Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Thanks for reaching out to the Community, @epad03.

Once you've entered the Invoice, then you can create a Receive Payment and place it in the Undeposited Funds account until the Deposit comes through your bank in the Online Bank Feed in QuickBooks Online. When you see the transaction in the For Review section in your Banking tab, then you can match the Deposit to the Invoice to clear the payment and zero out the Undeposited Funds account. Matching will prevent any duplications of transactions and help organize your books. If you don't have your bank connected, then you can create a Bank Deposit.

After the Invoicing process and it's the end of the month, then you'll need to reconcile your accounts in QuickBooks Online. This is to ensure that your bank or credit card statement matches what is recorded in QuickBooks. No worries, here's a Community Article that goes into detail and explains how reconciling works: Reconcile an account in QuickBooks Online.

If you need further assistance, please feel free and leave me a Reply. I've got your back. Have a nice day!

Thanks for keeping us posted with your questions, epad03.

You can enter the amount that will come in from your bank feeds, as you mentioned the partial payment of $3,000. This way it'll match to the amount posted in the bank downloaded deposits. You can check these screenshots below for your reference on how it'll look like.

You can follow the same steps every time you customer pays you with a specific amount. You can also check out this article for more details on how to manage bank downloaded transactions before you reconcile an account.

The Community is always open to help you. Just leave a reply below and my colleagues and I will surely assist you. You keep safe always!

Absolutely, correct, @epad03.

This way, the wire transfers or actual deposits from your bank will match with the invoice payment transactions in QuickBooks.

Additionally, the Undeposited Funds account holds invoice payments and sales receipts you want to combine. So when you make a deposit in QuickBooks, you can combine payments in Undeposited Funds to match.

It will ensure QuickBooks always matches your bank records and makes your reconciliation much easier.

Also, you can review this article as your reference on how to put your payments into the Undeposited Funds account before you combine them into a deposit in QBO: Deposit payments into the Undeposited Funds account in QuickBooks Online.

Feel free to place a comment below if you need further help. I'll respond as fast as I can. Stay safe and well!

Thanks for reaching out to the Community, @epad03.

Once you've entered the Invoice, then you can create a Receive Payment and place it in the Undeposited Funds account until the Deposit comes through your bank in the Online Bank Feed in QuickBooks Online. When you see the transaction in the For Review section in your Banking tab, then you can match the Deposit to the Invoice to clear the payment and zero out the Undeposited Funds account. Matching will prevent any duplications of transactions and help organize your books. If you don't have your bank connected, then you can create a Bank Deposit.

After the Invoicing process and it's the end of the month, then you'll need to reconcile your accounts in QuickBooks Online. This is to ensure that your bank or credit card statement matches what is recorded in QuickBooks. No worries, here's a Community Article that goes into detail and explains how reconciling works: Reconcile an account in QuickBooks Online.

If you need further assistance, please feel free and leave me a Reply. I've got your back. Have a nice day!

Thank You very much @Ashley H !

I want to make an example with the same information about the invoices and the clients paying me with Wire Transfers;

If I made an invoice of $15,000 and for being a loyal customer I make a payment plan for him, to pay me $3,000 every month until he pay it off in 5 months and he is paying me via Wire Transfers.

You mention "Once you've entered the Invoice, then you can create a Receive Payment and place it in the Undeposited Fund account until the Deposit comes through your bank in the Online Bank Feed in QuickBooks Online. When you see the transaction in the For Review section in your Banking tab, then you can match the Deposit to the Invoice to clear the payment and zero out the Undeposited Funds account. Matching will prevent any duplications of transactions and help organize your books."

When I create a Receive Payment of that invoice and place it in the Undeposited Funds account, what amount should I have to put in the Receive Payment of that invoice? It will be the $15,000 completly or it will be the $3,000 everytime that customer pays me?

Thank You, I will look up for your response.

Thanks for keeping us posted with your questions, epad03.

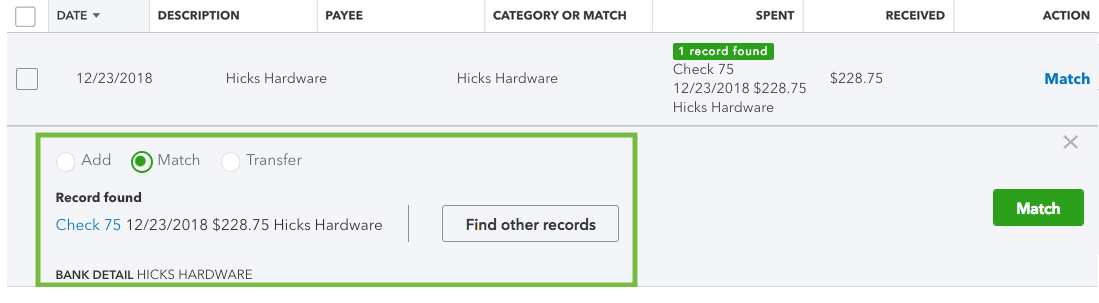

You can enter the amount that will come in from your bank feeds, as you mentioned the partial payment of $3,000. This way it'll match to the amount posted in the bank downloaded deposits. You can check these screenshots below for your reference on how it'll look like.

