this is how the bill payment looks like when linking it to the recently created advance payment.

You may also read this reference that'll help understand the difference of the vendor transactions you can use: The Difference Between Bills, Checks, and Expenses in QuickBooks Online.

If you have other concerns about recording the payment and receiving inventory products, please let me know. I'm just around ready to lend a helping hand. Take care always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here