Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI started using Quickbooks in June. I noticed that the mileage that has been recorded is not flowing to the standard profit and loss report. Is there something I need to change in settings to get these transactions to be included in the reports. I do see all the individual transaction under the mileage tab.

Solved! Go to Solution.

Hello, jacktjl.

I understand the importance of keeping track of your business miles and vehicle expenses so you have everything you need to calculate deductions when tax time comes around. I'll share some information on how this mileage feature works.

Importing and recording mileage expenses under the mileage tab or screen doesn't get reflected in the main account. This is only designed to keep everything in one place and tally the totals so you have everything you need to make tax deductions.

The profit and loss statement is a financial statement that summarizes the income, costs, and expenses incurred over a given period. You can create a reimbursement expense for you or your employee if you want the mileage expense to appear on your profit and loss report. I'll show you how.

Set up a vendor profile:

Set up a mileage reimbursement expense account:

Create an item for mileage reimbursement:

Create a bill for the mileage reimbursement:

Record the payment for the Reimbursement expense:

For your reference, you can visit this article: Reimburse employees' mileage and vehicle expenses in QuickBooks Online.

In addition, you can connect your bank or credit card account if you want QuickBooks to automatically download your bank transactions: Connect bank and credit card accounts to QuickBooks Online.

Don't hesitate to post again if you need anything else. We're always available to help you.

Good morning, @jacktjl.

Thanks for reaching out. I hope your day is going great.

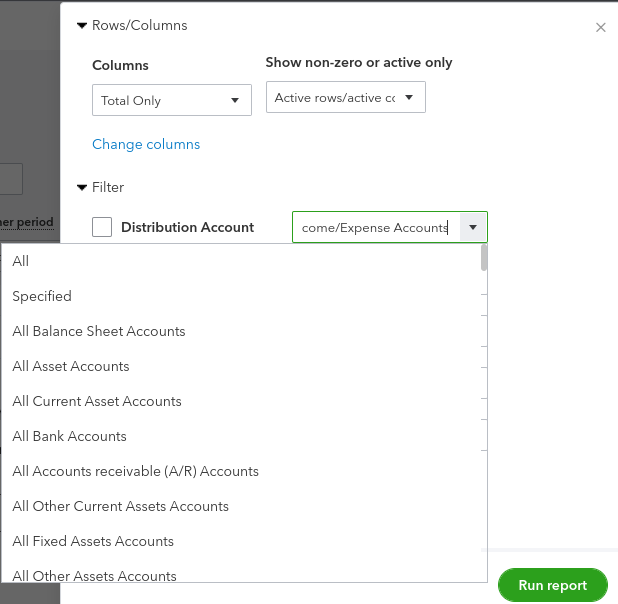

In QuickBooks Online, the Profit and Loss report is already set by default to include all income and expense accounts. You can customize the report further to include all registered accounts. Let me walk you through some steps to customize the report so I can ensure you see your mileage expenses.

Here's how:

That should do it. Let me know if you're still having issues seeing the mileage expenses. I'm here if you need me. Have a good one!

Tori B,

Thank you for your help. I am sure it would work but there is no FILTER option on my screen. Is it because I just have quick start? I only see General and Rows/Columns.

Hi, jacktjl.

Thanks for joining this thread. Allow me to chime in and share some information about customizing the Profit and Loss report in QuickBooks Online (QBO).

The report mentioned by Tori B is an Account report. You can pull up through Chart of Accounts or Profit and Loss report since you created an account specific for mileage transactions.

Here's how to open P&L report:

You'll want to check this article to learn which reports are available for your QBO version: Reports included in your QuickBooks Online subscription.

Just in case you want to improve your QBO subscription and have a filter option, feel free to check out this article for detailed steps: Upgrade or downgrade your QuickBooks Online subscription.

You can get back to me anytime if you have additional questions about customizing a report in QBO. Take care!

Debra,

Thank you for the information. Simple Start does indeed show the Profit and Loss report as standard. The problem is that the report is incomplete and does not show the mileage transactions I have entered since Jun 14th 2022. The report does include mileage transactions imported from GoDaddy from Feb 2022 to Jun 14,2022. Is there some type of possible issue related to that import.

Having all expenses in the standard report is as basic as it gets. Right now I don't have that information and am not receiving what I am paying for. Do you have any ideas for a remedy? I don't beleive that I should have to upgrade.

Hello, jacktjl.

I understand the importance of keeping track of your business miles and vehicle expenses so you have everything you need to calculate deductions when tax time comes around. I'll share some information on how this mileage feature works.

Importing and recording mileage expenses under the mileage tab or screen doesn't get reflected in the main account. This is only designed to keep everything in one place and tally the totals so you have everything you need to make tax deductions.

The profit and loss statement is a financial statement that summarizes the income, costs, and expenses incurred over a given period. You can create a reimbursement expense for you or your employee if you want the mileage expense to appear on your profit and loss report. I'll show you how.

