Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowVendor A sends me his bills for delivery services rendered a few times each month. Usually, I would enter his bill as an account payable and it is charged to the delivery services expense account.

Vendor B charges me $1000/month for warehouse rent and that bill gets entered as $1000 to warehouse rent and I do pay vendor B $1000.

Vendor A allows me to deduct $560 from vendor A’s bills in order to contribute to and reduce my $1000/month warehouse rent expense from vendor B. In other words, vendor A gives me a credit of $560 against his delivery services bills towards my warehouse rent expense each month. Question: if vendor A’s bill is $700, how do I make the necessary entries so that the net amount of delivery services expense becomes $140 and the net amount of warehouse expense becomes $440.

I've got an option to record these entries so they will show the correct balances for your vendors in QuickBooks Desktop (QBDT), @gemwaresupply.

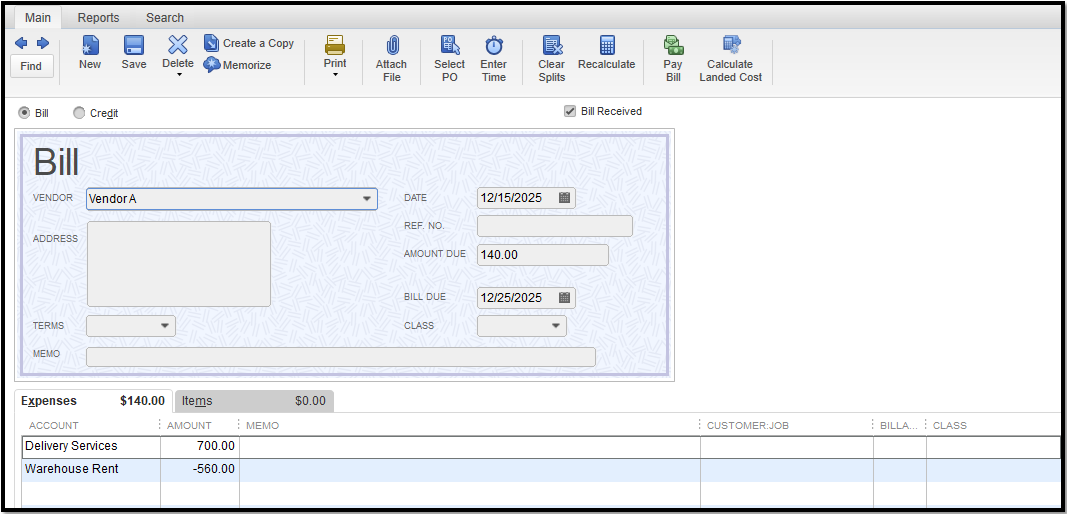

Let's start by entering a bill affecting the delivery services expense account and adding a negative line item for the amount you need to transfer to Vendor B.

