Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello, @bschimanski.

You'd want to set up a retainer account and create a retainer item. Once completed, you can use it in recording a bill every time you pay your lawyers. I can guide you how to do it.

Here's how to create a retainer account:

You can add the total retainers fee you've paid to your lawyers. Also, when choosing the specific account to associate your transactions, whether liability or an expense, I'd suggest consulting with your accountant. This is to ensure that this will not mess up your books.

Now, let's create the retainer or legal fees item. Here's how:

Once completed, you can use the retainer service item every time you pay your lawyer. You can record it as a bill, create a check or an expense transaction.

You can always get back into this post if you have other questions about tracking your expense transactions. I'm just a few clicks away.

i already wrote a check to my lawyer for the retainage. now i have an invoice against the retainage. I still have $ left on my account. I followed what you wrote, but it is adding the check for retainage + the invoice i entered against the retainage. not sure what to do

Hey there, bschimanski,

Let me clear things out for you about recording the check you've paid to your lawyer.

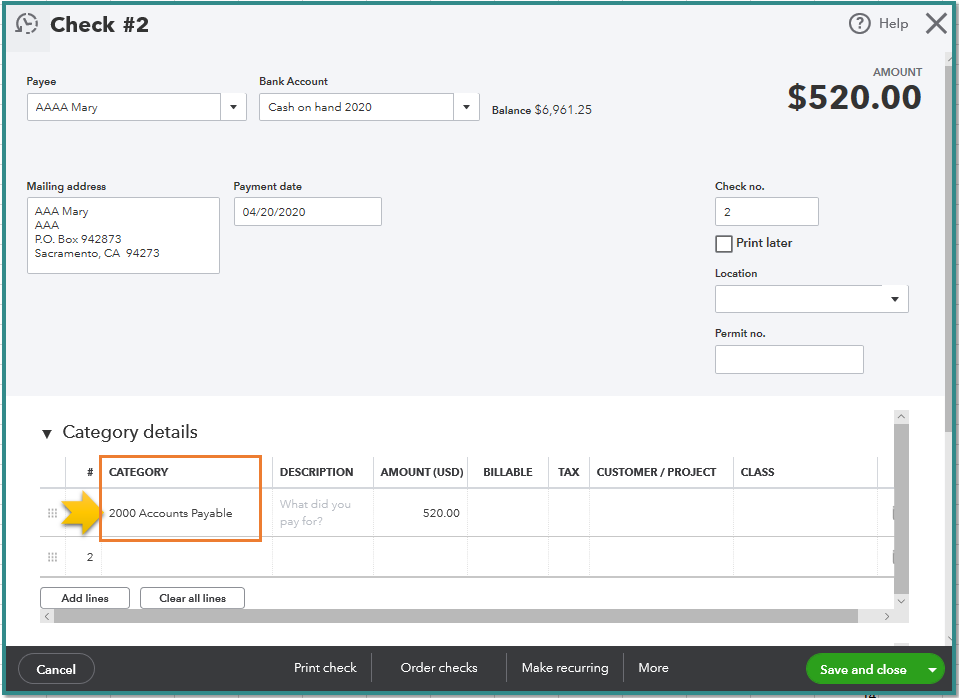

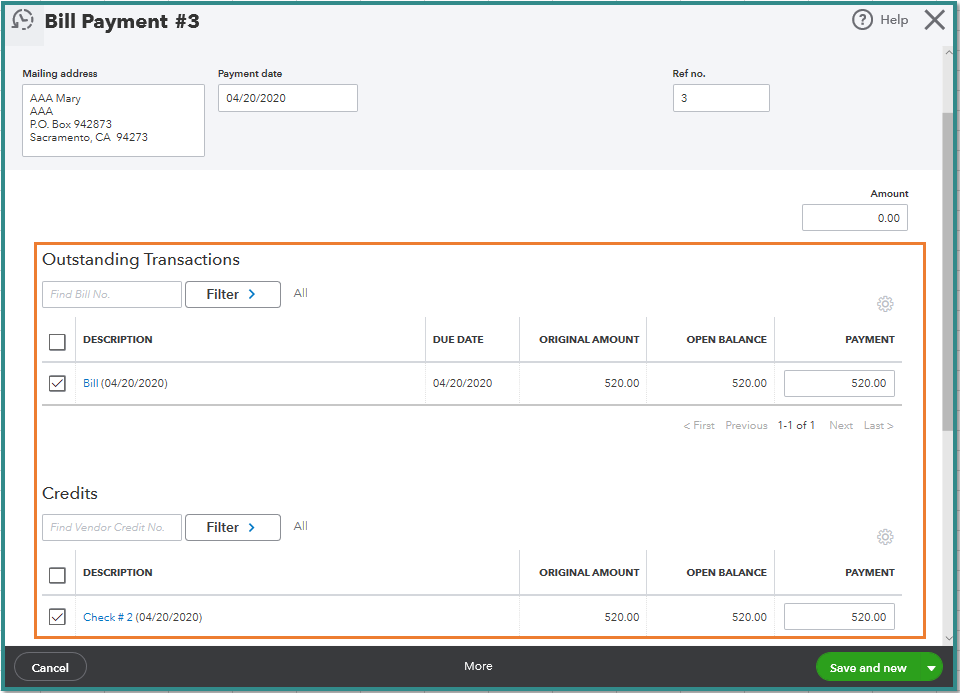

You'll want to use Category details for the check, then enter accounts payable in the Category field. This way, you'll be able to link it to the bill, and it won't add another amount on your retainage. See the attached screenshots below for your visual guide.

Once done, go to the vendor profile and make payments from there. The Pay bills option won't allow you to link the check and the bill.

I'm glad to show you how:

The Retainer account should have one entry for these transactions.

Check out the Video tutorials for QuickBooks Online for a step-by-step process to help manage your expenses and vendors.

Let me know if there's anything else you need. I'm always around to help you out.

Thank you and stay safe!

i don't know what i'm missing

it's taking the $ out of my checking account even tho i entered bill in as a product/service and used the credit to pay the bill

Hello, @bschimanski.

I appreciate you performing the steps provided by my colleague. Once you open the check and change it Accounts Payable, this will surely link the said check to your bill. Doing so will zero out the vendor's balance.

To isolate this, can you provide a screenshot of your bank register so we can check why this is taking twice?

I'll be on the lookout for your reply and assist you further. Have a good one.

I tried following this and I am thoroughly confused. When I created the bill, it put the amount in the Accounts Payable liability account. There isn't anything in the Retainer Other Liability Account. The attorney created a Sales Receipt to show that I paid him which will now come through my bank feed. So what happens then? Also what happens if I don't owe him the entire amount, in other words he refunds part of the funds held in his retainer account?

