Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Help! I purchased a truck from a dealer with a loan using a trade-in for my business for $24,497. How do I make all the appropriate entries in QB Desktop Pro to show sales tax paid, documentary fees, title and registry fees and the cash down payment? I have read at least 10 different ways of entering this type of transaction using journal entries, negative number entries, etc., but most don't seem to work with Desktop Pro 2018 for Windows. I'm not an accountant and I don't play one on TV so don't make those type of assumptions please.

Solved! Go to Solution.

Let me help you record your purchased truck with a loan, @DrainageGuy.

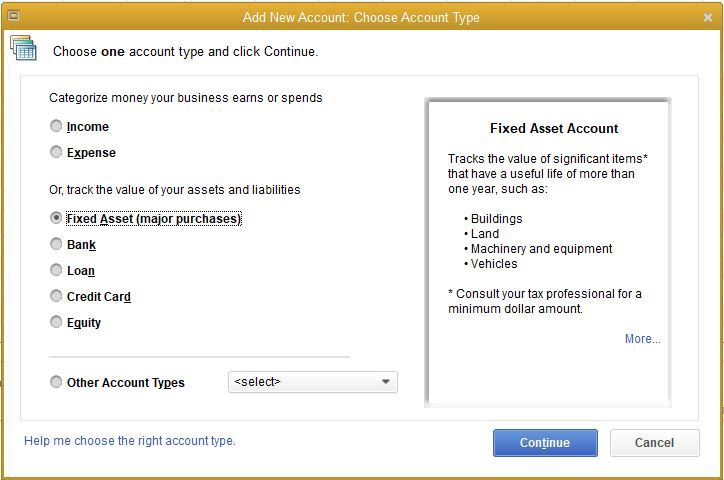

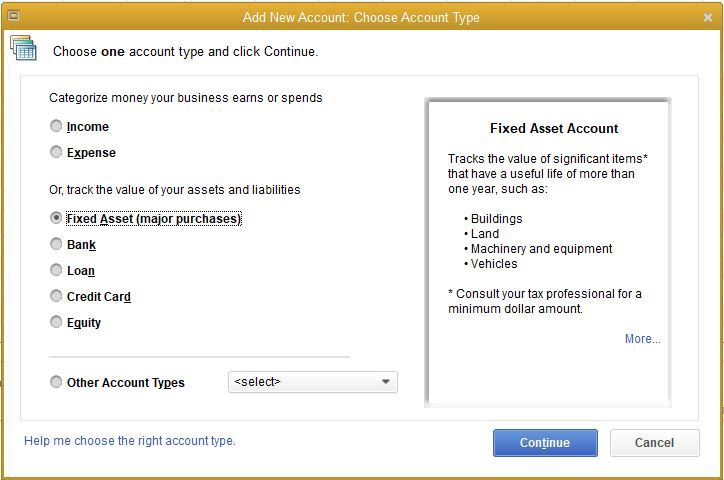

Here's how:

Once done, you'll need to record the purchase and link it to the Fixed Asset account.