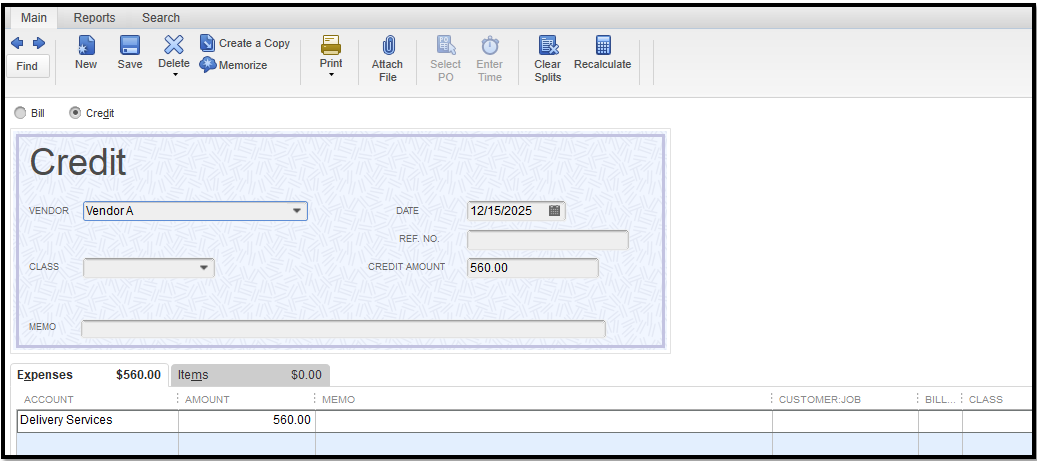

After that, generate a vendor credit ($560) for Vendor A to transfer to Vendor B.

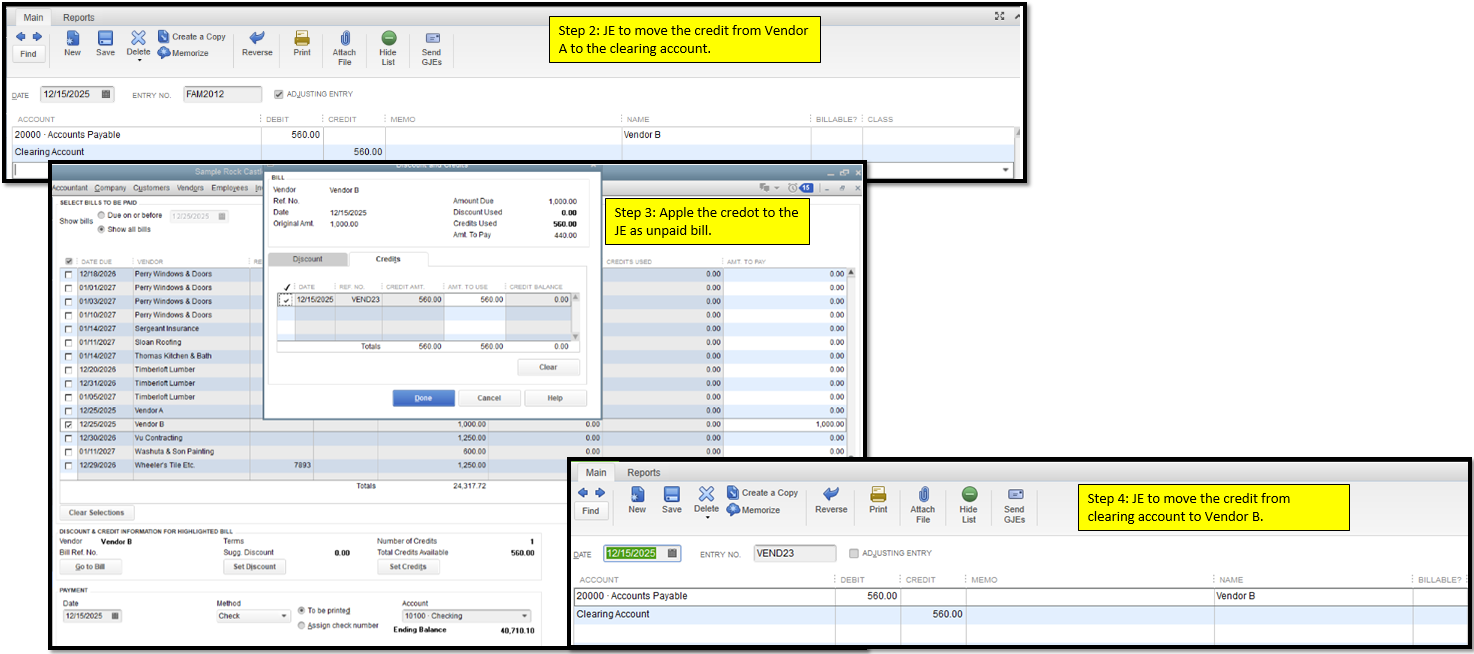

Once done, you can now transfer the credit from Vendor A to Vendor B using journal entries. Here is an article for the detailed process: Transfer and apply credit from one vendor to another in QuickBooks Desktop.

