Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there, sndramaria,

In QuickBooks Online, 1099 amounts are comprised of all non-Credit-Card transactions recorded in the previous tax years. In order to change this amount, you'd either have to add, remove, or edit those types of transactions.

Here's how to do this:

After that, you can refer to this article: Prepare and file 1099s for the detailed steps on how to submit the form in QuickBooks.

Thank you for posting here in the Community. Don't hesitate to leave a comment below if there's anything else you need, and I'm glad to help you out.

Why would you edit a payment made?

Doing so will also mess up the reconciliation too, and the audit trail will show that edit

the contractor is in business, he sends you a bill and you pay it. The amount of the bill is reportable on the 1099 if it was paid by cash or check.

If he says he should not be reported for something he calls reimbursed expenses, then you need to get the original expense receipts from him, and enter those in your books. Both of you can not claim the same expense.

We need to edit a few of ours because we didn't start using QB until February.

Payments were being coded half way through the year to a new COA - Marketing. QBs isn't grabbing those numbers even though the same type of Chart of Account type and detail type is being used. Without going and changing any payments from last year, that have been reconciled, how can I change amounts or why is QBs not grabbing everything for that contractor?

I'll help you prepare your 1099s, urspolo1.

Let's make sure that COA - Marketing is mapped to Box 7 so transactions using this new account are included in the 1099. Here's how:

Check out these articles for more details:

Don't hesitate to tap on us again if you need more when filing the rest of the tax forms.

We are a small business still learning Quickbooks. Our company got invoiced from one of our 1099 contractors through their Quickbooks program. The contractor was not yet set up yet. The owner of the company went ahead and paid through the company checking account via debit card. The contractor has since been added to Quickbooks. How do I go back and add this payment for 1099 purposes?

Thank you,

Thanks for joining the thread, @Gandres1.

You can record these transactions as a regular check or expense in QuickBooks Online (QBO). Here's how:

Just make sure to select the boxes that represent the type of payments made to all of your contractors this year when preparing 1099s.

For additional info, please check out this article: Create and file 1099s with QBO.

Please don’t hesitate to add a comment below if you have additional concerns or questions about managing transactions for contractors. I’ll be here anytime to help. Have a good one!

Hi ReymondO,

Thank you for your response. Our company uses QBO Desktop 2021. Are you able to provide instructions for this version?

Thank you,

Thanks for coming back and clarifying the version of QuickBooks you're using, @Gandres1.

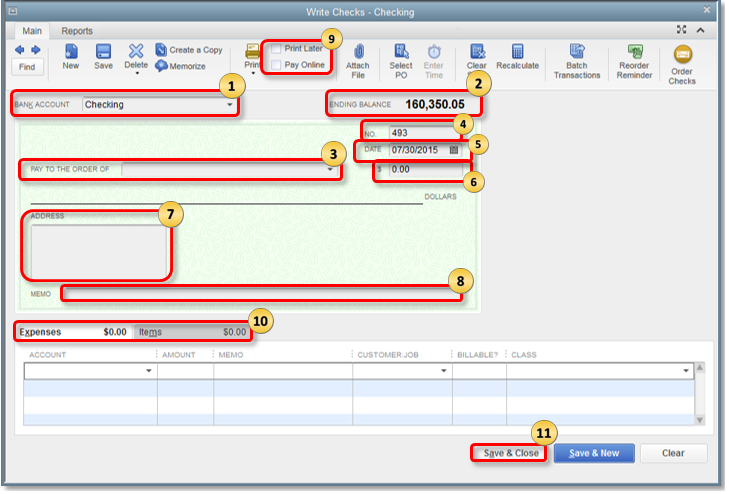

We can record these transactions as regular checks or expenses in QuickBooks Desktop. We use regular checks to pay for fixed assets, inventory and non-inventory parts, service, other charges, and any expense you track. You can also use this form to put money into a petty cash account or pay credit card dues. To write checks, go to the Banking menu and select Write Checks.

Here's an article you can refer to for more details about creating, modifying, and printing checks. To prepare and file your federal 1099s with QuickBooks Desktop, you can check out this article: Create and file 1099s with QuickBooks Desktop.

Keep in touch if you need any more assistance with this, or if there's something else I can do for you. I'll be standing by for your response. Have a great day ahead.

Hi RCV,

That info was super helpful and saved it for future reference. The amount paid to the 1099 contractor was by debit card. I created an expense account for this specific contractor. When I reconciled our bank statement I added the amount to that expense. The transaction is not listed under the vendor account or when I run the 1099 summary report.

Thank you,

Glad to know the info shared by my colleague is helpful, Gandres1.

I'm here to share some details about why the transaction is missing in the 1099 Summary report.

Payments to 1099 vendors made via credit card, debit card, or third-party system, such as PayPal, are excluded from the 1099-MISC and 1099-NEC calculations. The financial institution will be the one to report these payments, so you don't have to. Only those vendors you paid via cash or check should be reported, and only if the total of the payments is $600 or more.

