Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Recording client fees in QuickBooks is my specialty, userjohn7. I'll gladly show you the way.

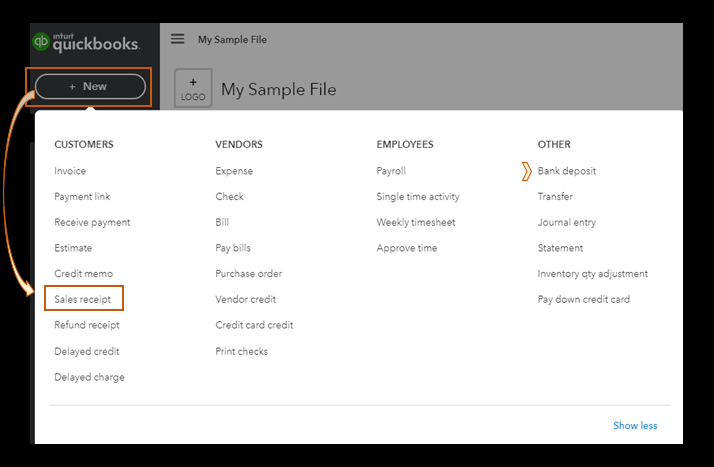

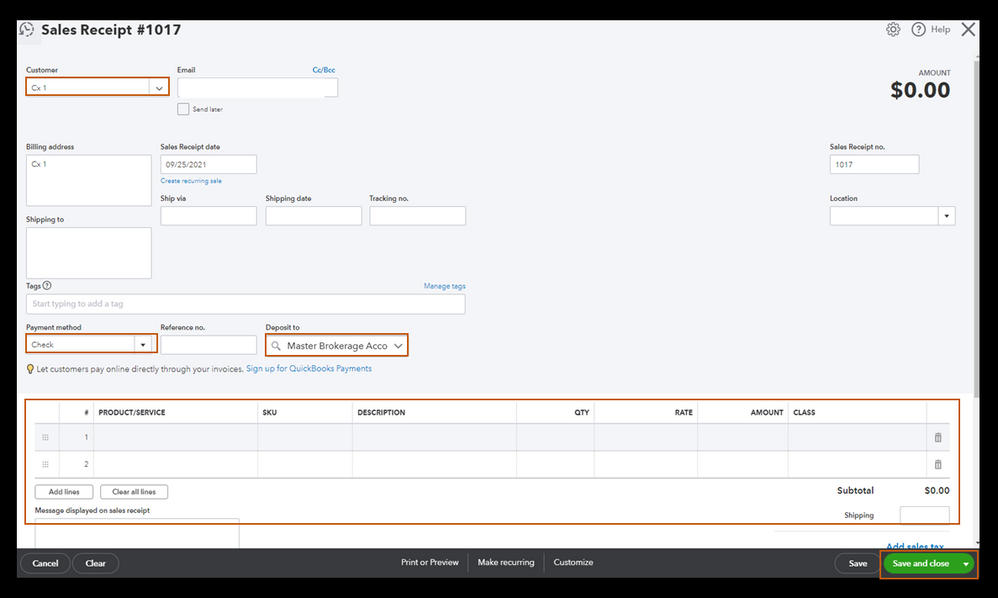

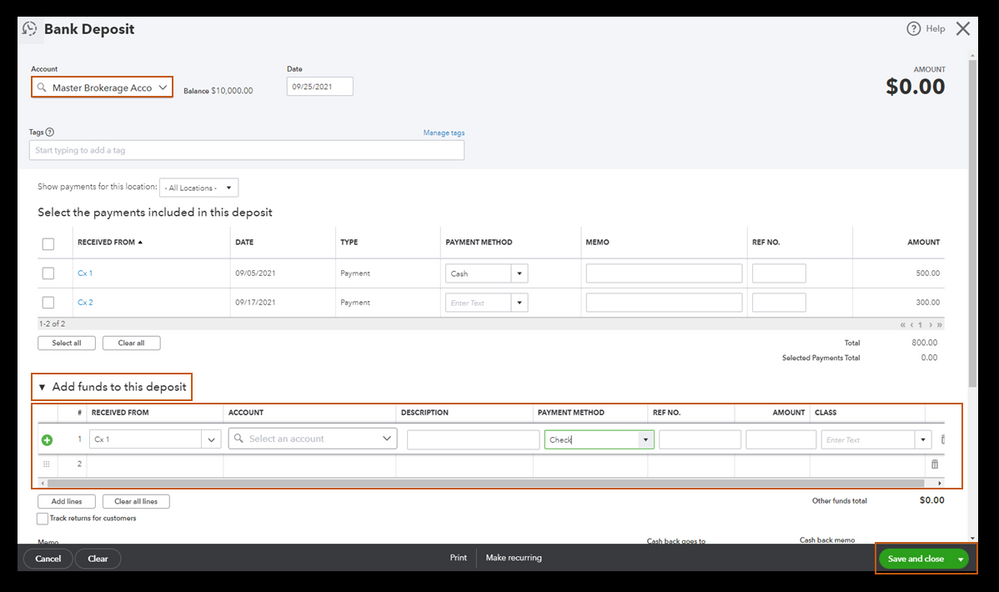

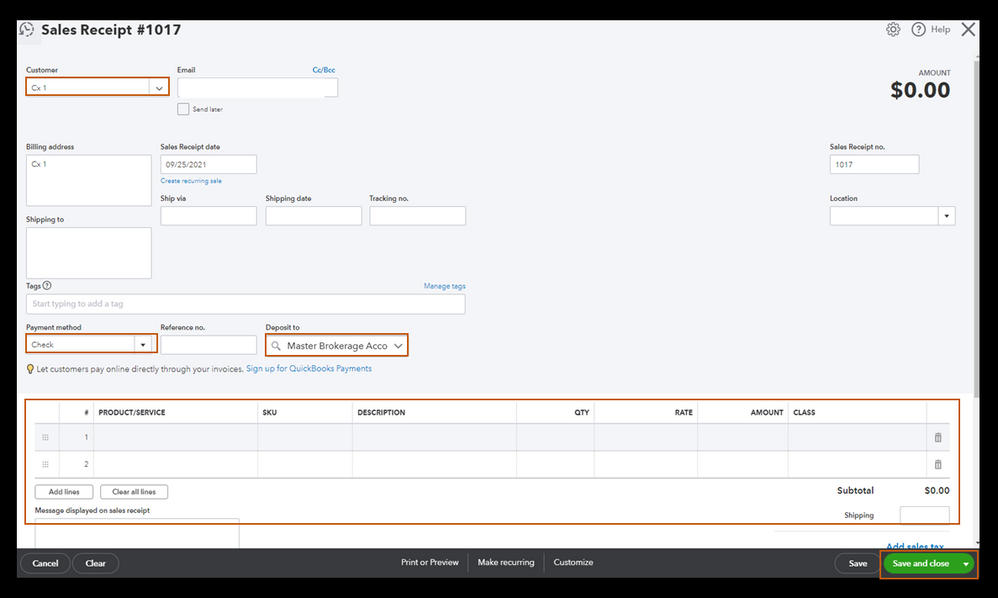

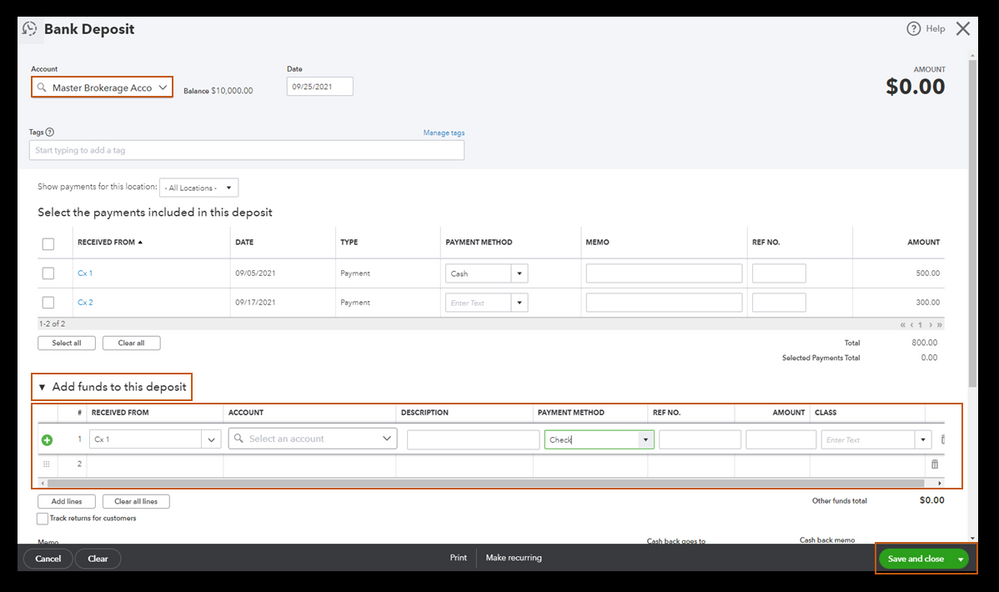

There are two ways to record the fees in the program. We can either enter them as sales receipts or bank deposits. I'd suggest checking the steps below to learn how.

Create Sales receipts:

Create Bank deposits:

Additionally, I've included these articles that'll help you view and manage your transactions in QuickBooks Online:

Please keep us posted on your progress in recording your client fees in QuickBooks, userjohn7. It's my priority to ensure your books are accurate.

Recording client fees in QuickBooks is my specialty, userjohn7. I'll gladly show you the way.

There are two ways to record the fees in the program. We can either enter them as sales receipts or bank deposits. I'd suggest checking the steps below to learn how.

Create Sales receipts:

Create Bank deposits:

Additionally, I've included these articles that'll help you view and manage your transactions in QuickBooks Online:

Please keep us posted on your progress in recording your client fees in QuickBooks, userjohn7. It's my priority to ensure your books are accurate.

Hey Charlene,

Thank you very much for that answer. I used the second method (the bank deposit). It seemed more intuitive. The results made sense to me.

Take care.

John

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here