Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowAs a small service oriented business in the education industry (tutoring, specifically) who invoices clients on account at the end of 2 week billing cycles, I need to conform to the accrual basis of accounting. The problem I am having is with the need to invent or develop workarounds to record accrued/unbilled revenue. Since I invoice every two weeks, and complete my basic accounting reports at month end, I will almost always have accrued revenue to report on each balance sheet (and, simultaneously, revenue on the P&L that hasn't been invoiced yet). This is because the month end rarely lines up exactly with the end of my billing cycle. So, for example, I have a billing cycle running from Sat. 5/21 to Fri. 6/3, and I invoice all those jobs on Fri. 6/3. Well, most of that revenue was earned in May and needs to be reported in the May monthly accounting period, even though it wasn't billed in May. I hope this makes sense.

Well, I got excited when I discovered the Delayed Charge feature in QBO, until I realized that they are non-posting transactions :(

It would be really nice if I could adjust a setting to make them postable transactions, specifically to Accrued Revenue on the balance sheet (debit) and Revenue on the Profit and Loss (credit). Then, as I generate invoices from these Delayed Charges, Accrued Revenue would be credited and A/R would be debited by the amount on each invoice created from a Delayed Charge.

I don't hold out a ton of hope here, but is this possible to do? I know some of you are thinking that I should just change my billing cycle to be monthly, but I have a billing rhythm as the business owner and my customers have come to accept that rhythm over the years.

Solved! Go to Solution.

Hello there, @HAAcademicSolutions. I'd like to provide some insights about the Delayed charge feature in QuickBooks Online (QBO) and guide you on the steps you need to take care of this matter.

Yes, you're correct that delayed charges are non-posting transactions. I can see how the benefit of being able to make them postable would aid you in managing your service-oriented business with QBO. However, the said option is currently impossible.

For the time being, you record delayed charge transactions when you want to keep track of items to be billed to customers in the future. Then, convert them later to invoices. For additional insights about this, I recommend following this article: How to Create Delayed Charge Invoices in QuickBooks.

We take your suggestions as opportunities to improve the various features of our products. Therefore, I would encourage you to send suggestions or product recommendations.

Your valuable feedback will be forwarded and reviewed by our Product Development team to help improve your experience while using the program. Here's how:

Also, you may want to see all your transactions on a certain report like the Profit & Loss or the Balance Sheet in your QBO account. In case you need help in doing so and a guide in familiarizing how to utilize the Reports feature, please check out this article as your reference: Run reports in QuickBooks Online.

Let me know in the comments if there's anything else you need or concerns about delayed charges in QBO. I'll gladly help. Take care, and have a great day, @HAAcademicSolutions.

Hello there, @HAAcademicSolutions. I'd like to provide some insights about the Delayed charge feature in QuickBooks Online (QBO) and guide you on the steps you need to take care of this matter.

Yes, you're correct that delayed charges are non-posting transactions. I can see how the benefit of being able to make them postable would aid you in managing your service-oriented business with QBO. However, the said option is currently impossible.

For the time being, you record delayed charge transactions when you want to keep track of items to be billed to customers in the future. Then, convert them later to invoices. For additional insights about this, I recommend following this article: How to Create Delayed Charge Invoices in QuickBooks.

We take your suggestions as opportunities to improve the various features of our products. Therefore, I would encourage you to send suggestions or product recommendations.

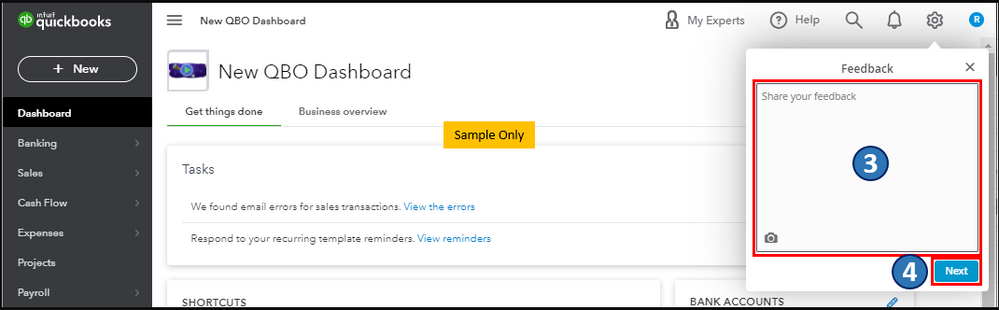

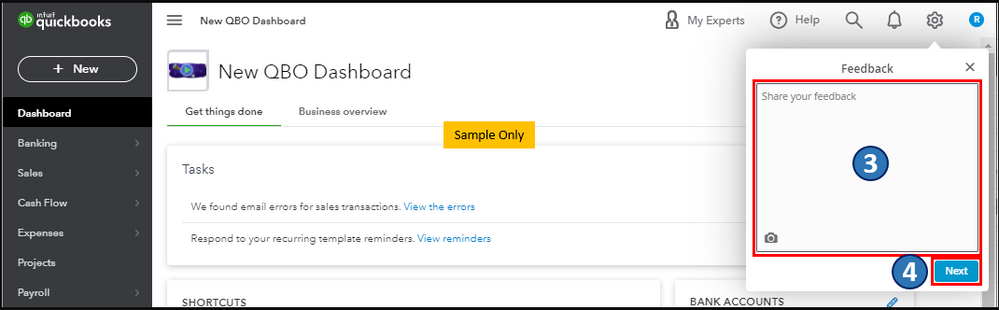

Your valuable feedback will be forwarded and reviewed by our Product Development team to help improve your experience while using the program. Here's how:

Also, you may want to see all your transactions on a certain report like the Profit & Loss or the Balance Sheet in your QBO account. In case you need help in doing so and a guide in familiarizing how to utilize the Reports feature, please check out this article as your reference: Run reports in QuickBooks Online.

Let me know in the comments if there's anything else you need or concerns about delayed charges in QBO. I'll gladly help. Take care, and have a great day, @HAAcademicSolutions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here