You can follow the same steps every time you customer pays you with a specific amount. You can also check out this article for more details on how to manage bank downloaded transactions before you reconcile an account.

The Community is always open to help you. Just leave a reply below and my colleagues and I will surely assist you. You keep safe always!

Thank you @Catherine_B

So you telling that is better that every transaction should be individual. Instead of putting in the Receive Payment all the amount of $15,000 in Undeposited Funds right away I made the invoice, it is better to put in partial receive payments of $3,000 in Undeposited Funds when the customer pays me every month?

Thank you

Absolutely, correct, @epad03.

This way, the wire transfers or actual deposits from your bank will match with the invoice payment transactions in QuickBooks.

Additionally, the Undeposited Funds account holds invoice payments and sales receipts you want to combine. So when you make a deposit in QuickBooks, you can combine payments in Undeposited Funds to match.

It will ensure QuickBooks always matches your bank records and makes your reconciliation much easier.

Also, you can review this article as your reference on how to put your payments into the Undeposited Funds account before you combine them into a deposit in QBO: Deposit payments into the Undeposited Funds account in QuickBooks Online.

Feel free to place a comment below if you need further help. I'll respond as fast as I can. Stay safe and well!

I believe I'm having the same problem. So I create an invoice in QB, and then type in 'custom amount' in square equal to the invoice total- and charge the customer like that. Then I click paid by square on the QB invoice and select the account square deposits to in the drop down box on my QB invoice. However it still doesn't link the square charge to my QB invoice. I end up having a square invoice and a quickbooks invoice in my sales history, both equal to the same amount. Which is 'doubling' my visual profits. Which means most of quickbooks other features are irrelevant since my numbers in QB are incorrect. Does anyone know how to fix this? Or since we create the invoices in QB instead of square will it always be separate and therefore incorrect?

That’s exactly correct, @SamAutomotiveRepair.

Allow me to share some information about handling transactions in QuickBooks and to get rid of the doubled entries.

Once the square account is connected to QuickBooks, it automatically imports your sales and expenses. Meaning, creating separate transactions in QuickBooks for your Square is unnecessary.

