Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowJust switched to quickbooks online and added banking transactions. Rounded numbers for simplicity: Tenant pays property management $1,500/MO. Property Management companies takes $100 as their fee, pays $100 in bills and then sends remaining $1,300 to me. Quickbooks has picked up the $1,300 bank deposit transaction.

I need to do a journal entry to show the gross rent "Income" was actually $1,500, not $1,300 as the $1,500 never hit my account as that was paid directly to property manager. When I go to reconcile my bank statement it wants to pull the $1,300 deposited and doesn't see the journal entry I did. I can not split the banking transaction into credits and debits if I try and "split" it. How in the world can I do this simple transaction and then reconcile the bank checking account that shows the $1,300 deposit but showing the gross income (must be recorded on tax return) was actually $1,500 before expenses....

I spent 2 hours on the chat and phone with quickbooks people who couldn't figure out how to do this and said they had never come across a transaction like this....

Hello there, @districts. I appreciate the detailed information about your concern and the steps you've taken to record it in QuickBooks. I'll also understand the time and effort you've put into reaching out to our support team. Allow me to chime in and help you record this into QuickBooks so you can reconcile your account.

Since you added the $1300 to your banking transactions, you'll need to manually exclude them from your banking feeds. That way, your gross rent income will show as $1500 in QuickBooks, and you can reconcile your account.

Here's how:

To learn more about excluding transactions in QuickBooks Online (QBO), please see this article: Exclude a bank transaction you downloaded into QuickBooks Online.

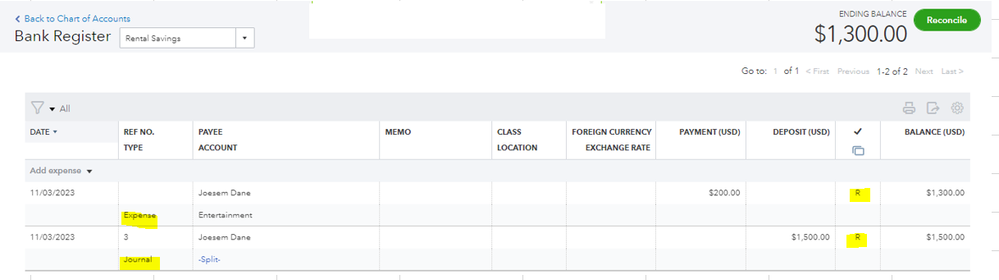

Then, manually reconcile the journal entry by putting R in the Check column. This way, the gross income will show as $1500 in you account. Then, tick the Check column until it shows you the R status. Let me show you how:

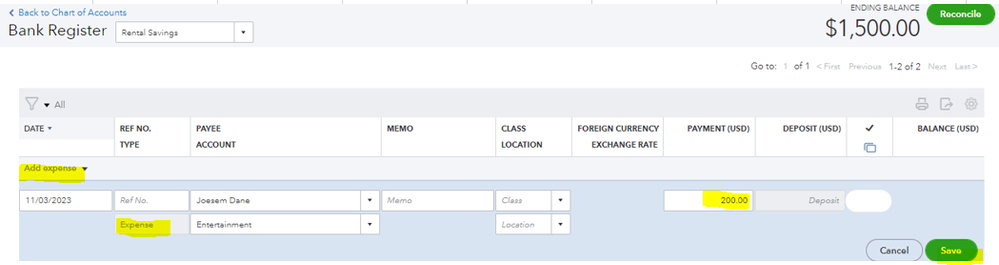

Also, you'll need to manually record the $200 in QuickBooks. Although this amount may not have been deposited into your account, it is still necessary to add it to QuickBooks for accurate recording purposes. Then manually put R to the transaction so it will not be included in your reconciliation. You can sum up the $200 or record them one by one.

Here's how:

Once done, you can go back to resume/start reconciliation. Upon sharing the steps above, I'd still suggest consulting your accountant. They can guide you on how to properly record the rental and ensure that your account is accurate. If you have none, you can also seek help from our accountant through this site: Find an accountant or bookkeeper.

For future reference, here are our articles to help you fix in case you encounter another reconciliation discrepancies:

I want to make sure that you'll be able to get this sorted out. Please don't hesitate to let me know if you have additional questions about recording rental and reconciling accounts. I'm always here to lend a hand.

Thank you for the quick response. Why do I have to force the "R" when I record the journal entry? Can I not record in one journal entry the 4 different transactions: $1,500 income, $100 property mngmt exp, $100 Utility Exp and $1,300 to my bank?

This will be a lot of work to trick the system manually every time the deposit transactions are downloaded from the bank - undo and exclude the transaction, then go to Journal entry and force a reconciliation. Why is there no way to split the deposit transaction and add the $1,500 income there?

I do not understand why I have to force the "R" on the journal entry? I was previously using desktop and would use journal entries, when I debited or credit cash it always pulled through when I went to reconcile my bank statement. Why doesn't it copy from the journal entry to when I reconcile my checking account? This is worse than what desktop did....?

I still have to add as journal entry, correct?

