Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm glad to provide the steps on how you can enter discounts for early payments, userm-dickinson.

In QuickBooks Online, you can choose between applying discount as a percentage or specific amount to your sales forms. You'll simply need to turn on the discount feature and apply it to invoices or sales receipts.

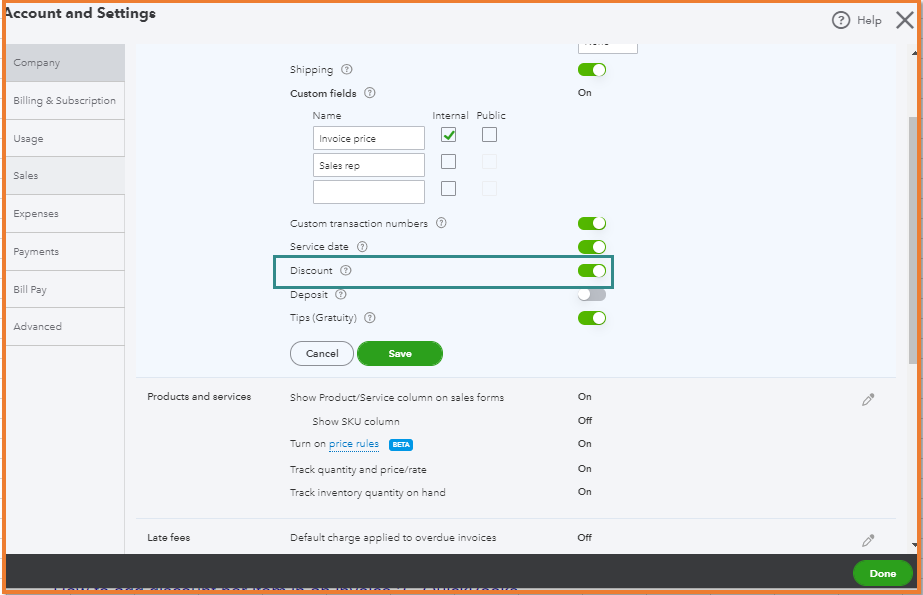

Here are the steps you can follow on how to turn on the feature:

Once done, you can see the discount field when you create an invoice or sales receipt.

Aside from the discount field, you can also create a discount item. Then, add it as another line item on your sales forms. Feel free to visit this page for more details: Add a discount to an invoice or sales receipt in QuickBooks Online.

Let me know if you need anything else by commenting below. I'm always right here to help giving discounts to your customers.

Thanks, but what I really need to know is how to add the discount after receiving a payment. They already know what discount to take if paying early. There just does not seem to be a way to enter the discount when receiving a payment.

Thank you for getting back, @userm-dickinson.

I'll be sharing with you the steps on how to apply a discount after or when receiving a customer's payment.

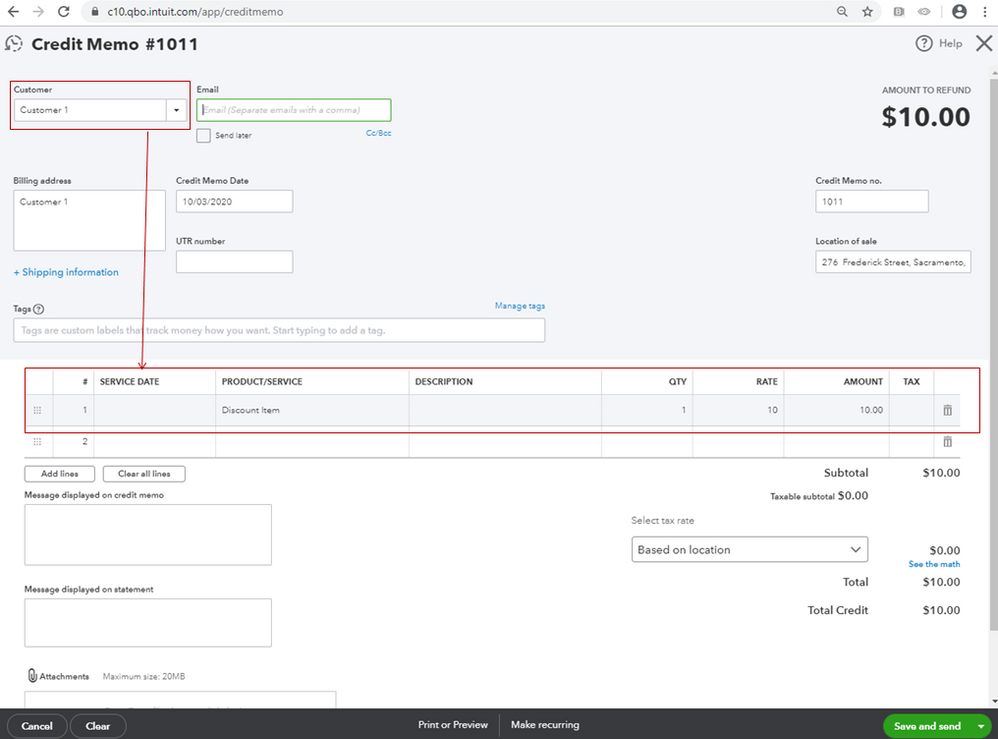

At this time, you can record a credit memo for the discount and apply it to the payment or customer's future transactions. Before that, you need to create a service item for the discount amount and use the discount account for the income account.

Here's how to create a service item:

Once completed, you're now ready to write down a credit memo transaction.

Then, here's an article that shares some information on how you can apply a credit memo to an invoice or a payment. You can read the details from here as your reference: Create and apply credit memos or delayed credits in QuickBooks Online.

I also got this handy link that contains articles you can read more as you continue working with QuickBooks in the future. Feel free to read the topics from here during your free time: QBO articles, video tutorials, and more.

If there's anything else you need help with, let me know by adding a comment. I'm always here for you. Have a good one!

Hello - Is there a way to have an automatic prompt pay discount for a customer? Meaning if i make an invoice for $100k and they have 2/10 net 30. If they pay the invoice in 10 days they pay $98k but if they pay it in 11+ days its the full $100k? I know i can add that in later but is there a feature that automats that?

Thanks for joining the Community space, @steve_NewJersey. I'm here to share information on how to enter discounts for early payments from customers.

You can use the price rules feature in QuickBooks Online. This will help you control the price of your products and services. Using this feature, you can offer discounts or charge different rates by item and offer them to only certain customers for a specified amount of time.

Before doing so, make sure to turn on the price rules in the Account and Settings. Let me show you how:

Once done, you can now create a price rule.

See this article for detailed instruction: Set price rules in QuickBooks Online. It also contains FAQ's about price rules in QuickBooks Online.

I'm adding these articles that will guide you with received payments, record bank deposits, and reconcile accounts for future reference:

If you have any other concerns, don't hesitate and come back to the Community. I'm always here to help you. Have a great day, @steve_NewJersey.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here