Hello there, @patreed-reedins-. I've come to guide you on ways how you can pay your IRA vendors in QuickBooks Online (QBO).

You'll have to manually or directly pay your IRA vendors for you or your employees' contribution to a retirement plan. With this, you can either create a liability check or utilize the Online Bill Pay feature to pay your bills directly from QBO.

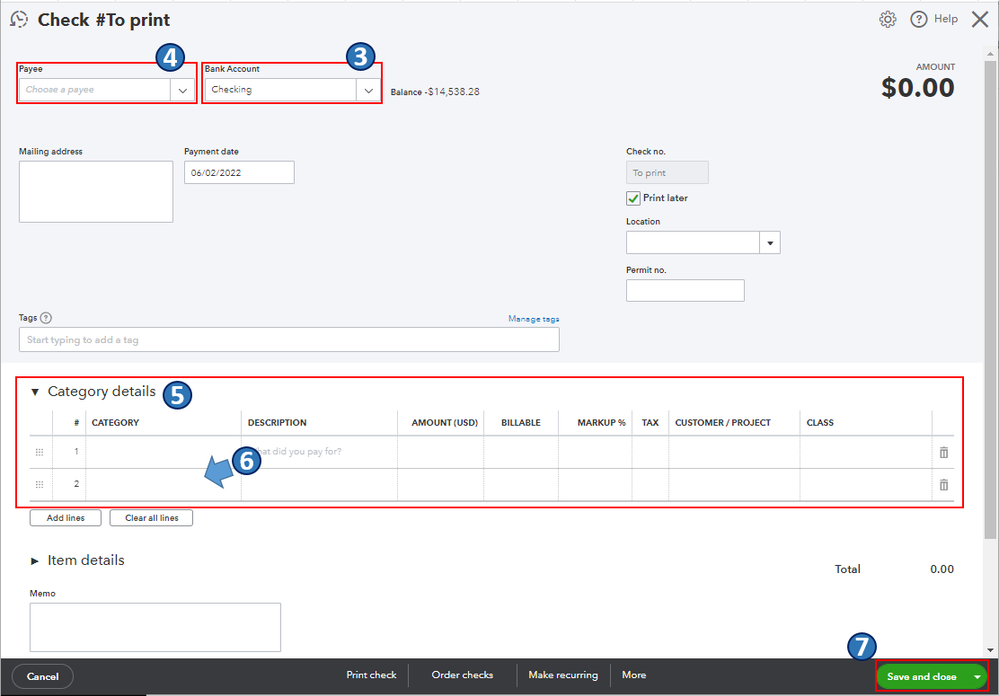

If you'll want to create a liability check, let's visit the Check screen and follow these steps:

- Go to the + New button.

- Select Check.

- From the Bank Account dropdown, choose the account you use for liability payments.

- From the Payee dropdown, choose the IRA vendor.

- In the Category details section, select the account you use for tracking your liability payments. Then, enter the amount.

- If you have sub-accounts for each agency you are paying, make sure to point to those specific accounts and enter the appropriate amount for the agency.

- Fill in the rest of the check as you normally would, then select Save and close.

To make sure your liabilities are paid on time (monthly), you can set up recurring transactions to remind you when your payments are due. You can learn more about this by checking out this article's Set up recurring transactions section: Create a payroll liability check.

If you opt to pay your IRA vendors through Online Bill Pay, you'll first have to sign up for an account (if you haven't already). Then, pay your vendors by following the step-by-step guide in this article: Pay bills in Online Bill Pay.

For more details about Online Bill Pay, please see this article: Online Bill Pay Overview.

Also, when you set up a retirement plan deduction or company contribution in QBO, a limit is placed on how much an employee and employer can contribute in a year. You may want to check out this article as your reference in learning more about the yearly retirement plan contribution limits in QBO: Understand retirement plan contribution limits.

Please keep me posted if there's anything else you need or questions about setting up retirement plans in QBO. I'll gladly help. Take care, and have a great day, @patreed-reedins-.