I can guide you where you can see how QuickBooks calculates sales taxes on your progress invoice in QuickBooks Online (QBO), Matt.

Before proceeding, please know how QuickBooks calculates sales taxes:

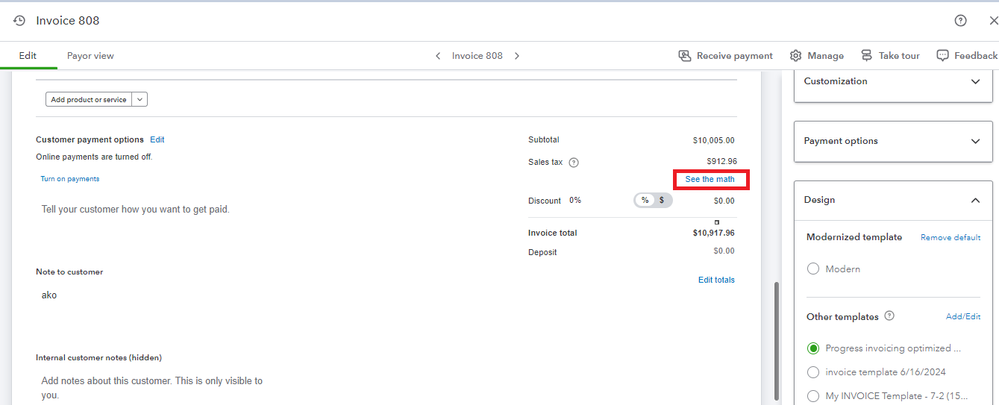

Since the sales tax calculation is incorrect, we can use the See the Math option to determine how QBO comes up with the specific amount. It will also allow you to edit the sales tax on the invoice page.

I've attached screenshots for reference:

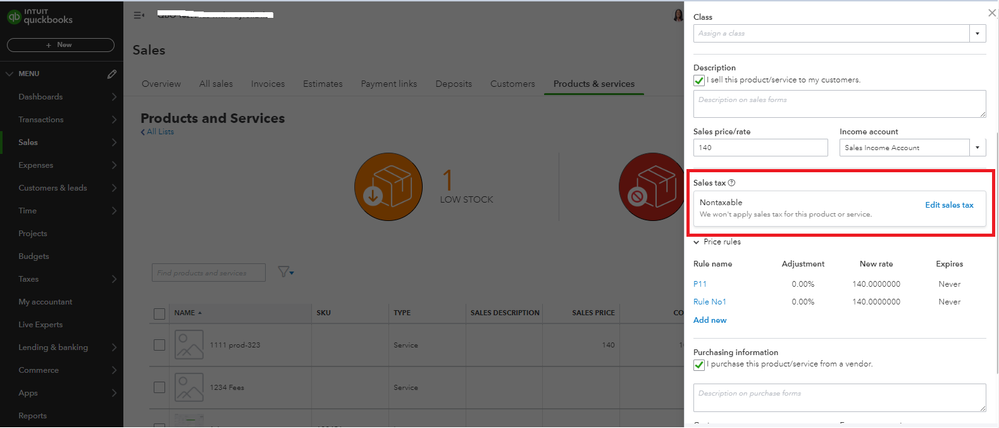

In the meantime, let's check your sales tax category and rate for your item setup in the Products and Services section, which also affects sales tax calculation:

- Go to the Settings icon at the top right corner of your QBO page.

- Click on Products and Services.

- Select the specific item and click on Edit.

- In the Sales Tax section, select Edit Sales Tax.

However, if you've set up the address and product category correctly based on how QuickBooks calculates taxes but still have incorrect sales tax calculations, I suggest performing browser troubleshooting.

If the issue persists, it's best to contact our Support Team to assist you further. They have the required tools to identify the cause of the problem by initiating a screen-sharing session.

Here's how to reach out to them:

- Sign in to your QBO account.

- Click the Help (?) icon.

- Select the Search tab, then click Contact Us.

- Select a topic and choose how to contact our support team:

- Via Callback, where they save you a spot and call you back

- Via Chat, to start a chatting session with our available expert

The supporting hours are available from Mondays to Fridays, 6 AM to 6 PM PT, and Saturdays, 6 AM to 3 PM PT for Plus, Essentials, and Simple Start. Advanced users will be at any time, any day.

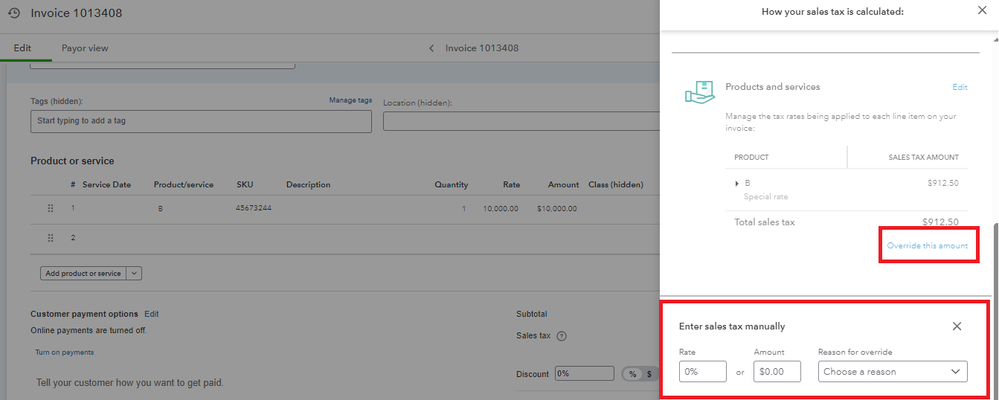

As a workaround, let's modify the sales tax calculations by manually entering the amount to override the calculation.

Moreover, you can use this article to learn how to personalize your sales forms information: Customize invoices, estimates, and sales receipts in QBO.

Feel free to comment below with any other questions regarding sales tax calculations on the progress invoice. We're here to help you.