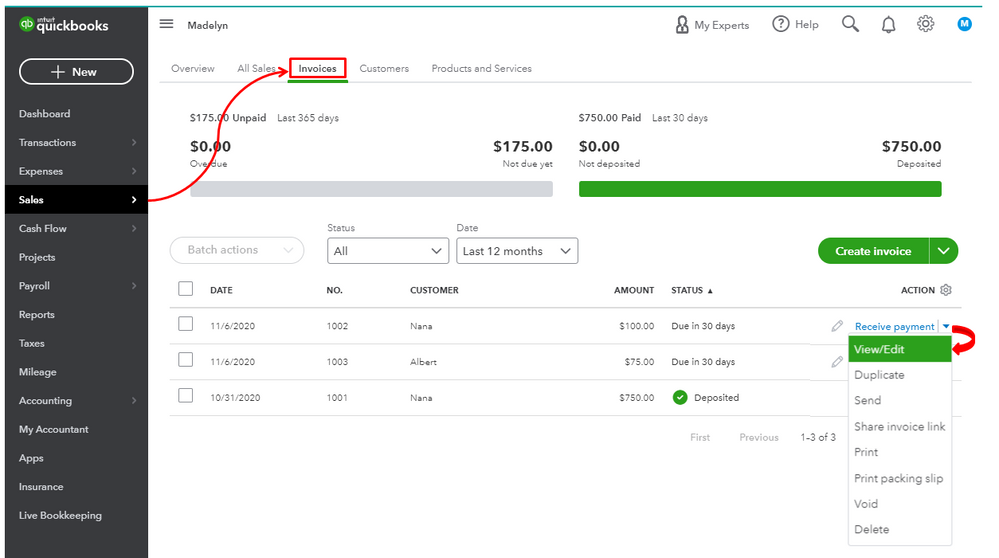

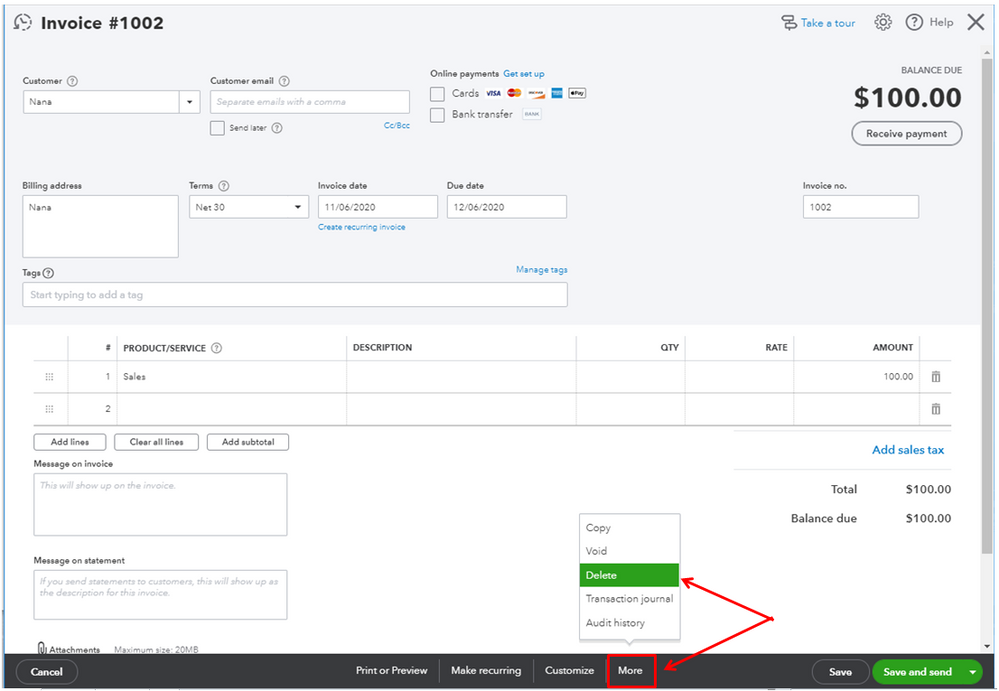

You can delete the invoice you’ve created in QuickBooks to fix the duplicate income that displays in your Sales History.

Here’s how:

Once your bank downloads events which include square payments, you can directly match it to the square invoice. Doing this will clear and settled the entries. You’ll just need to go to For review tab on your banking page then match them.

I have a reference here that tackles on how square data imports your sales into QuickBooks Online. It includes information about managing settings and troubleshooting instructions in case there’s a duplicate transfer.

Get back to me here if you need further assistance with your square transactions. I’ll be here to help anytime. Have a good day.

How do you handle wire transfer fees? Say I invoice the customer $100, he pays $100 via WT but I only receive $75 from my bank due to WT fees. How to I mark as paid if it is not the correct amount?

Thanks for checking in with us, Kay03. Handling wire transfer fees in QuickBooks Online is pretty easy and I'd be glad to show you how.

