I appreciate you for providing in-depth details of your estimated tax payment concern, jade-lui.

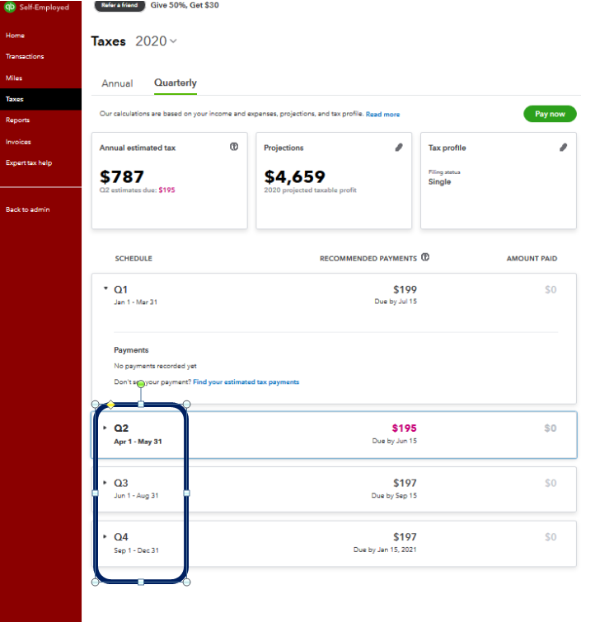

In QuickBooks Self-Employed (QBSE), it will provide you a breakdown of the estimated tax payments per quarter (as shown in the screenshot below). Let's make sure we selected the specific quarter that we need to pay on the Taxes page. Then, fill out the needed information and click Continue to accomplish. This is to ensure that we will pay for the right quarter.

For more tips and details about this one, check out this article: Pay Federal Estimated Quarterly Taxes.

To verify the estimated tax amounts per quarter, I'd suggest contacting our QBSE Customer Support Team. They'll pull up your account in a secure environment. Then, they'll help you review and check on why the amounts are too hight for the second quarter.

Just refer to this article to reach out to them: Contact QuickBooks Self-Employed Support.

I'm also adding these articles to know additional information on when to pay your taxes:

Fill me in if you need a hand with categorizing your transactions or any QBSE related. I'll be here to ensure your success. Take care always.