Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

I'd be glad to help you categorize bank deposits in QuickBooks Online, @mdncnsn.

If the several checks are downloaded as a single transaction, you can find the match and then select all invoices that are covered in that one particular downloaded entry.

Here's how:

If each check is downloaded, you can match it to the applied payment. For more information about categorizing transactions in QuickBooks, feel free to open this resource: Review the downloaded bank and credit card entry.

In addition, I've attached this article to help you reconcile your account in QuickBooks Online. This is to ensure that they match your bank and credit card statements.

Keep in touch if you have other questions about categorizing deposits in QuickBooks. I'll be happy to assist you again. Stay safe and take care.

I'd be glad to help you categorize bank deposits in QuickBooks Online, @mdncnsn.

If the several checks are downloaded as a single transaction, you can find the match and then select all invoices that are covered in that one particular downloaded entry.

Here's how:

If each check is downloaded, you can match it to the applied payment. For more information about categorizing transactions in QuickBooks, feel free to open this resource: Review the downloaded bank and credit card entry.

In addition, I've attached this article to help you reconcile your account in QuickBooks Online. This is to ensure that they match your bank and credit card statements.

Keep in touch if you have other questions about categorizing deposits in QuickBooks. I'll be happy to assist you again. Stay safe and take care.

Hi, @mdncnsn.

Hope you’re doing great. I wanted to see how everything is going about categorizing the bank deposits concern you had the other day. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at any time.

Looking forward to your reply. Have a pleasant day ahead!

Hi, I have a new issue. For some reason, my credit card (Capitol One) stopped talking to Quickbooks and when I finally noticed the problem and reconnected the account, none of the credit card transactions got inputted into Quickbooks. Is there a way to have QB automatically pull the missing transactions? Or do I have to input all the missing transactions manually? And if it must be done manually, what is the procedure for this?

Thank you!

(If this is a whole new question and needs to be asked as such, please let me know!)

I appreciate you getting back to us, mdncnsn.

I can share the step-by-step process on how you can manually import the missing transactions from your credit card into QuickBooks Online. To get started, you can use our WebConnect feature.

Here's how: Step 1: Pick a start date:

Step 2: Get transactions from your bank:

For other steps, you can refer to this article (proceed to Step 3): Manually upload transactions into QuickBooks Online. On the same write-up, you'll find links on how to set up bank rules as well as reconciling your account.

Once imported, I recommend editing, assigning, and categorizing your transactions. Also, you can match them to the existing entries in the software. Just go to the For Review tab from the Banking menu. Doing so will help you ensure the accuracy of your financial records.

I'm only a post away if you have any questions about this topic or anything else you need in QuickBooks. Have a wonderful day! Take care.

What if I have a deposit that I need to split and I only have one invoice to match against? I went to Find Match and selected the one invoice but the remaining balance has no invoice to match against. How do I categorize the remaining balance against a project from that screen?

Hello @LizPa,

Thank you for posting here in the Community. I'm here to help you match bank transactions in QuickBooks Online.