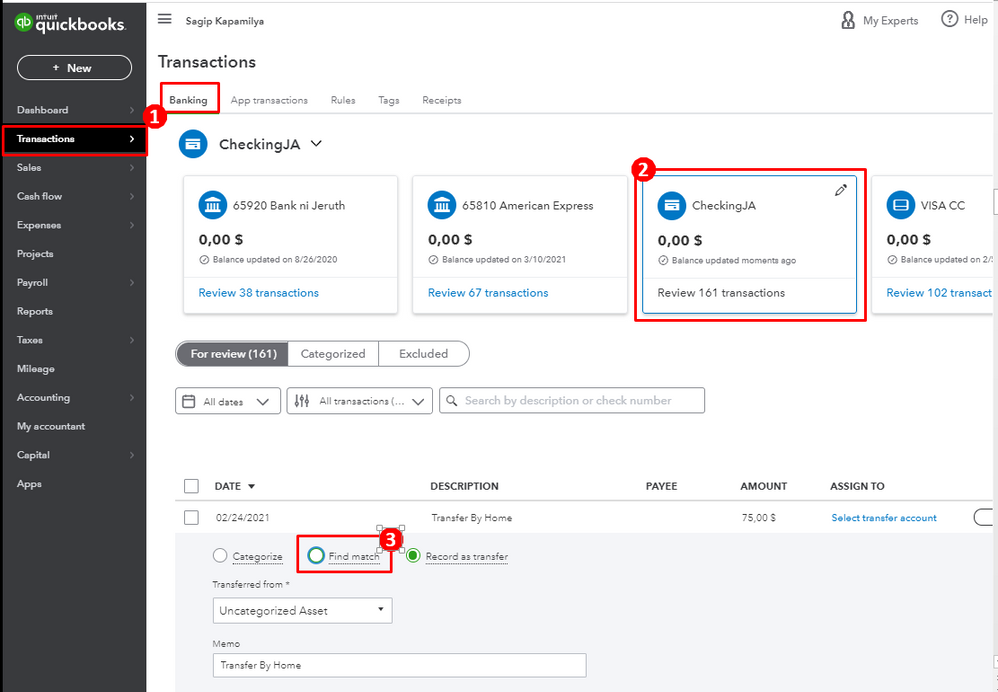

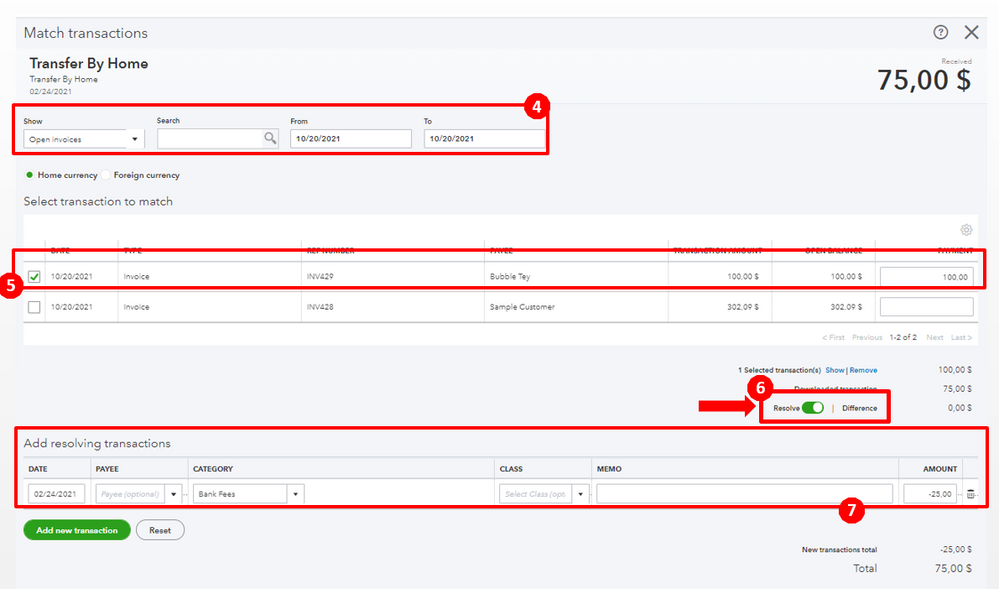

You can record the wire transfer fees using the Resolve | Difference option from the banking page when matching the payment to the open invoice. Below are the steps to complete the process:

In case you want to reconcile the account, you can follow the guide in this article: Reconcile an account in QuickBooks Online. This will provide you steps on how to manually reconcile your account that's not connected to online banking.

Let me know if there's anything else you need in QuickBooks, I'll be around to help. Have a good one.

Hi! So when I did that, it reduced my payment amount by another $25.

Original amount of invoice - $8199.35

Wire Transfer payment received - $8174.35

When I followed the exact steps at the end of the transaction it said the new total was $8149.35

Should I put the bank fee of $25 in a positive amount as opposed to a negative?

You came to the right place for QuickBooks help, @Kay03,

I'll be right here to guide you on how to handle customer payments along with the charges. This way you can reconcile them properly.

Yes, you need to add a negative amount to reduce the payment (Refer to Step 3). I've added the detailed steps below to help you further.

Step 1: Create the customer invoice.

Step 2: Receive the payment.

Step 3: Enter a Bank Deposit for the fee.

For your reference, see the following link for the steps: Record and make bank deposits in QuickBooks Online

Once done, you can now match the transaction to the online banking entry. Here are the steps with sample screenshot:

See this article to learn more about managing bank transactions in QBO: Categorize and match online bank transactions in QuickBooks Online.

Now, you're ready for reconciliation. For your reference, here is a reconciliation article you can refer for further instructions: Reconciliation Hub for QuickBooks Online

If you need anything else, please let me know in the comment below. I'll be right here to help categorize your bank transactions. Have a good one!

These are 2 completely different ways of handling this payment which has made it very confusing. My bank is attached to my QB, so won't creating a deposit duplicate the amounts?

I received payment in my bank which transferred to my QB for $25 less than my invoice amount. The $25 bank fee was not taken out of my bank. How do I properly record payment of the invoice minus $25?

Let me ease your confusion, Kay03.

Base on your situation, Jen_D's steps are a better option for you. I know the steps let you create a deposit. No worries, though. It won't lead to duplicate transactions. You'll have to match the downloaded transaction to the existing deposit in QuickBooks Online to avoid any duplicates.

To record the payment properly, you'll have to receive the invoice payments, deposit them to the Undeposited Funds, and deduct the fee from there. Then, you can match the downloaded deposit to the invoice payment.

You can follow Jen_D's steps above to help you.

If you have more questions, please feel free to get back to this thread. We'll answer you as soon as we can. Keep safe!

excellent Thank You

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here