For more details, please see this article: Understand which Payments are Excluded from a 1099-NEC and 1099-MISC.

Additionally, I've added these articles that'll help you learn more about preparing and filing 1099 in QuickBooks Desktop:

Please keep us posted if you have additional questions about the 1099 forms. We're always here to help you out.

Hi CharleneMae_F,

Thank you for the clarification. I honestly did read that somewhere but still was unsure. This is our first year filing 1099.

I have another question if I may. Is a 1099 Misc processed for shareholder withdrawal?

Thank you,

Hello there, Gandres.

For processing the 1099 MISC shareholder withdrawal, I suggest contacting our payroll support team where they can take a look at this.

You can reach them by following the steps below:

Lastly, you can read through these articles to further assist you with managing your 1099-related transactions:

Leave a comment below if you have other questions or concerns. I'm always here if you need anything else.

We set up QB this past year but didn't start using payroll until 2023. One of our contractors bought a house from the owners and the payment has been deducted from the checks. I need to add that back in as payment on the 1099 but have already set up the loan account so I can't have it as a payroll expense. I was hoping to just edit the 1099 amount but that doesn't seem possible. How can I amend the 1099 without adding expense to the company?

Hey Jackieat_home,

Thanks for reaching out to the Community! You would need to work directly with the IRS to make a manual amendment to your 1099 forms. Use these IRS instructions to do so. Once corrected, provide the corrected return to the recipient or contractor yourself.

Please let me know if you have any other questions! My team and I are here to help. Bye for now.

It does not anythihg to do with the threshold or not maping accounts correctly. It is simply not printing even when it should. Everything else is printing correctly exept the dollar amount.

@RCV We use accrual accounting practices. One of our Board Members purchased Marketing Supplies, provided a receipt, and was reimbursed. We need to exclude this amount from his 1099 without changing the expense account. How would we go about changing the 1099 amount? We have the same scenario for other receipt provided reimbursements, they are coded to an account that other Board Members have non-receipt reimbursements. We need to be able to exclude the receipt reimbursements from the 1099 total.

Your help is greatly appreciated,

Warm greetings, Justine. I understand that you want to exclude the receipt reimbursements from the 1099. I'm here to guide you and provide information.

To exclude the receipt reimbursements amount from 1099 without changing the expense account, you can change the payment method to a credit card, debit card, or third-party system, such as PayPal. I'd still recommend contacting your accountant to check if this is suitable for your business and for guidance. If you don't have one, you can find a professional through this link: https://quickbooks.intuit.com/find-an-accountant/.

Meanwhile, you can read the year-end checklist to wrap up this year's payroll. It includes essential tasks such as processing employee bonuses, preparing W-2 and 1099 forms, and verifying year-to-date totals for each employee.

Whenever you need me, I'm here to assist you. Click the reply button for further information associating to receipt reimbursement and 1099.

Oh, good idea. I will check with our CFO to assure the payment type does not disrupt the financial statements; I don't believe it will. I appreciate the quick and helpful advice. Kind regards,

Unfortunately the option of changing the Payment Method will not work. I thought I could simply change the "type" of payment, but that is not the case. I would have to change the account the payment was made from, which would through off the connection to the item from the bank feed. So this is not a viable solution either.

Does anyone else have a suggestion?

Thanks,

Thank you for the updates, JustineEFI. I can provide you with some instructions to solve your concern.

You'll want to create a new account in your Chart of Accounts and transfer the receipt reimbursement amounts to avoid including them from your 1099 total.

First, let's generate a 1099 Transaction Detail report to track the reimbursements. Here's how:

Next, let's create a new account on your Chart of Accounts where you need to transfer the refunds. To do this:

Then, once a new expense account is set up in your QuickBooks file, you'll need to use a journal entry to move the amounts from one account to another.

For more details, check out this article: Modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

I also suggest reaching out to your accountant for guidance and accurate recordkeeping.

Once everything's on track, I've added this link to help you prepare and file your 1099s: Create and file 1099s with QuickBooks Online.

I'm looking forward to getting this sorted for you. If there's anything else you need help with any payroll inquiries, kindly leave a reply. I'm here around the clock to assist you.

I have a similar question. We have a contractor who changed their tax status mid-year, so that payments for the first half of the year need to be on their 1099, but thereafter they are an S-Corp and those payments should not be included. Payments are all for the exact same expense/service, so we don't want to reclassify any of them to a different expense account. QuickBooks used to let you exclude certain payments from 1099s or even allocate individual payments between 1099 and non-1099. Why did they change it??? I hate that they presume what users *should* do when the situation is often more complex, or assume that users aren't capable of making these decisions. Help!

Hello jmartini74,

We understand how convenient it could be to be able to have the option to exclude payments.

While this option is currently unavailable, I'd recommend reaching out to the IRS so they can guide you accordingly on the best way to exclude the transactions.

Moreover, you can check this article on how you can create and file 1099: Prepare and file 1099.

Keep me posted whenever you have concerns about 1099.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here