Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowHello, higent.

I have just the steps to help you designate the checks as taxes paid in the Self-Employed program.

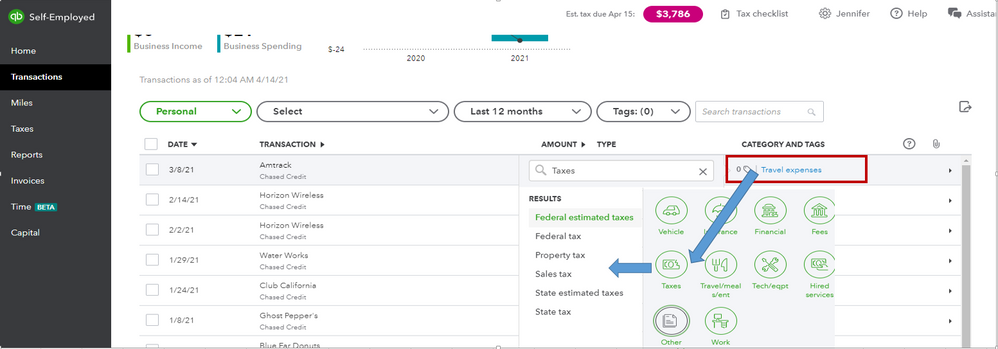

You can designate the checks by categorizing them under Estimated taxes. Here's how:

If you have your bank connected, then there's no need to manually record the tax payment. You'll just want to categorize it directly.

Also if you haven't already done it yet, you'll also want to record the tax payment in the taxes page. This article can guide you through the process: Pay federal estimated quarterly taxes in QuickBooks Self-Employed (follow the steps under Pay by mail and save or print the form for a copy).

Need to take care of other things such as mileages, other transactions, and your current tax profile? Check out the guides for the Self-Employed program from the articles list page.

Do you have any other concerns? Let me hear them. I'll ensure you're able to finish your tasks in the Self-Employed program.

I am still hung up. The checks I sent to IRS do not appear in TRANSACTIONS. I think I marked them PERSONAL and don't know how to find them and correct my error.

I got your back to help you locate the missing check on your Transactions page, @higent.

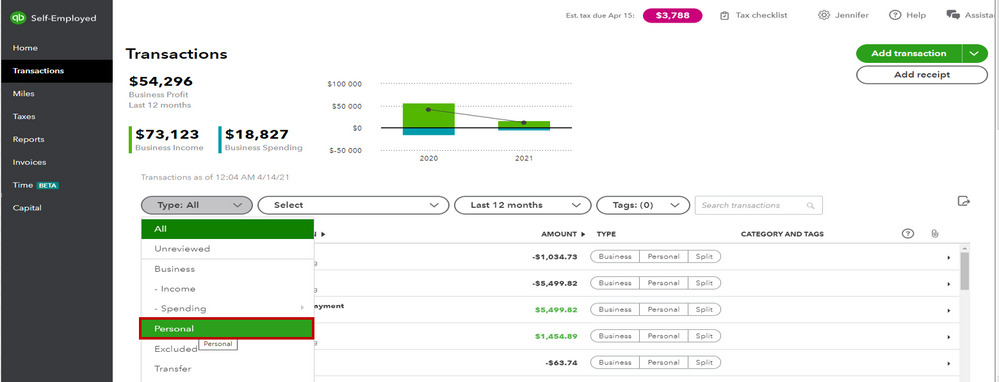

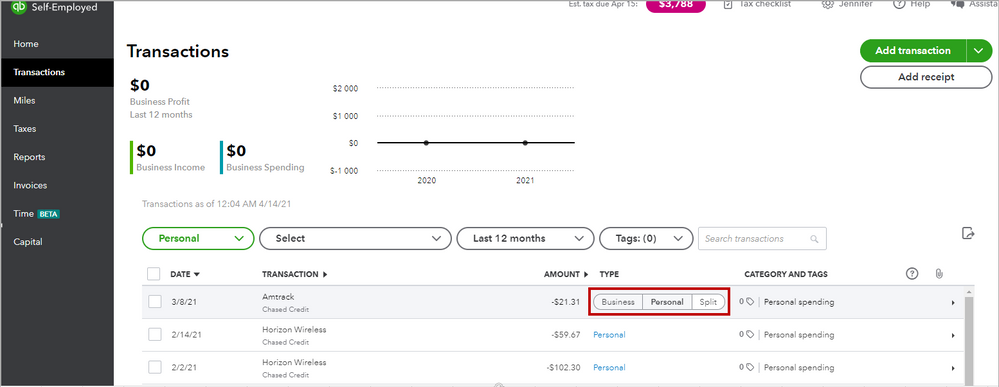

We can filter your transactions to show all data marked as Personal. This way, we can correct and designate them as tax paid.

Here's how:

Otherwise, we can enter the checks manually if they don't appear in the list. Then categorize them as tax payments in QuickBooks Self-Employed.

I'm also adding this link to provide more details on how QuickBooks Self-Employed tracks self-employment taxes. It includes insights into how QuickBooks Self-Employed estimates your federal quarterly tax payments.

I'm just a post away if you need additional assistance. Simply click the Reply button to add your response. Wishing you and your business continued success.

How do you record this in Quickbooks Online?

Welcome to the thread, @ejohnson1481.

To ensure we're on the same page, can you verify what specific tax payment you want to record in QuickBooks Online (QBO)?

If you're referring to recording a sales tax payment manually, here's what you'll need to do:

If you're referring to record the payroll tax payment, follow the below steps:

For more information about the process above, see the below articles:

However, if you mean something else, please let me know. You're always welcome to comment below if you have other concerns or follow-up inquiries about managing your taxes in QBO. I'm just around to help. Take care.

I'm referring Estimated Tax.

Thanks for the prompt reply, @ejohnson1481.

You can record the estimated taxes by writing a check. Writing and recording checks for your expenses keep your checking account organized in QuickBooks.

Let me show you how.

For detailed steps, kindly refer to this article: Create and record checks in QuickBooks Online.

Upon sharing the steps above, I would suggest consulting your accountant. This to ensure that you properly recorded the taxes and ensure your books are accurate. If you’re not affiliated with one, you can visit our ProAdvisor page, and we’ll help you find one from there.

To learn more about the tax processing in QuickBooks, refer to this Resource Guide: Manage taxes in QuickBooks.

Feel free to get back to me if you have other questions about taxes in QBO. I'll be sure to get back to you.

I have been paying my payroll taxes thru EFTPS on line then record in QB as regular ACH check . I haven't used the payroll tax section. How do I get my tax liab to show in QB payroll?

I know a way how you can show your tax liability in QuickBooks Online (QBO), @SG59.

Let us work together so you can get back to the working order.

You can enter a prior payroll tax payment to get the tax liability shown on your QBO payroll. I'd be glad to guide you on how:

For your reference about the process, please check this article: Recording prior tax payments. It also includes detailed instructions on how you can edit a prior payment.

Also, in QBO running a report to view your tax liability information is a breeze. It will also make it easy for you to see the taxes you need to pay and the ones you’ve already paid.

If you have any other questions about recording your tax liability in QBO, please leave a reply below. I'm always here ready to help you further.

For QB online, how do categorize I categorize federal / state

tax payments made for a prior fiscal year (2021)? The checks cleared in 2022. They are messing up my balance sheet. I don’t want to delete them, I just want to mark them so they don’t effect my balances.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here