Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI am using Quickbooks Pro 2019. Is there any way we can put in the hours of a job, and the cost of the job. And as we are working towards the job it backs the hours and money out of the cost based on the reports from T-sheets. I added estimates for each job we are working on. And the time is going through T-sheets, but we can't get real-time cost until we actually send out an invoice. Does anyone know a workaround or a report I can pull up?

I can share some insights about the Job Costing process in QuickBooks, @snunez89,

While estimates are non-posting transactions, we're unable to assign time nor see its cost on the reports. You can, however, pull up separately a Time by Job Detail report to show unbilled time and Job Estimates vs. Actual Detail for company estimated costs and revenues.

Once you have them open, export the data and manually combine them in Excel. To access the reports, simply go to the Reports menu and select Jobs, Time & Mileage. Click the reporting type you need from the list.

Here are some resources to help you with QuickBooks reports:

Feel free to comment down below any questions you need help with. I'll be right here to help. Have a good one.

How do you combine them manually?

6/17/2020

I am trying to pull a P&L for one job that has more than one class on the invoice.

Example:

Customer = XYZ

Class = Bluff Project (customer)

Class + Truck 101 (equipment)

Class = Tractor 50 (equipment)

but....we are using certain equipment on the job that we are classing under the equipment on the invoice.

How do I get a P&L to report all income to include the equipment classes and the job. The job does not have equipment classed in hierarchy under it as we use the same equipment on multiple jobs.

Can this be done?

Welcome to the Community, @Mesha.

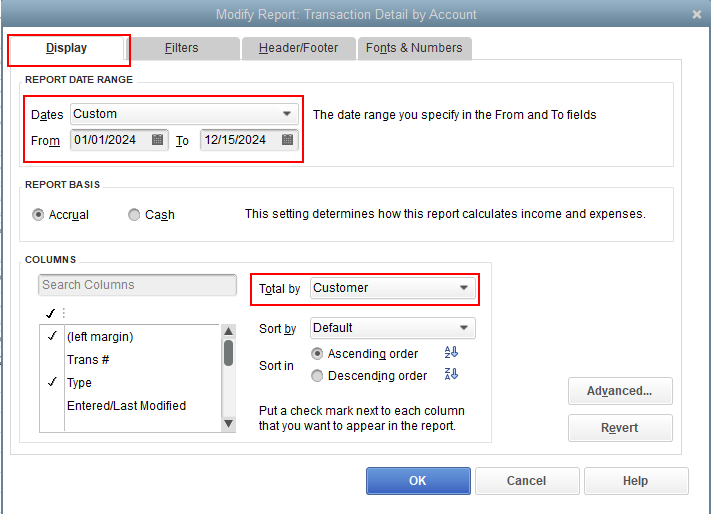

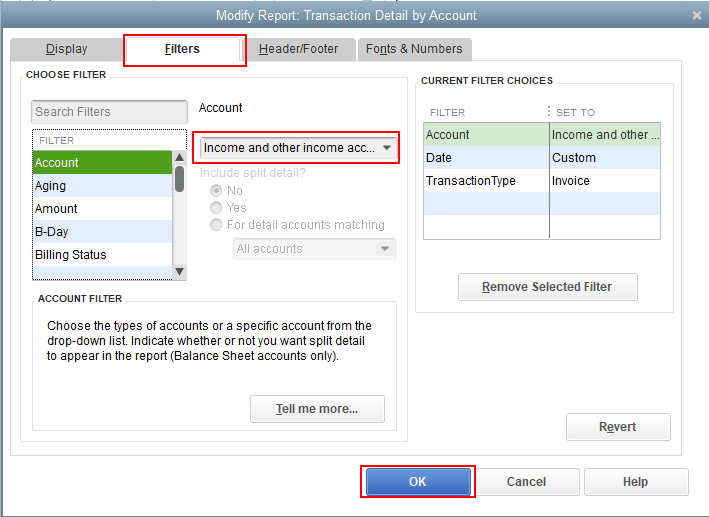

At this time, there isn't an option to customize the Profit and Loss report to show all incomes, including classes and the job. As a workaround, you can consider running and customizing the Transaction Detail by Account report.

Here's how:

I'm adding this article to learn more about how to customize reports: Customize reports in QuickBooks Desktop.

Just in case you want to memorize this report, feel free to check out this article for the detailed steps and information: Create, access, and modify memorized reports.

Please let me know how it goes in the comment section below. I'm only a post away if you have any follow-up questions. Wishing you all the best.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.