Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowYes of course, that is the way it was always done

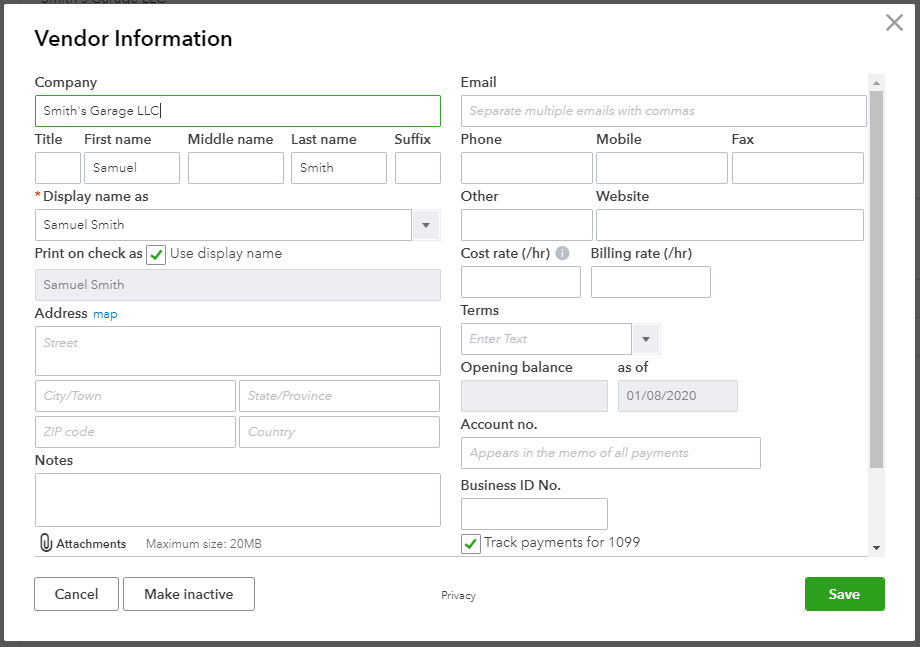

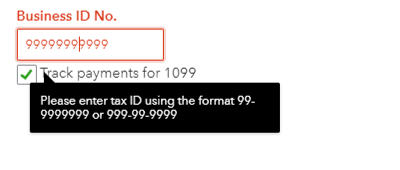

edit the vendor record and enter the information you have from the W-9

Intuit created this contractor tab, but in reality there is no difference between a contractor and a vendor other than whether or not they require a 1099 at year end

I can enter the W9 information but QB will not let me create 1099s unless the vendor or contractor has entered their information themselves. I can't get some of them to enter, they just sent me a copy of their W9. How can I create 1099s for them? It just ways waiting for info and won't let me process.

Good to see you in the Community, @Bethf.

You can create 1099s for your Vendor/Contractors by manually updating their information using the W9 as what @Rustler said. Non-employees are categorized in Box 7 since they are Vendors/Contractors.

You can update their information by going to the Vendor menu.

Here's how:

There you can now prepare and file 1099s.

If you want to E-file with the 1099 E-File Service, use this article as your reference: E-file through the 1099 E-File Service (QuickBooks Online).

You can always get back through this post if there's anything else. I'll be glad to help. Take care!

So I did that and discovered that 4 of my contractors who I paid over $1000 show up as not meeting the threshold for 1099. Is this a bug or did I do something wrong?

Hey there, Bethf.

Thanks for following up here after trying those steps.

After researching this situation a bit more, I wasn't been able to find any bug reports of several contractors not meeting the 1099 threshold. To make sure you get the best fitting information, I recommend calling in to speak with a member of the Support Team. Agents have specialized tools to take a look at data on both your side and ours to make sure everything is set up correctly. Here's how to contact this team:

1. Click the Help button in the top right corner.

2. Select Contact Us.

3. Enter Support in the field and choose Let's talk.

4. From here you can select to receive a callback at a time that's convenient for you.

Additionally, you may want to check out the following article to find out more about 1099 Troubleshooting.

Please feel free to let me know how the conversation goes. I'll be here to help in any way that I can.

Unfortunately, I tried to reach support several times and never got a chat or a call back. Finally called my accountant and she was able to fix the problem. The accounts that I posted payments to needed to be marked as 1099 eligible. She fixed the accounts and the contractors showed up. I was unable to find any documentation that this was necessary. Now I know.

I run into the same problem. The fix was to change pay from to CHECKING ACCOUNT. If “credit card” option is selected, it will not be recognized. Hope it helps.

No you cannot prepare and efile 1099s after checking the box. It is requiring the contractor create an account and electronically fill out the form.

This is useless as most w-9s are still on paper for the payor's file.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here