I've attached screen shots of the process I used to create the retainer trust account.

Thank you for the screenshots, @Ladyhwg10.

When creating the item used on your bill to pay your attorney, well have to make sure that created liability account is chosen under the Expense Account field of your item. We can do this by following the second set of steps shared by my college, @IamjuViel.

From here, we can go ahead and pay your lawyer by closing out the bill. To do so, we can follow the screenshots and steps outlined by my colleague, @MaryLandT above. Once the payment (sales receipt created by your attorney) is posted in your bank statement, you can then match it with this bill payment.

Now for the last question, you can consider creating any sales transaction if you receive a refund from your attorney. In addition, I'd also suggest contacting your accountant for additional assistance and professional advice.

Lastly, here are helpful articles you can read for ideas to keep of all your sales and purchases: Income and Expenses for QuickBooks Online.

If there's anything else that I can help you with, please let me know in the comments. I'll be here to lend a hand.

So, a legal retainer I have on deposit with my lawyer is a "liability"? So when I send them a check to add to my retainer balance, I'm turning cash into a "liability"? As a journal entry, then, I'd credit cash (decreasing the asset balance) and debit a liability account which would create a negative balance in the liability account. I mean, seriously, WTF? That seems totally effed up.

What should happen is that the Retainer account should be an asset account. Kind of like an escrow account where a balance is retained for a specific purpose: to pay a specific category of expenses. When those expenses are realized, you should be able to enter a bill and then pay that bill from that asset account. But Quickbooks won't let me do that. Insanity.

Thank you for saying it out loud, I thought I was crazy thinking that this can't be the way!!

THANK YOU! I read through all of this trying to figure out how a retainer paid out to someone else is a liabiltiy. Clearly this is not the way to accomplish recording a retainer.

Thank you!

I was sitting here going, no if you pay OUT a retainer that's an asset...

Hi I'm sorry but I think you are confusing a received retainer and a paid out retainer.

If you pay OUT a retainer, that is an asset to be used at a future date.

If you RECEIVE a retainer, that is a liability you owe until services are rendered.

yes

There's a whole lot of confusing and incorrect information here, so I'm going to give a different (and hopefully correct) answer.

The retainer is a deposit you're paying for future services. Record an Expenditure transaction, using Accounts Payable as the account. This will create a credit balance in the vendor account.

As the vendor/attorney bills you for services, record their invoice as a Bill, using the appropriate expense account.

Finally, go to Pay Bills and process a zero payment for the vendor, using the credit balance.

After this, the vendor account will show the remaining credit balance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here