Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy A/R aging report is cluttered by quite a few $0 balance customers because of offsetting JEs entered by a previous employee. How can I clear these so they do not show up on the aging report?

Solved! Go to Solution.

A journal entry that increases A/R will show up under Outstanding Transactions when you go to Receive payments (New > Receive payment). The credit will show under Credits. You can apply the credit there. Sorry about the confusion. Yeah, technically it's not an invoice but the journal entry is closed out the same way as an invoice.

Let’s find out how to delete journal entries in QuickBooks Desktop, @SSMGC.

In QuickBooks Dekstop, we have the option to delete journal entries.

In such cases, we delete the erroneous entry from the account. Deleting a journal entry allows you to remove it from your records and correct any inaccuracies. Nonetheless, deleting entries can have an impact on your financial data.

Follow the steps below:

A friendly advice. It is always advisable to consult with an accountant or bookkeeper before making any significant changes to your records in QuickBooks. Do you want to have one? Visit this article: The ProAdvisor Program.

In QuickBooks Desktop, you can monitor and manage your sales and expenses, customer, job, and sales reports. These reports are designed to provide you with valuable insights into your business's financial performance. See this page for more guidance: Customize customer, job, and sales reports in QuickBooks Desktop.

I'm always here if you need more guide while handing your journals in QuickBooks Desktop. Keep safe.

Unfortunately I cannot delete these JEs as they are from different closed periods. In this case, it is a year end JE that is then reversed on the 1st of the following year.

There is no invoice, just a journal entry increasing the balance in the A/R account and then another journal entry reducing the balance in the A/R account by the same amount.

A journal entry that increases A/R will show up under Outstanding Transactions when you go to Receive payments (New > Receive payment). The credit will show under Credits. You can apply the credit there. Sorry about the confusion. Yeah, technically it's not an invoice but the journal entry is closed out the same way as an invoice.

Thank you! There were inactive A/R accounts and customers that were making them not show up originally, but knowing this should work helped me troubleshoot.

Once you applied payment, can you unapplied? Is there a way to do that in QB Enterprise?