Set up a vendor profile:

Set up a mileage reimbursement expense account:

Create an item for mileage reimbursement:

Create a bill for the mileage reimbursement:

Record the payment for the Reimbursement expense:

For your reference, you can visit this article: Reimburse employees' mileage and vehicle expenses in QuickBooks Online.

In addition, you can connect your bank or credit card account if you want QuickBooks to automatically download your bank transactions: Connect bank and credit card accounts to QuickBooks Online.

Don't hesitate to post again if you need anything else. We're always available to help you.

Thank you for the explanation and process. This is very helpful.

Hi there, @jacktjl.

I'm happy to hear that my peer was able to help you with the process. Visit us again if you have any other concerns. We're always here to assist.

Have a lovely day!

Despite reading through these posts multiple times, I'm still unsure how to get my mileage deduction into the Profit & Loss Statement.

I've entered mileage for all of my trips. How can I pull what is already entered in the system into the P&L Statement?

Having all of my expenses incorporated into the P&L is a basic accounting function. But right now I can't seem to get that, which is what I'm paying for. How can this be accomplished without me making duplicate entries with your "vendor" creation solution? I don't believe I should have to make duplicate entries or upgrade to get this basic functionality.

Let me help you shed some light, @ssllc2222

QuickBooks Online (QBO) only tracks mileage for recording reasons. As a result, it is excluded from the client profitability report and income statement.

You can use the data in the mileage tab to create the expense transaction manually.

You can also submit feedback straight to our product developers so they can review this option and help you with your business needs.

Here’s how you can add your feedback in QBO:

For future reference, you can utilize this article to automatically track mileage in QuickBooks Online.

In addition, if you’re using your personal car for business, then I suggest checking out this article. It's about reimbursing employees' mileage and vehicle expenses in QuickBooks Online.

Let me know if you have further questions in mind about mileage. I’m just one post away from assisting you. Have a great day!

I appreciate your response, Bryan, and I have submitted feedback to the developers using the Gear icon.

However, this process is still so incredibly disappointing. This is such a basic accounting function. It makes no sense to create duplicate entries to accomplish something so basic.

for the first step with the New vendor information - what do you put here? this is for my own personal mileage throughout the year, Do I add myself as a vendor?

Welcome to the Community, @Lucie hird.

I'm here to help you with mileage expenses in QuickBooks Online (QBO).

Yes, you can add yourself as a vendor in QuickBooks Online for tracking your mileage. Just enter your name and relevant details to categorize your expenses.

Here's how to set up a vendor profile:

In the meantime, you can check this article for additional guidance on how you can categorize your mileage via mobile or web browser: Automatically track mileage in QuickBooks Online.

I'm also adding this link here in case you encounter issues tracking mileage: Fix mileage tracking issues in the QuickBooks Online mobile app.

Feel free to comment down below if you have any other concerns or questions about printing your mileage report. I'm always glad to help in any way I can.

These instructions do not work for me. When I get to new bill the options in the instructions do not exist. There really must be an easier way to do this.

Thanks for joining the thread, @psych4kids. I'm here to help.

To provide better assistance, may I kindly inquire as to what happens when you enter a bill? It would also greatly help us if you could attach a screenshot of the issue you encountered.

Aside from creating a bill to track your mileage expenses, you can consider creating a check or expense instead.

I also encourage sending feedback, especially about easier ways to handle and manage mileage expenses to show in standard reports. Here's how:

Let me add these resources to assist you in automatically monitoring your business mileage and effectively evaluating the value of your vehicle:

We'll be on the lookout for your reply about handling mileage expenses in QBO. We're committed to offering ongoing support. Take care.

I'm the sole member of my LLC. So my mileage accruals are a simple expense incurred that should be reflected in the P&L. To make me double enter this every time I travel is insane. I can understand the desire or need to track who you are expensing mileage reimbursements for in a larger organization with employees. But a simple on/off toggle for Mileage that allows you to simply accrue each trip as an expense to the overall P&L for single member LLCs should be a no-brainer. I imagine there are a LOT of single member LLCs - probably the largest user group of this type of software. Why make it harder for your core audience than necessary? This software is not customer-centric if an unchangeable default is not set up for the majority of users.

I'm the sole member of my LLC. So my mileage accruals are a simple expense incurred that should be reflected in the P&L. To make me double enter this every time I travel is insane. I can understand the desire or need to track who you are expensing mileage reimbursements for in a larger organization with employees. But a simple on/off toggle for Mileage that allows you to simply accrue each trip as an expense to the overall P&L for single member LLCs should be a no-brainer. I imagine there are a LOT of single member LLCs - probably the largest user group of this type of software. Why make it harder for your core audience than necessary? This software is not customer-centric if an unchangeable default is not set up for the majority of users.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here