Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Hello there,

I'm here to help share an option on how to record a non-refundable downpayment in QuickBooks Online (QBO).

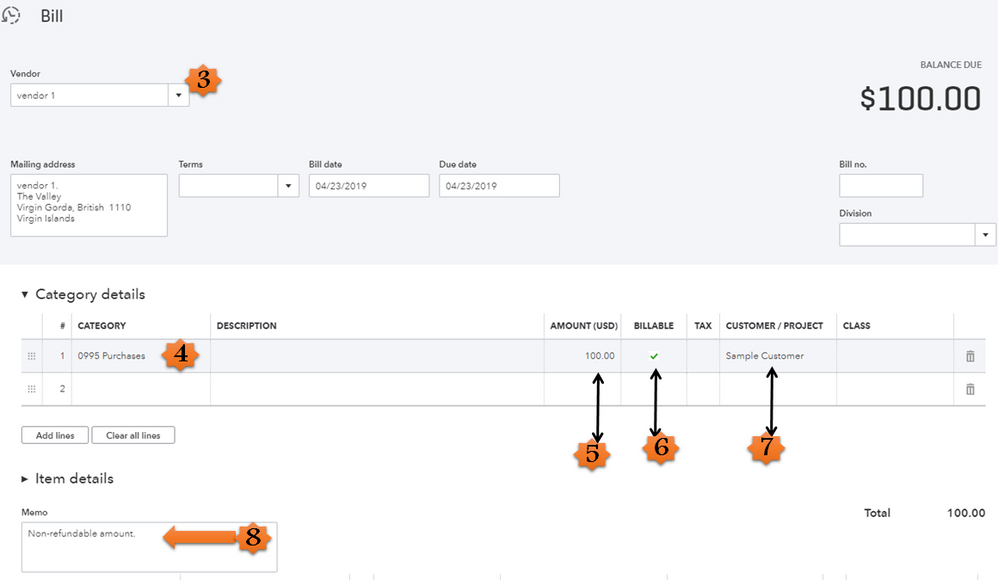

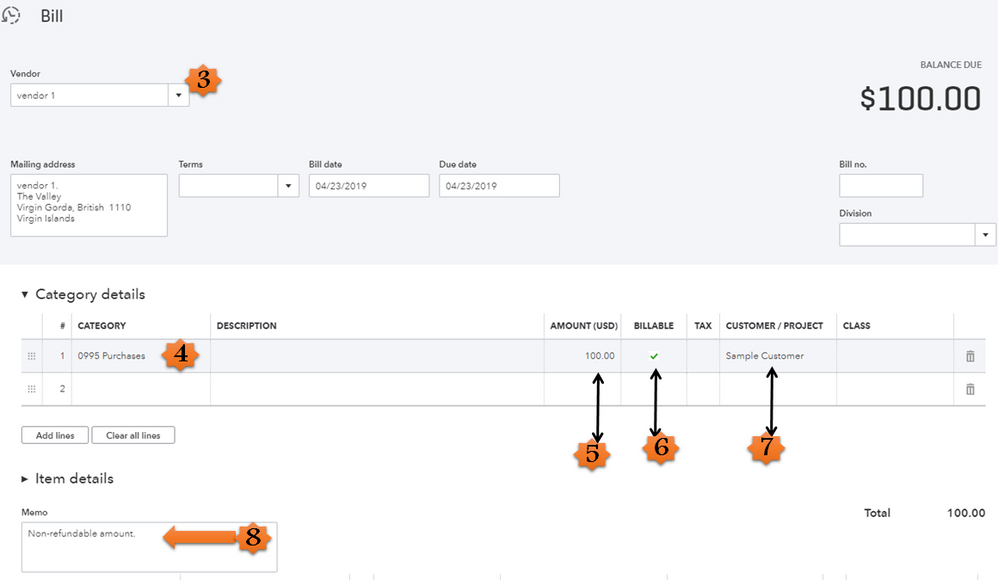

QuickBooks doesn't have an option to mark the Accounts Payable (A/P) as billable, what you need to do is create a bill or check for your vendor with the downpayment amount and mark it as billable to link with your customer. And since QBO cannot identify if it's a non-refundable, you can add a note on the memo field instead.

To create a bill, here's how:

If you'd like to write a check, you can visit this article for the detailed steps: How to write checks.

Once done, you can now create an invoice to the customer to link the billable bill/check you've created.

If you need further assistance with the steps, I encourage you to contact our QuickBooks Online Support so they can do a screen-share.

Here's how you can contact our customer support:

That should do it! Fill me in if you have additional questions about recording a downpayment in QBO. Wishing you and your business continued success.

Hello there,

I'm here to help share an option on how to record a non-refundable downpayment in QuickBooks Online (QBO).

QuickBooks doesn't have an option to mark the Accounts Payable (A/P) as billable, what you need to do is create a bill or check for your vendor with the downpayment amount and mark it as billable to link with your customer. And since QBO cannot identify if it's a non-refundable, you can add a note on the memo field instead.

To create a bill, here's how:

If you'd like to write a check, you can visit this article for the detailed steps: How to write checks.

Once done, you can now create an invoice to the customer to link the billable bill/check you've created.

If you need further assistance with the steps, I encourage you to contact our QuickBooks Online Support so they can do a screen-share.

Here's how you can contact our customer support:

That should do it! Fill me in if you have additional questions about recording a downpayment in QBO. Wishing you and your business continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here