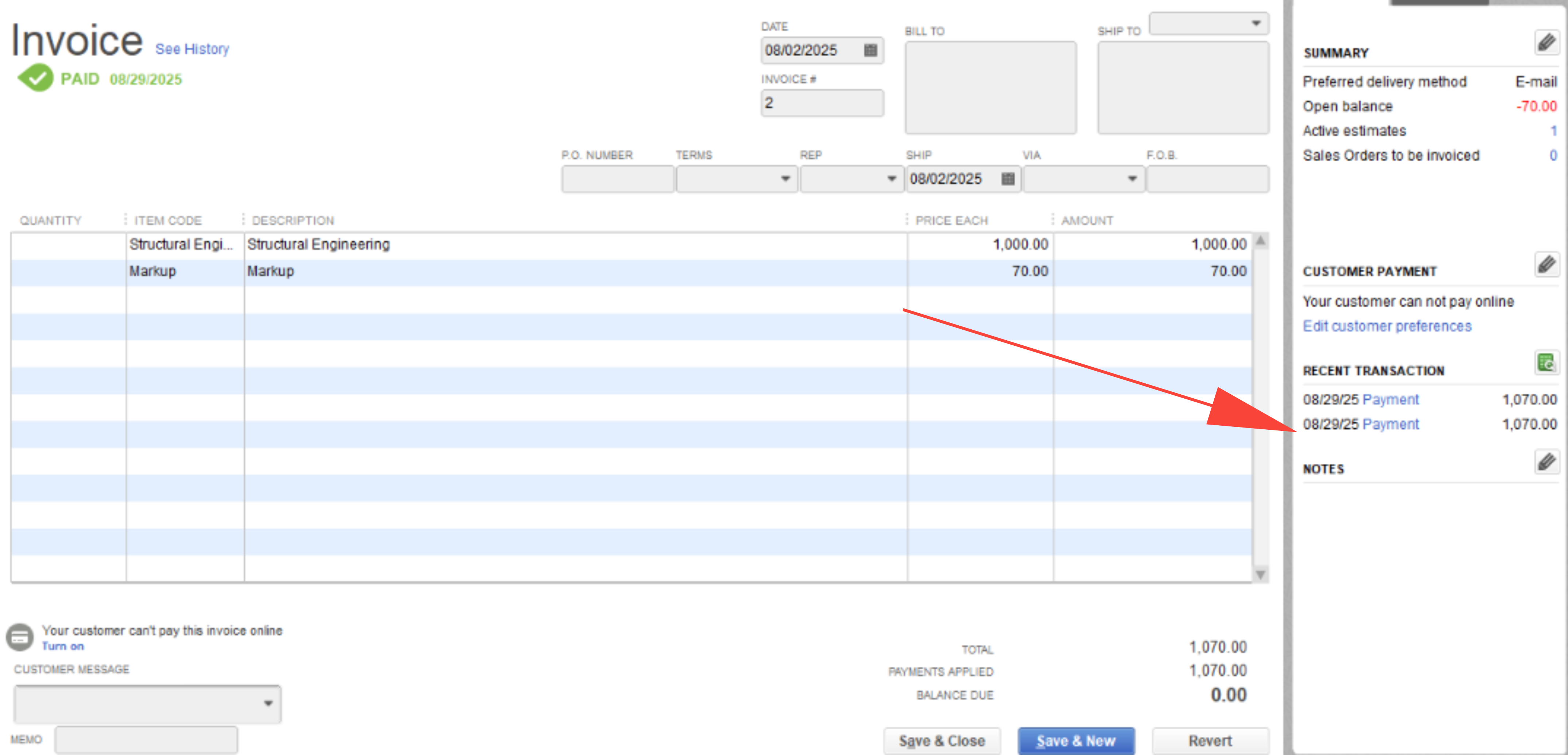

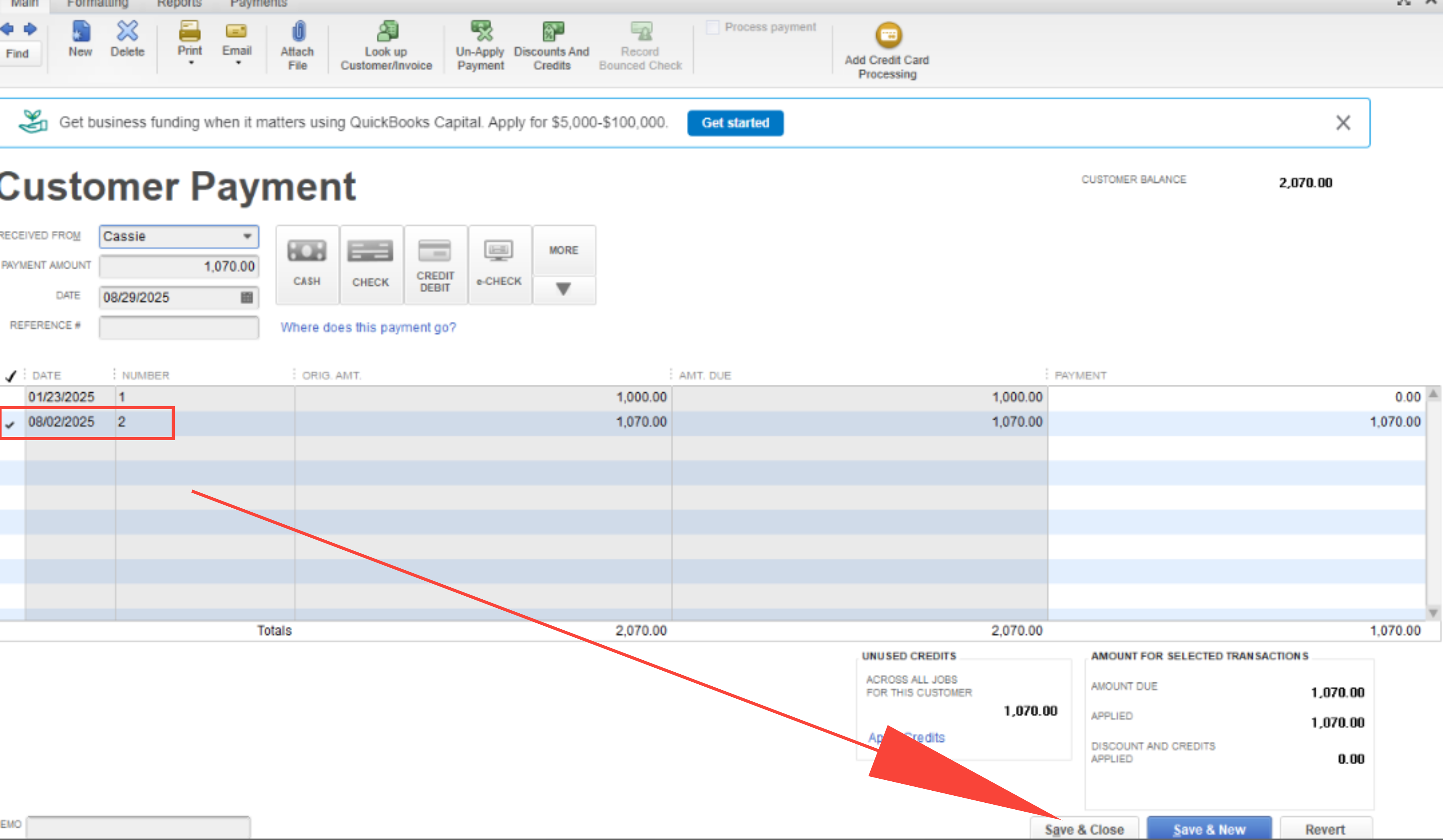

Yes, you can open the actual invoice and unapply the payment from there, Golden_Bee.

To give you the detailed steps, once you're on the invoice, click the Payment hyperlink to open.

Next, uncheck the box to unapply the payment. After that, click Save & Close to apply the changes.

By following the steps, you'll successfully unapply the payment. If needed, you can later reapply it to other invoices or handle it as a credit. Please let me know if you need further assistance or if you have any questions or clarifications when unapplying a payment. We're always around to assist you.

Thank you! However, since my AR old balance are all journal entries, I was not able to see the payment transactions and uncheck them.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here