You can then apply the credit to Vendor B's open bills.

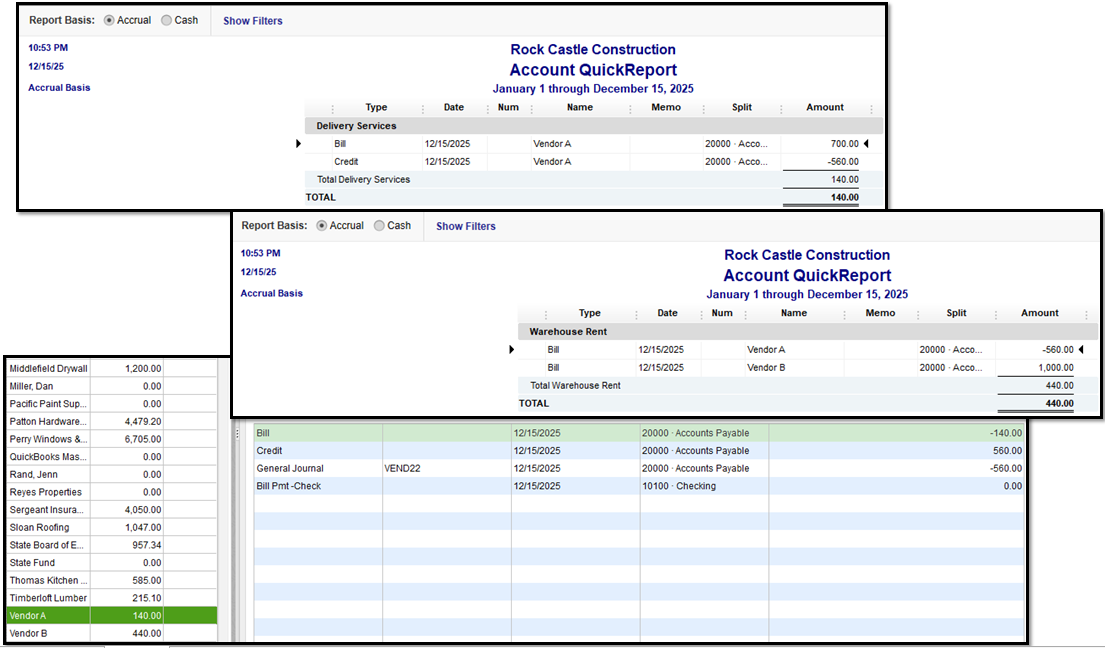

See this screenshot for an example of how it appears on your reports and vendor's profile:

Nonetheless, it would be best to reach out to your accountant for the best approach or other ways to handle these entries properly.

Additionally, you can check out this article to personalize the ready-made reports that outline the current state of spending and accounts payable for your business: Customize vendor reports.

Feel free to reply anytime with additional questions or clarifications about managing vendor transactions in QBDT. I'm more than happy to lend a helping hand.

"Question: if vendor A’s bill is $700, how do I make the necessary entries so that the net amount of delivery services expense becomes $140 and the net amount of warehouse expense becomes $440."

I would not follow @Kevin_C 's advice. It is incorrect. That would take the credit twice when you only should take it once.

Do I understand correctly that you are reducing the amount you owe Vendor A from $700 to $140, but you want that credit applied as a reduction in your rent expense? If that's the case, all you need to do is reduce the bill from Vendor A with a -$560 line item to rent expense (as @Kevin_C illustrated) or create a credit memo from Vendor A assigned to rent expense. Then, pay Vendor A's $140 bill. You cannot, then, also take a $560 reduction in your delivery services expense nor would you want to since that would reduce your expenses by an additional $560, thereby causing your income to be overstated by $560 and increasing your tax liability.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here