Thank you.

Thank you for your timely response, @districts. I understand that entering transactions into QuickBooks, such as undoing and excluding bank deposits, can be a tricky task. Allow me to provide some insights on the reasons why manually reconciling the journal entry is necessary.

I appreciate that you've been utilizing QuickBooks Desktop to maintain your transactions. However, there may be differences between QBO and QBDT in terms of accessibility, updates, user interface, and platform compatibility. QBO offers streamlined features designed for collaboration and remote work, while QBDT has a more traditional interface and is often preferred by businesses that require more advanced accounting features.

You need to force the Journal entry as reconciled to show the Gross Rent Income of $1500 in your QuickBooks account. This is because QBO is only used for recording purposes of the transactions you've received. In your case, you can add the journal entry with the three transactions: the $1500 income, the $100 property management expense, and the $100 utility expense. You don't need to include the $1300 in your journal entry as it will be added to your bank balance.

However, if you already created a journal entry, you can modify it and include the three transactions accordingly. Then, you'll have to manually reconcile the transactions again.

Here's how:

Also, it is highly recommended that you seek advice from your accountant to guarantee the accuracy of your financial records.

In the meantime, check out this article for more information on how you can set up QuickBooks Online for Property Management: QuickBooks Online Advanced for real estate property management, Part 1: Overview and setup.

Let me know if you have other questions about managing your property-related income and expenses. I'm always here to help. Stay safe.

JoesemM,

Thank you again for your response. You said above I need to undo and exclude the bank deposit, but then said in the Journal entry I don't need to include the $1,300 because it is already added to bank balance? Won't it not show since I undid and excluded it?

On the journal entry, credits must equal debits, how can I put $1,500 on one side and the two $100 transactions on the other side and exclude the $1,300? This is not a balanced transaction? Don't all 4 of these amounts need to be listed on the journal entry? How do I get the reconciliation to see the $1,300 in the journal entry?

Thank you.

Let's get this straight and correct everything that we have here, @districts.

I've read the thread, and I was able to get a grasp of the situation. This is your situation as I understand it:

So, here's the flow on how we can record the scenario in QBO:

Step 1. Record the gross sales (1500). you can select Sales Receipt or Invoice.

Step 2. Record and deposit the payment to Undeposited Funds/Payments to deposit account.

Step 3. Create a bank deposit that includes the payment. I'll lay out the details at the bottom.

Step 4. Match the bank deposit to the downloaded bank transaction.

Here are the detailed steps for Step 3:

After following STEP 4, you proceed to reconcile the transactions. There's no need for journal entries, but it is best to get your accountant for a further opinion regarding this matter.

Here are the articles that might be helpful to you in the future:

I know this is kind of a lengthy answer, but I hope this clarifies everything in this thread. You'll get back on track in no time. Have a great day!

Ignore @JoesemM 's responses. So frustrating to see a QB employee not knowing how to help and creating more work for their customers - so much more work. There is no reason to do any reconciling when entering this. And the advice to exclude the $1,300 on the JE? Yikes!

The fact that your JE is not showing on your reconcile screen is a mystery. It should be there. I've never had one not be there. Do you see the journal entry in your bank account register? If it's there, it should be on your reconciliation.

In terms of how to record this, you seem to know what you're doing. The journal entry should look like this (you will have your own income and expense accounts):

| Debit | Credit | |

| Bank Account | 1,300 | |

| Management Expense | 100 | |

| Other Expense | 100 | |

| Revenue | 1,500 |

Or, you can record this using a sales receipt. You will need a service product for the two expense accounts and the revenue account. Enter the revenue account as $1,500 and the two expense accounts on separate lines as a negative $100/ea. That leaves $1,300 due. Select your bank account under 'Deposit to', save it, and you're all set.

Hi @ShaniamarieC: I have a follow up question regarding your post. Please let me know if you're available for a detailed discussion.

Hello there, @Bellingham.

We appreciate your time for posting here in Community. We want to make sure we provide the resolution you need regarding recording rental property in QuickBooks Online.

With that said, we'd like to ask what further questions or concerns you have that are related to my colleague's answer. You may attach screenshots so we can get a clear picture of your current situation and supply the needed assistance to resolve this.

Furthermore, please know that the posts in the Community are assigned randomly. There's no guarantee that it will be assigned to the same agent.

Please visit us anytime here in the Community space if you have any follow-up concerns. We'll be happy to assist.

My asset has three banks. My bank, my former property management bank, and the current property management bank. I would like to see all three accounts and reconcile them, and record transactions between them. That's too complicated but I did not have experience when I first set up my company in Quickbooks.

The net rent that the property management send each month flows automatically into my bank as my account CASH IN BANK. However, I used their monthly statement to manually add that net rent as the expense from the the property management bank and wrongly put it into Owner's withdrawal account. Now I saw the Owner's Withdrawal account make my equity minus but in fact that should record as payment to owner as their expense from the property management. How can I fix this? if I create a new account called Payment to Owner and record these transactions instead, where that data will be appeared?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.