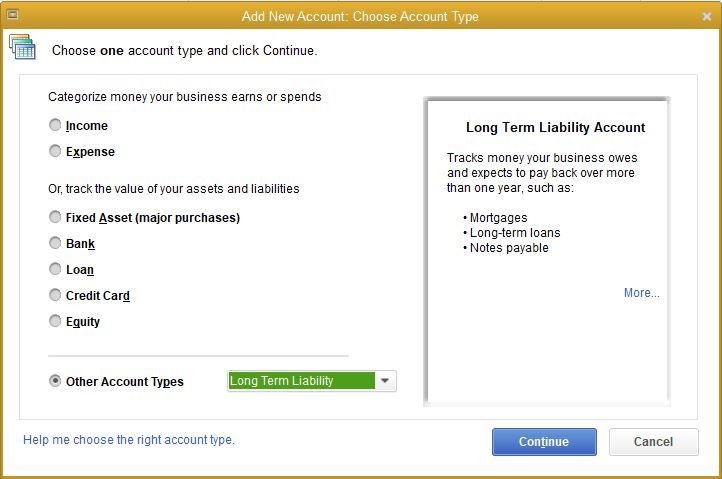

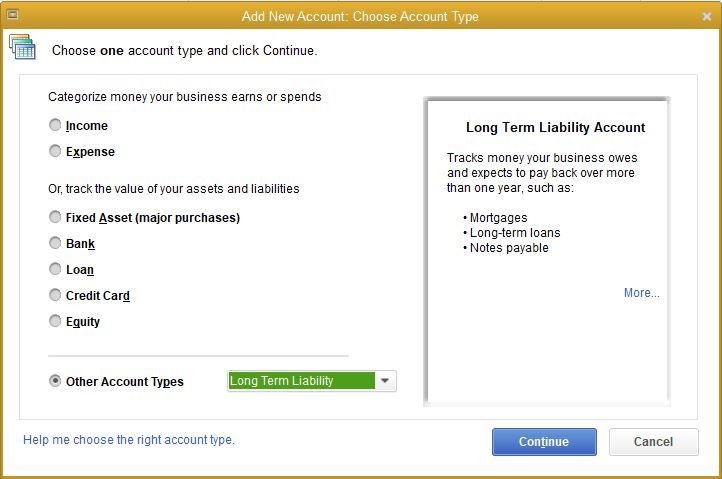

Then, set up a liability account. Here's how:

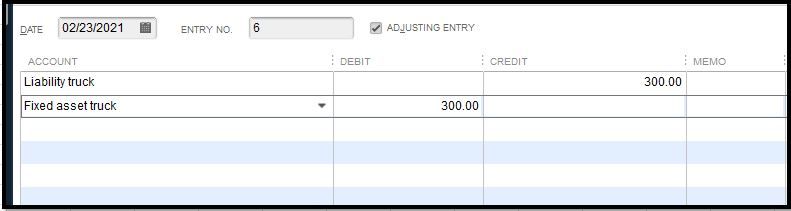

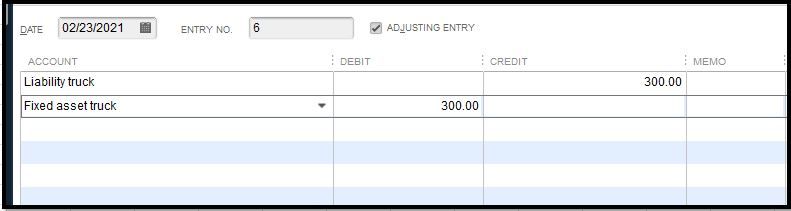

Now, here are the steps to record the loan amount:

Also, it's recommended to always create a backup copy of your company file before doing any changes. This is to ensure you have an original copy and restore it anytime.

For the best advice on how you can record it, I recommend consulting your accountant. If you don't have one, no worries you can look for a Pro-Advisor near your area using our Find an Accountant tool.

In case you need tips and related articles in the future, you can visit our QuickBooks Help page.

Feel free to get back to me if you need further assistance in recording purchases with a loan in QuickBooks. I'm just a post away to help. Have a good one.

Let me help you record your purchased truck with a loan, @DrainageGuy.

Here's how:

Once done, you'll need to record the purchase and link it to the Fixed Asset account.

Then, set up a liability account. Here's how:

Now, here are the steps to record the loan amount:

Also, it's recommended to always create a backup copy of your company file before doing any changes. This is to ensure you have an original copy and restore it anytime.

For the best advice on how you can record it, I recommend consulting your accountant. If you don't have one, no worries you can look for a Pro-Advisor near your area using our Find an Accountant tool.

In case you need tips and related articles in the future, you can visit our QuickBooks Help page.

Feel free to get back to me if you need further assistance in recording purchases with a loan in QuickBooks. I'm just a post away to help. Have a good one.

Thank you, I followed your directions and everything seemed to work and without making negative entries which QB didn't seem to like. Any advice on recording sales tax paid and documentation fees?

Hello @DrainageGuy,

Let me walk you through the steps on how you can record sales tax payments in QuickBooks.

In the same manner, here's an article you can read to learn more about paying your sales taxes: Use the Pay Sales tax window to create sales tax payments.

On top of that, I've also included this reference for a compilation of articles you can use while working with us: Pay and manage sales tax in QuickBooks Desktop.

If there's anything else that I can help you with, please let me know in the comments below. I'll be here to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here