Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen I follow this set up--Set up and record in-kind donations in QuickBooks Online--

It is not clear whether to include on the Products/services I sell this product (in kind income acct or I purchase this product from a vendor (what expense acct do you enter?) I entered this screen under income account and when I create a bill using the above product linked to my in kind income acct the profit and loss reports show a negative number in the in kind income account instead of a positive number.

Please clarify.

Solved! Go to Solution.

Hello there, @parksbarbie.

I want to make sure you can set up and record in-kind donations in QuickBooks Online (QBO).

To record an in-kind donation, you should set up an income and clearing account for charitable contributions, and create a product or service item for the donations. Since you aren't sure what expense account to use, I recommend seeking help from your accountant. This way, they can provide the right account to use.

If you don't have an accountant, you can find one through this link: Find an accountant.

Just in case you want to record donations or charitable contributions in QBO, you can read through this article for the detailed steps and information: How to record donations or charitable contributions.

Don't hesitate to leave a comment below if you have other concerns or follow-up questions about recording in-kind donations. I'll be right here to provide further information.

so the product is an expense correct? If t $100 in kind donation is entered correctly what would the reports look like?

clearing acct is zero

in kind donation income acct?

other accts?

Can someone help me with this?

Hi there, @parksbarbie.

I want to ensure you get the help you need in recording in-kind donations in QuickBooks Online (QBO).

To get started, I'd like to verify how you set up the product or service item for the in-kind donation and what account you use for the income and expense account. Did you also create a sales receipt before making a Bill? Any information is much appreciated.

We're looking forward to hearing from you.

Set up income acct-in kind donations 5100

set up bank acct (clearing)-In Kind clearing

created new service product-In Kind donations--I sell--Income acct is the revenue acct 5100

I purchase--expense acct is 1250 professional services expense

created a sales receipt using services (in kind donations) this put $1500 into in kind clearing acct and in the income acct 5100

created a bill for 1500 category is 5100 in kind donation income acct then paid bill

P&L shows income acct 5100 as zero

balance sheet shows clearing acct as zero

It seems like the in kind income acct should be positive 1500

where did I go wrong and how do I correct it? thanks.

I appreciate you sharing the detailed process of recording in-kind donations in QuickBooks Online (QBO), @parksbarbie. I'm here to explain how you can fix the negative amount in your Profit and Loss (P&L) report.

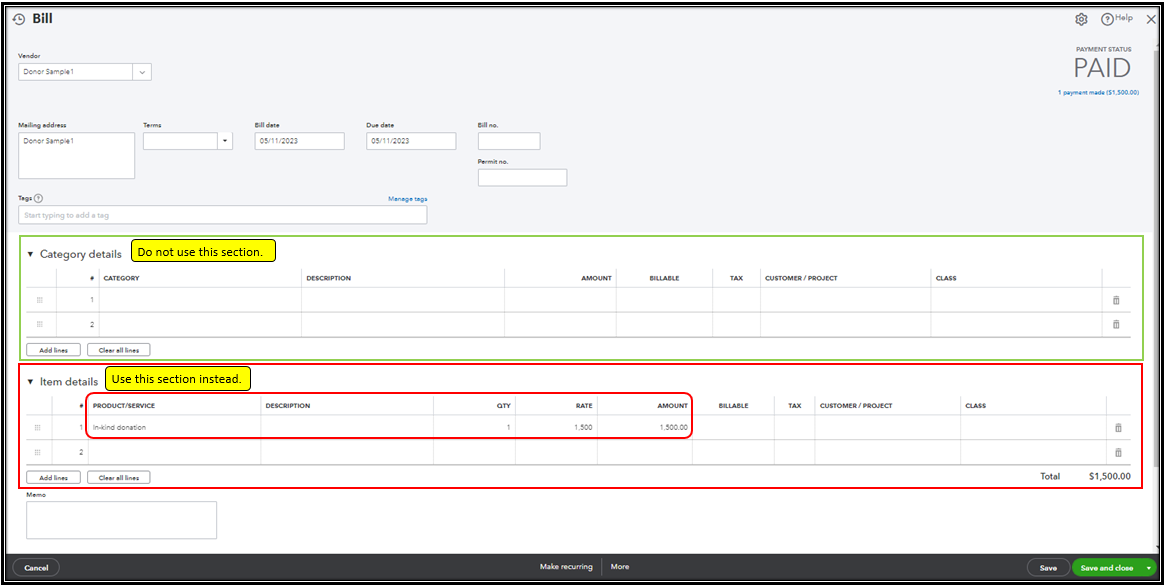

One of the possible reason it shows as a negative amount in your P&L report is because you recorded the bill transaction using an incorrect line item. Thus, instead of utilizing the Category details section as the line item of the Bill page and affecting the In-kind donation income account, you'll need to use the Item details section and choose the in-kind donation service item.

