Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhat is the difference between these two? I can't really see if they affect anything by switching between the two.

I use purchase orders to buy material that is consumed on a job. I do not bill the customer for materials or resell them. I'm going through all of this and trying to get everything setup properly.

Searching here and online there is no way to have the billable item default to unchecked? So every time I enter a bill using items i have to manually uncheck each item? Not a huge deal but annoying.

What is the best way to set these items up for a business like mine that purchases items for a specific job but does not bill the customer for them?

I'm here to provide answers to your queries in QuickBooks Desktop (QBDT), @JBUESKING.

The products marked as 'Non-Inventory' in QuickBooks are products of which the inventory isn't tracked. This means that when a product is sold or added, its quantity available doesn't change nor does the inventory quantity automatically sync to the Onsight app.

On the other hand, Other charge item is an item that you use to purchase or bill for things such as miscellaneous labor or services, materials that you aren't tracking as inventory, and special charges, such as for delivery or setup or rush jobs.

For your second concern, you can turn off the Mark of expenses as billable option. This will disable the automatic billable checkmark once you entered expenses on your bill. Here's how:

For your third question, I'd suggest getting in touch with your accountant. This way, they can help you set up your items and make sure your records are accurate.

If you need related articles for future use, please feel free to visit our site: Help articles for QuickBooks Desktop.

Keep me posted if you have other questions about entering your bill. I'm always here to help. Have a good one.

Hi Customer, @JBUESKING.

Hope you’re doing great. I wanted to see how everything is going about the inventory concern you had the other day. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

I would like to double up on the question asked above. I need to know how to track our inventory purchased for jobs. IE. We purchased 30000 sq ft of flooring and this will be allocated to different customers. We would like to enter the 30000 sq ft of flooring on our books and eat away at it per job... how can we do that? PLEASE NOTE: This is not inventory we are selling to customers as it is already included in our bid.

Good day, Wheelhouse Construction1.

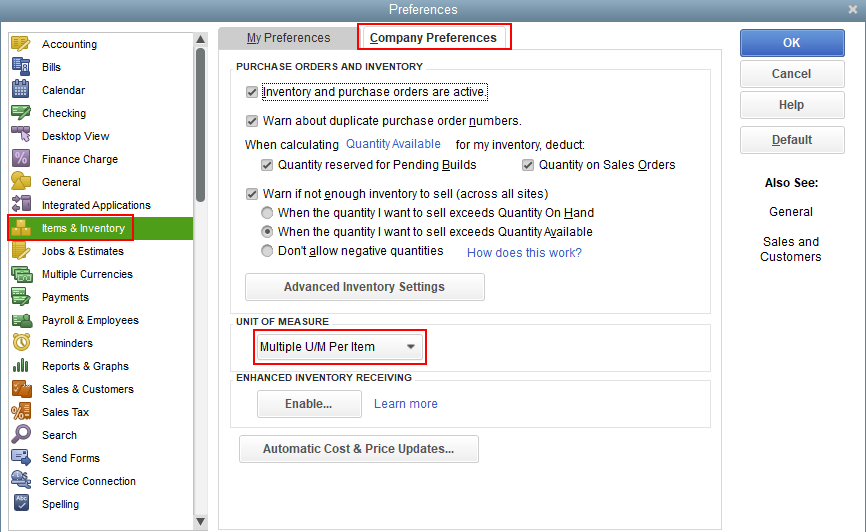

You may want to use the Unit of Measure feature in QuickBooks Desktop and then create an invoice to allocate them per job.

Here's how to turn on the feature:

You can refer to this article in creating an invoice in QuickBooks: Create an invoice in QuickBooks Desktop.

You might want to read these articles to learn more about the Advanced Inventory feature in QuickBooks Desktop:

Please let me know if there's anything else I can do for you. I'll be standing by for your response. Have a great day.

Similar style business I believe. We don't sell the flooring to the customer box by box per say.

We sell 3000 sq. ft. installed for dollar amount and have labor and material costs and don't show itemized bills.

The only way I have figured out how to do this using inventory adjustments by adjusting qty on hand.

So I cut a PO to my vendor for say 20,000 sq. ft of flooring. We receive it and it shows up in my inventory.

Then on each job I adjust "qty on hand" and select the job I'm moving the inventory to. It works but becomes a little cumbersome.

Looking at Quickbooks online and I think you can do the same but you create a sales order with inventory items and basically sell them to the custom behind the scenes internally for zero dollar amount. Only way to get the costs showing on each job.

Similar style construction business I believe but not flooring. We don't sell the "flooring" to the customer box by box per say.

We sell 3000 sq. ft. installed for a fixed dollar amount and have labor and material costs and don't show itemized bills to customer.

The only way I have figured out how to do this using inventory adjustments by adjusting qty on hand.

So I cut a PO to my vendor for say 20,000 sq. ft of flooring. We receive it and it shows up in my inventory.

Then on each job I adjust "qty on hand" and select the job I'm moving the inventory to. It works but becomes a little cumbersome.

Looking at Quickbooks online and I think you can do the same but you create a sales order with inventory items and basically sell them to the custom behind the scenes internally for zero dollar amount. Only way to get the costs showing on each job.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here