Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and accounting

- :

- How do I bill reimbursable expenses. They were incurred on my company CC and will be billed and paid by a third party?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I bill reimbursable expenses. They were incurred on my company CC and will be billed and paid by a third party?

A) When the charge is downloaded from CC do what account do I charge it. B) When I invoice it to third party where do I charge it?

Solved! Go to Solution.

Labels:

Best answer June 01, 2021

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I bill reimbursable expenses. They were incurred on my company CC and will be billed and paid by a third party?

Hello, Mark.

I'd be happy to help you record the reimbursable expenses incurred on your company's credit card.

You'll want to turn on the Billable Expenses feature first. Then, record the credit card expenses normally. Finally, bill it to the third party using an invoice.

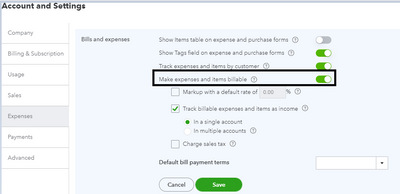

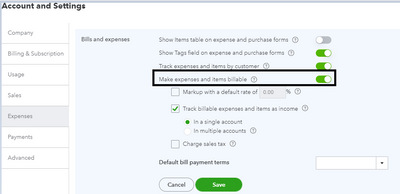

To turn on Billable Expenses:

- Go to the gear icon, then select Account and Settings.

- Click the Expenses tab.

- Expand the Bills and expenses section, then toggle Make expenses and items billable to On.

- Toggle any other billable options you need.

- Click Save then Done.

Before anything else, you'll want to add a customer profile for them if you haven't done it already.

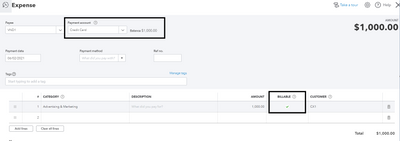

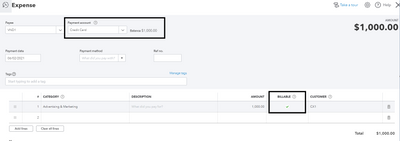

Next, record the credit card expense:

- Click the + New icon then select Expenses.

- Ensure you've selected the credit card account under Bank account.

- Add the details of the purchase.

- Under Billable, check the box to mark it as billable then map their customer profile.

- Once done, click Save and close.

Regarding the category, you'll want to select the expense account according to the purchases. I recommend consulting an accountant so you'll be guided on what account to use.

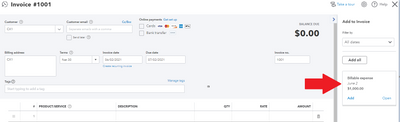

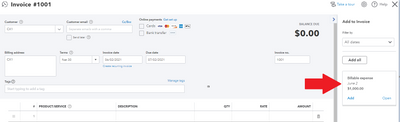

To record the invoice, click the + New icon then select Invoice. Add their customer profile under Customer.

You'll be prompted to add the Billable Expense Charge transaction at the right panel. Add it to the invoice and enter any other important transaction details. Click Save and close afterwards.

After recording the invoice (and the payment), you'll want to pay the credit card charge.

Regarding the downloaded charge, you'll simply want to match it to the downloaded credit card transaction. This article can help you with the process: Categorize and match online bank transactions in QuickBooks Online.

If you'd like to learn more about billable charges, you can check this article: Enter billable expenses.

Ready to reconcile your credit card account in QuickBooks? Feel free to check out this article for a guide: Reconcile an account in QuickBooks Online.

Do you have any other questions about billable expenses? Please let me know and I'll guide you through another process. If you have any other questions about QuickBooks Online, add them to your post and I'll help you out.

1 Comment 1

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I bill reimbursable expenses. They were incurred on my company CC and will be billed and paid by a third party?

Hello, Mark.

I'd be happy to help you record the reimbursable expenses incurred on your company's credit card.

You'll want to turn on the Billable Expenses feature first. Then, record the credit card expenses normally. Finally, bill it to the third party using an invoice.

To turn on Billable Expenses:

- Go to the gear icon, then select Account and Settings.

- Click the Expenses tab.

- Expand the Bills and expenses section, then toggle Make expenses and items billable to On.

- Toggle any other billable options you need.

- Click Save then Done.

Before anything else, you'll want to add a customer profile for them if you haven't done it already.

Next, record the credit card expense:

- Click the + New icon then select Expenses.

- Ensure you've selected the credit card account under Bank account.

- Add the details of the purchase.

- Under Billable, check the box to mark it as billable then map their customer profile.

- Once done, click Save and close.

Regarding the category, you'll want to select the expense account according to the purchases. I recommend consulting an accountant so you'll be guided on what account to use.

To record the invoice, click the + New icon then select Invoice. Add their customer profile under Customer.

You'll be prompted to add the Billable Expense Charge transaction at the right panel. Add it to the invoice and enter any other important transaction details. Click Save and close afterwards.

After recording the invoice (and the payment), you'll want to pay the credit card charge.

Regarding the downloaded charge, you'll simply want to match it to the downloaded credit card transaction. This article can help you with the process: Categorize and match online bank transactions in QuickBooks Online.

If you'd like to learn more about billable charges, you can check this article: Enter billable expenses.

Ready to reconcile your credit card account in QuickBooks? Feel free to check out this article for a guide: Reconcile an account in QuickBooks Online.

Do you have any other questions about billable expenses? Please let me know and I'll guide you through another process. If you have any other questions about QuickBooks Online, add them to your post and I'll help you out.

Log in today

Get expert help and peer support to tackle all your QuickBooks questions effortlessly.

Featured

Hi Community! Have you felt overwhelmed learning QuickBooks Online? Are

the...

Make your QuickBooks Online invoices, estimates, and sales receipts work

fo...