To fix this, you can delete the line item under the Category details section and use the Item details section in the Bill page. Here's a screenshot for your visual reference:

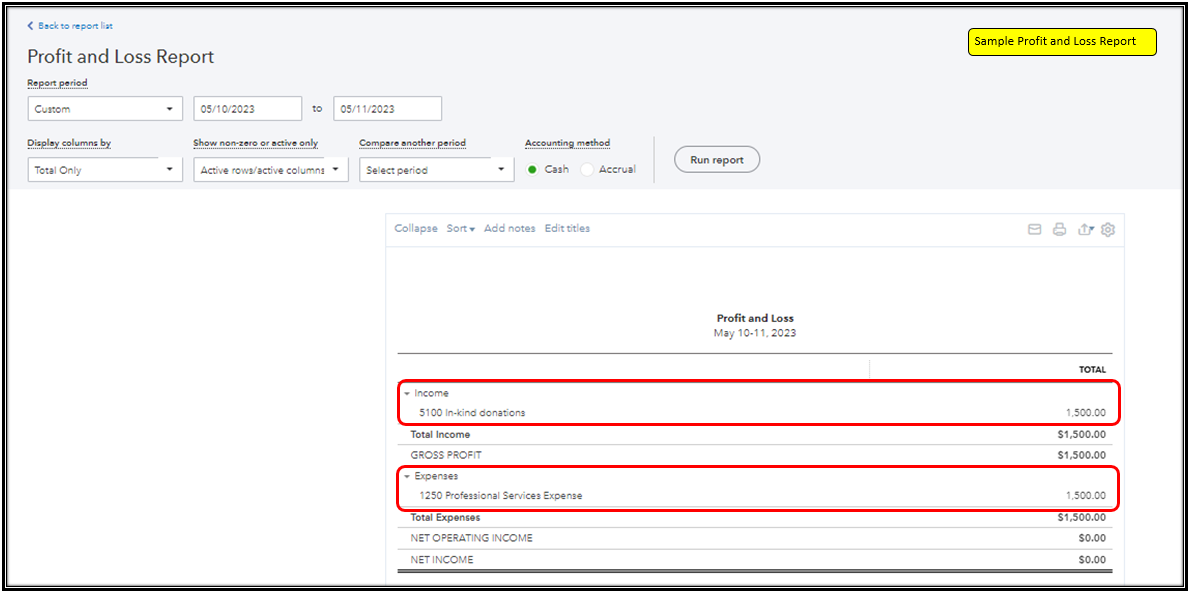

After ensuring you're using the Item details of the Bill transaction, it will show up in your P&L report as positive for income and expense accounts.

Moreover, I recommend seeking assistance from your accountant to help and provide more expert ways of dealing with this situation. If you're not affiliated with one, you can use our Find an Accountant tool to look for a Pro-Advisor near your area.

Additionally, feel free to check out this article to learn more about how to customize reports in QBO. This way, you'll be able to pull up the desired details for your reports: Customize reports in QuickBooks Online.

Feel free to drop a comment below if you need further assistance with recording in-kind transactions into the program. I'm always here to provide additional assistance. Have a great day ahead!

Assign the '1250 - Professional Service Expense' to the bill and the '5100 - In-Kind Donation Income' to the sales receipt. Your post indicates you assigned the '5100 - In-Kind Donation Income' to the bill. That will reduce your income by $1,500.

I made your adjustments. Now the clearing acct is zero-correct . On the P&L the in kind donation INCOME acct shows $1500- correct and the Professional fees EXPENSE also shows $1500. Is does not seem right??

Yes, that’s right. You want the income and the offsetting expense to offset (net to $0) when in-kind services are donated.

Great thank you for your time explaining this!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here