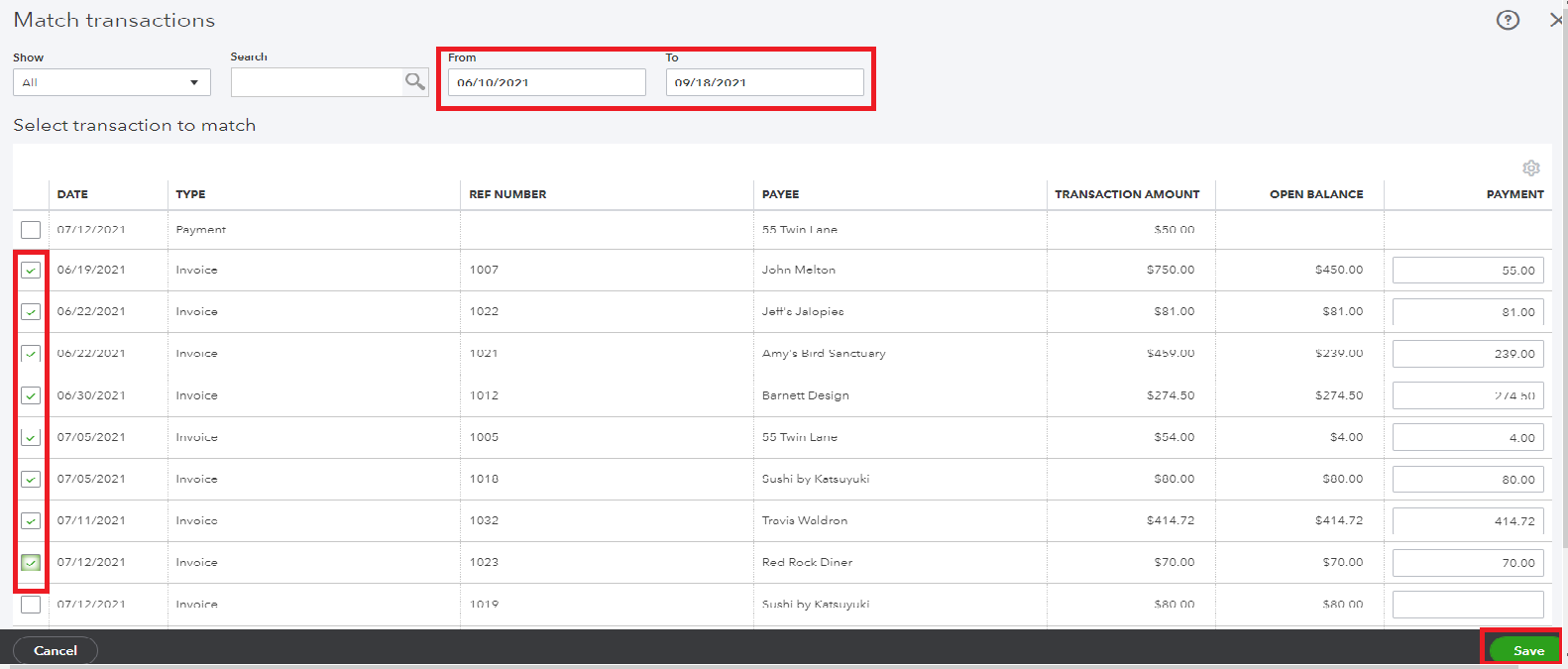

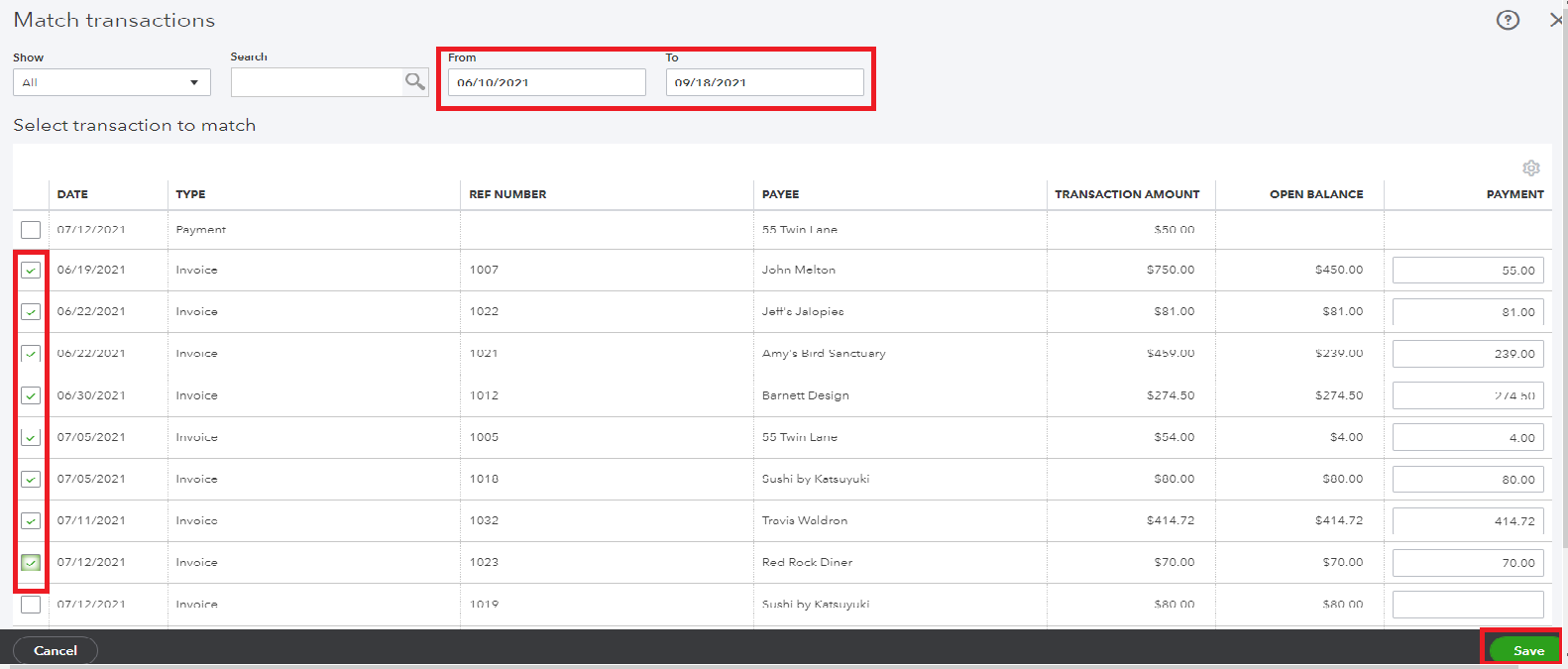

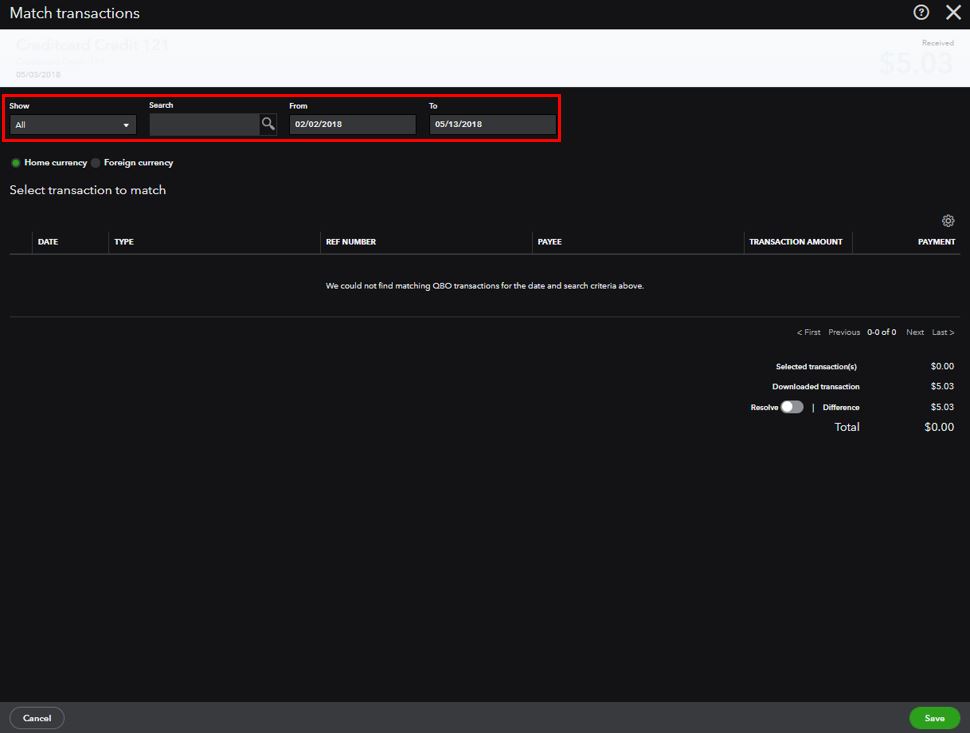

The invoices that show when matching transactions will depend on the filters. I recommend you set the transaction to All and ensure the date range is correct.

Here's how:

Also, verify if the invoice you're looking for exists in QuickBooks. Please follow these steps:

Additionally, you can use this link as your reference on how to categorize or split transactions between multiple accounts in QuickBooks: Categorize and match online bank transactions in QuickBooks Online.

Feel free to back to me anytime you have additional questions about QuickBooks Bank feeds or invoices. I'll be happy to help you some more.

I have this same situation right now. Were you able to figure out a solution?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.