Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHelp!

My retail storefront/business opened in May. I didn't get signed up for Quickbooks until July. All sales and deposits, etc...need to be manually entered for the months of May, June and July. In order to get everything caught up, I need help to: 1) Manually enter all Square sales from May, June and July. Instead of doing this for each day, at this point since I'm behind, I am thinking it would be easiest to input the entire amount for the month (for May, for June, and for July, individually). 2) Manually enter Sales Discounts (employee discounts, markdowns, etc). 3) Manually enter Square Gift Cards sold. 4) Manually enter the Square fees, which were deducted prior to Square depositing into my bank. 5) Manually enter the amount of Gift Cards redeemed. 5) Manually enter Sales Tax Collected. Once I think I have all this completed, I do still need support in how to adjust Square deposits so that they reflect gross sales before those Square fees. That seems to be an issue with everyone who uses Square and QB!

It's my top priority to help you manually enter all your Square transactions, nikndick.

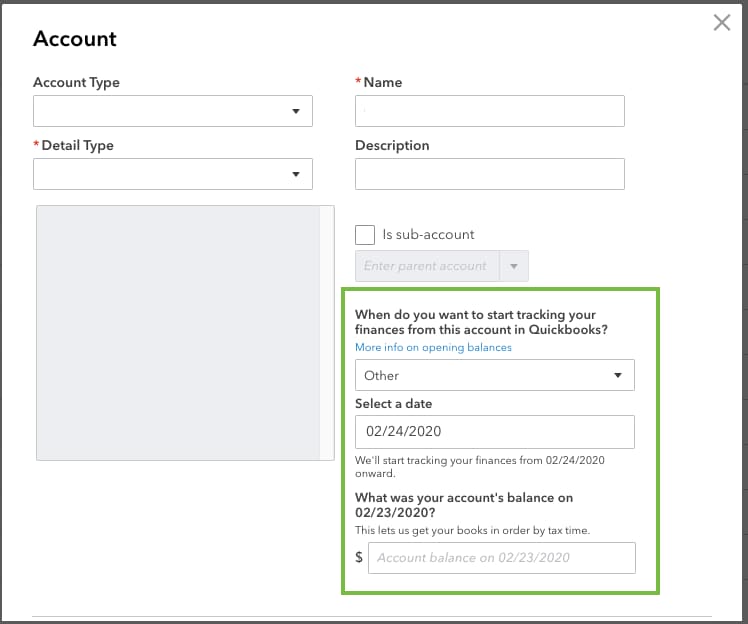

You'll have to create a new account so you'll be able to track all the transactions including all your sales in QuickBooks Online. To do this, you can follow the steps below.

For Square fees, you can add a negative amount for the square fee in the line item when entering a bank deposit. Let me show you how:

If you're using the Sync with Square app to import sales into QuickBooks Online, you can check the mapping of the downloaded transactions. You can go to the app's setting to review the setup and ensure the transactions will sync correctly.

Here's how:

I'm adding the article for more information: Sync with Square Hub.

For more helpful articles, you can check out this link for your reference.

Reach out to us if you need further assistance about entering your Square transactions. I'll be here to help you.

This feels like a programmed response. Not really an answer to my questions/concerns. Anyone else out there?

Glad to have you in this thread, @nikndick.

Allow me to give more details about entering square deposits and correcting past deposits in QuickBooks Online (QBO).

If you're using online banking when adding deposits, you can just UNDO the deposits from the In QuickBooks tab. Once done, these transactions will be transferred to the For Review tab.

Here's how:

Once you record all the transactions correctly, you can now start matching downloaded transactions.

In addition, to lessen the total amount deposited, you can add a negative amount for the square fee in the line item when entering a bank deposit.

Let me show you how:

After successfully recording the transactions in QBO, you should be able to match them to the downloaded Square deposit.

Please check out the article about syncing with Square. It explains the setup, the things you need to do in QBO, and the mapping of transactions.

I'm still here to help you more if there's anything else you need. Just drop a comment below. Wishing you all the best!

As another option, explore this connector to reconcile your Square transactions easily.

https:// synder.grsm.io/quickbooks

I assume you have resolved this by now, but I just went through the same thing and found the answer verbose. In addition, the first answer did not record the expense to Square.

1. Manually add the expense. + New -> Expense.

2. When adding the Expense, set the account as Undeposited Funds.

3. Also deposit the full amount to Undeposited Funds.

4. Go to + New -> Bank Deposit. Select both transactions and make the deposit to the account.

I've figured out how to post my square deposits and separate out the fees by splitting the transaction and posting the two amounts to Sales and then my account for Merchant Fees. However I am finding out over time that QB is not tracking those "sales" as taxable sales. How do we set this up so that you can show the "Sales" amount, split out the tax, and the merchant fees and have everything go to the right account and when it comes time to pay quarterly sales tax my totals are correct? I CANNOT figure this out!!

Thanks for joining in on the thread, bdthreads. Let me provide you with additional information so we can start tracking sales as taxable in QuickBooks Online (QBO).

If you're using the Square app to sync transactions to QBO, I'd recommend contacting their customer support. This way, they'll be able to determine the root of the issue and reflect the sales taxes going into QBO.

Furthermore, we can use the Journal entry (JE) for the taxes that cause negative amounts in your sales. It allows you to transfer money across accounts and ensure that your books are balanced in particular ways. However, I'd suggest consulting your accountant before entering transactions in JE. To do that:

Once we settle everything, I'd recommend reconciling your accounts every month. This way, we can compare your bank statements with the transactions you entered in QBO to see if they match. Doing so will ensure that your books are balanced and accurate.

Let us know in the comments below if you have further clarifications about setting up taxable sales in QBO. We're always around to lend a helping hand. Have a bountiful new year to you and your business!

If you’re doing it all manually, you can batch the monthly totals as journal entries or sales receipts and then add separate expense lines for Square fees so gross and net match up. If you want automation I load Square totals with Skyvia and create the daily entries in QBO. You can find more integration details here.

I have never had to deal with Square before and this is so confusing. I think your response is on the same track of what I am thinking. Right now the deposit from Square is just showing the net amount, not breaking down the fees, tips, loan payment and taxes. When I export the transfer detail amount from Square to excel it still doesn't make sense to me. Oh, I forgot to mention that I was just handed this client to clean up and audit the books from someone else. I am thinking the best way to clean this up is using a journal entry. Run a annual report for 2024 from Square if possible that shows the gross sales & all the taxes, tips, loan payments and fees and then create a journal entry with this data against the sales (deposits) account. I would greatly appreciate any guidance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here