Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello hunsuckerjk,

Let me guide you on how to apply the vendor credit to your cash account.

Since you've received a cash refund for the returned items, you'll have to enter a deposit transaction to your cash account. Then, link the deposit to the vendor credit.

Here's how:

To deposit the cash refund to the cash account:

To link the deposit to the vendor credit:

Here's an article for more the detailed steps: Handle vendor credits and refunds.

That should do it. If you need any further information, please don't hesitate to leave a comment below. I'm always happy to help.

This only works if you have an outstanding balance. It does not work if you paid your bill and then returned items and received a credit to your account. I can't find anything for a refund from a vendor when there is no outstanding balance (refund for damaged goods/ returned goods etc)

Hi there, @cipgifts.

The steps provided by my colleague can still work even when there's no outstanding balance in your account. The bank deposit is used to track the refund. Since you can't enter inventory in a deposit, you need to create a vendor credit to record the returned items.

For additional reference, you can visit the QuickBooks Blog to see the latest product enhancements that you'll find beneficial for your business.

Thank you for reaching out to us. Please let me know if you have any questions. I'll be happy to help you out.

There is no way to match it to the vendor credit. The vendor balance is off as a result.

Hello cipgifts,

Thanks for joining this conversation. I'm here to lend a hand in matching the deposit to the vendor credit.

You need to enter a bank deposit and post it to Accounts Payable. Then, we have to create a dummy bill to match the deposit and vendor credit. This will remove the incorrect balance on your vendor's profile.

Here's how:

To create a dummy bill:

To link the deposit and the vendor credit:

You can always go back to the article I provided above for further guidance.

This should answer your concern for today. I'd appreciate if you can let me know how these steps work for you, so I can help if there's anything else you need. Have a good one.

why can't you simply post a journal entry and link the vendor?

Thanks for following in this thread, Richard Head.

Let me provide some information on how QuickBooks Online (QBO) handles vendor credits.

When tracking the transaction mentioned above, you should consider creating a bill. This will help track your account balance and credits using Accounts Payable.

Alternatively, enter a note to remind yourself about this credit in the future. Performing this process ensures your records are in tiptop shape.

For additional information, see the following article: Enter a credit from a vendor. This resource outlines the complete steps on how to create a vendor credit and apply it to a bill.

Need help managing expenses and other vendor transactions? You can browse here to access our self-help articles. From there, you’ll see topics about purchase orders bills, expenses, inventory, and other supplier related-activities.

If you have additional questions about vendor credits, feel free to post a comment below. I’ll get back and make sure you’re taken care of. Enjoy the rest of the day.

I had the same problem. I could not match a bank feed deposit (refund) to a vendor credit I entered. I was told that this can't be done right now and the vendor transactions wouldn't be accurate which is not the best. She also said this is in development. That is to allow us to match a refund received in a bank feed to a vendor credit. Is this incorrect? Process otherwise seems a bit needlessly complicated but I'm not an accountant. Is there a resource we can see where this in the development process?

Hi there, @JerzyBoy.

Thanks for following along with the thread and sharing your concerns.

At this time, the ability to match a bank feed deposit to a vendor credit is not available. You can keep up with our latest happenings and updates by using our Firm of the Future site.

Please know that we understand how beneficial this feature would be for you and your business. Our engineers work each day to make QuickBooks the best that it can be to match our customer's needs.

Let me know if you have any questions or concerns. I'm always here to lend a hand. Take care!

How do I fix??

Edit: AP Aging still showing credits

Hi, Scott62995.

Thanks for joining this conversation. Allow me to jump in and provide information about managing vendor credits in QuickBooks Online (QBO).

Based on the steps you've done, the AP Aging shouldn't show any credits. To isolate this, let's sign in to your QBO using a private browser (incognito). This will help us check if this is a browser-related (cache and cookies) issue.

Here's how:

If everything looks good, return to your default browser and perform a clear cache to refresh the system. However, if the issue persists, try using other supported browsers.

For more information about managing vendor credits in QBO, consider checking out this article: Handle vendor credits and refunds in QuickBooks Online.

I also recommend visiting our website for tips and other resources you can use in the future: Self-help articles.

Please post again or leave a comment in this thread if you have follow-up questions about vendor credits or anything else QuickBooks. I'm always here to assist. Keep safe.

I am using QB Pro. Sorry, I should have mentioned that.

Thanks for the update, Scott62995.

You may have posted the credit to the Accounts Payable (AP), and that's why it's not showing as an outstanding credit.

