It's good to hear from you today, wendy42.

Changing the invoice due date is pretty easy and I'd be glad to show you how. You can open the invoice itself and change the due date from there.

Let me walk you through the process:

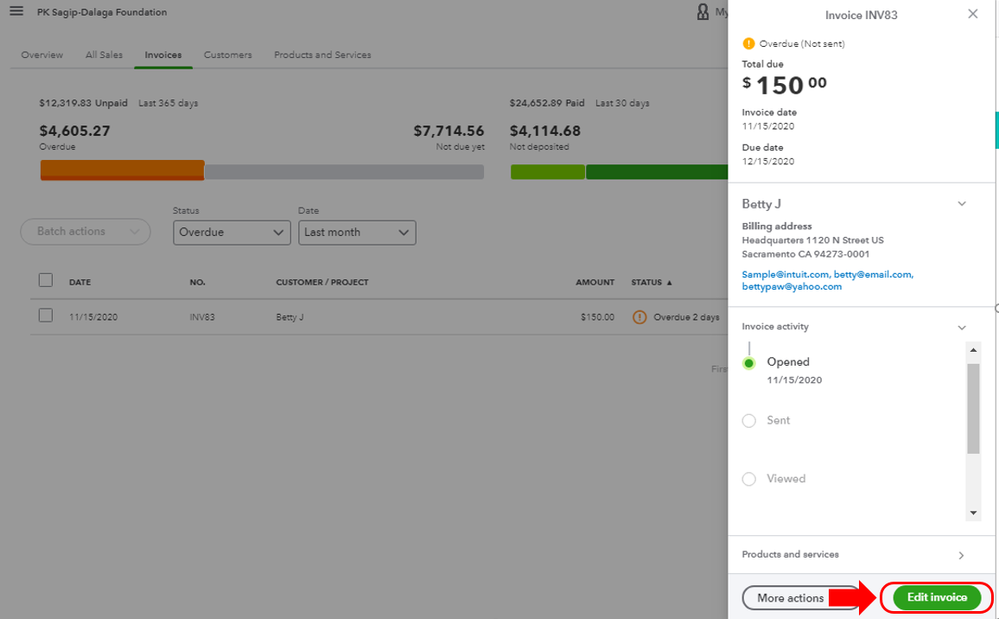

- Click Sales in the left panel and choose Invoices.

- Find and click the transaction. Then, tap on Edit invoice.

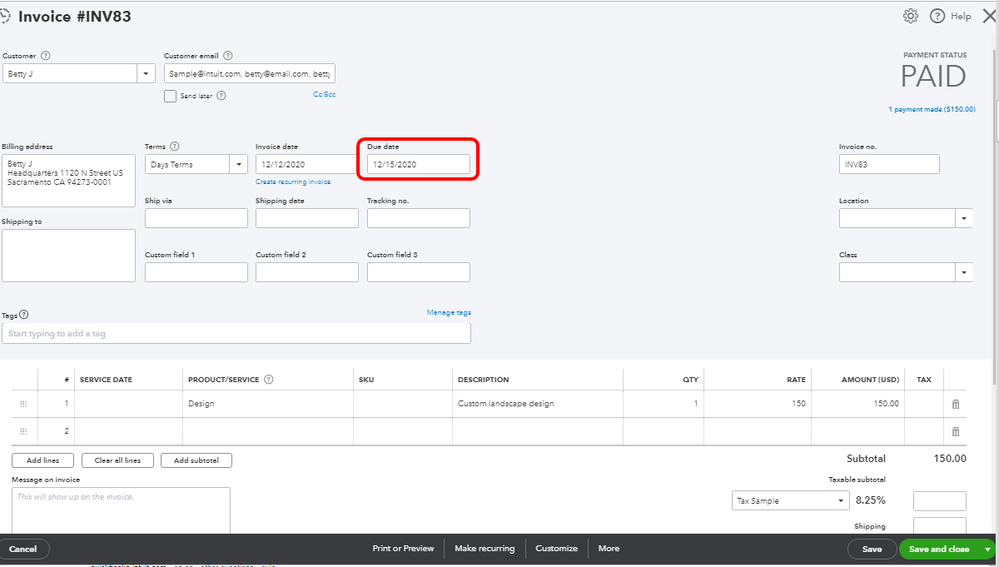

- Change the Due date from the invoice screen.

- Hit Save and close.

You might want to set a default payment date for your invoices using the Terms feature in QuickBooks Online. This can help you record a discount if you receive a payment before the due date or on your agreed upon time. You can get more details about this in this article: How to Adjust Invoice Payment Terms in QuickBooks Online.

If you have additional invoice concerns, please let me know. I'm always here to keep helping. Happy Holidays!