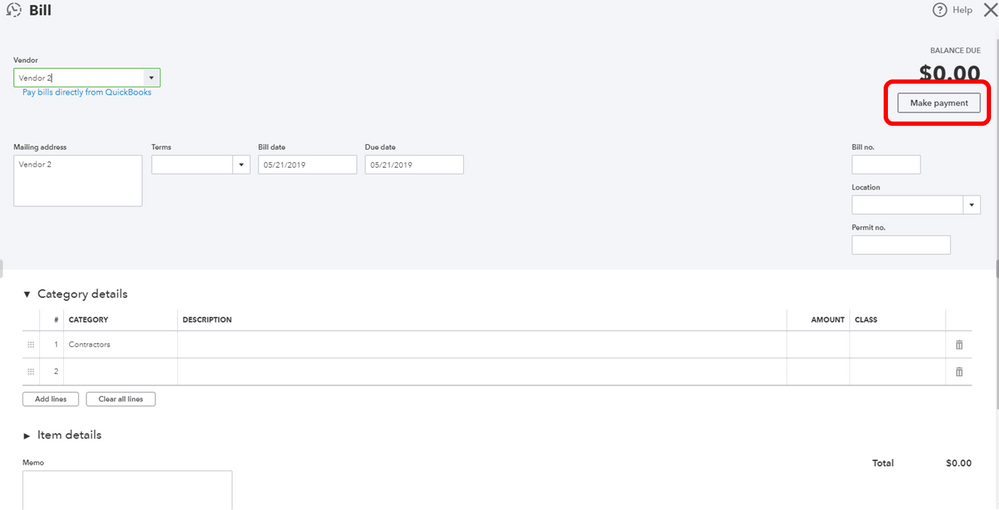

What you need to do is open the credit from the AP report. Then. make sure to select an expense account, not AP. See the attached screenshot below as your visual guide.

Now, we will link the two entries using the Pay Bills option. Here's how:

Regardless, there are different scenarios that requires specific set of steps to account for a vendor refund. I would still recommend checking this article for other ways to record them in QuickBooks: Record a vendor refund in QuickBooks Desktop.

On top of that, I've also included this reference for a compilation of articles you can use while working with us: Expenses and Vendors for QuickBooks Desktop.

If you have any other questions, please let me know in the comments below. I'll be right here to answer.

Something is getting lost in translation.

Pictures loaded not in order sorry

I'll help you zero out your aging AP account, Scott62995.

Does the check you recorded have the same purpose, or use the A/P account as the vendor credit? If so, there's no need to create it if there's an existing vendor credit. This way, it won't double the A/P or vendor balance.

To delete a check:

If not, you'll have to use an expense account instead.

Also, I encourage checking the expenses and vendors page shared by my peer above to browse articles you can refer to that can help you with future tasks in QBDT.

As always, the Community is here to lend a hand whenever you need help again in the future.

Clear as Mud.

What Check are you saying delete?

I deposited the refund check and to the AP account as QB says to do.

I used the Pay bills to set credits and paid. As QB says to do.

QB auto generated the Zero balance checks.

Vendor account is zero balance as should be.

Yet the AP aging still shows credits.

Please be specific step by step on correction.

Let me clarify things and help you zero out your credits shown on your A/P Aging report, @Scott62995.

You don't need to delete any transactions to resolve your issue. You just need to perform a few more steps to remove the credits on your A/P Aging report. Since you've already deposited the refund check to the Accounts Payable (A/P) account, you'll need to record a Bill Credit for the refunded amount and link it to the created deposit. This way, the credits showing on your A/P Aging report will zero out. Here's how to create a bill credit:

Once done, you'll need to link the deposit to the bill credit. Let me guide you how:

For more guidance, you can check out this article and follow the steps of scenario 1: Record a vendor refund in QuickBooks Desktop.

You may also want to learn about the Accounts Payable workflows you can use in QuickBooks Desktop. This article will provide you the detailed information: Accounts Payable workflows in QuickBooks Des....

Come back to this post and let us know how it goes, @Scott62995. I want to make sure this issue is taken care of.

You are telling me to do a step I've already done

I deposited the refund check and to the AP account as QB says to do. (It showed up in Bills to Pay)

I used the Pay bills to set credits and paid. As QB says to do.

QB auto generated the Zero balance checks.

Vendor account is zero balance as should be.

Yet the AP aging still shows credits.

Please be specific step by step on correction.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here