Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowOn my P&L, salaries and payroll expenses show up distorting my net income. The amounts are not exactly the same but similar. Payroll expenses show up as the total amount deducted from my bank account at the time of direct deposit. Salaries detail as individual check amounts to my employees. How can I fix this?

Hello there, jrbarnes.

I can help provide clarifications about the data shown in your Profit and Loss Report.

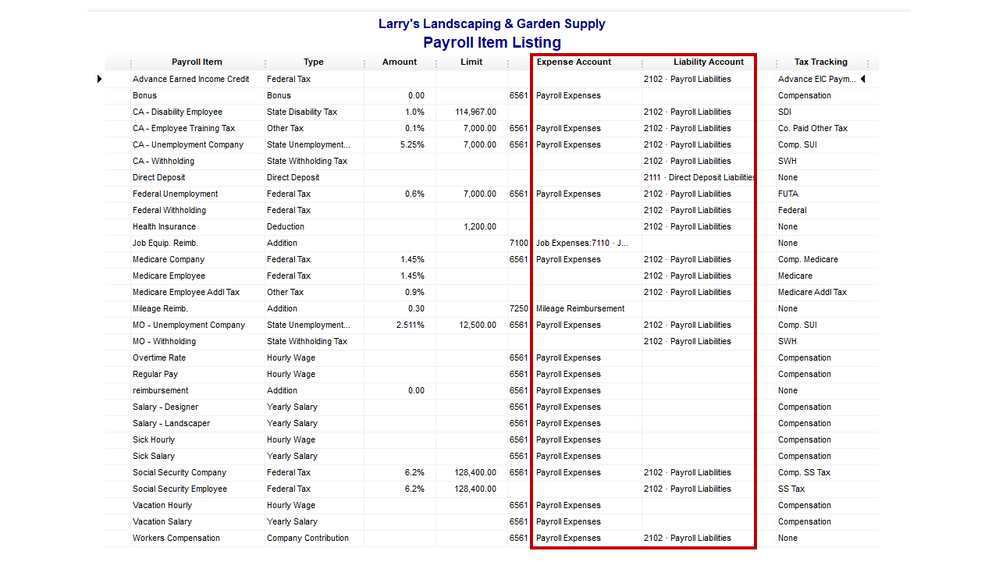

The information that will show on your payroll expenses are the gross pay and cost of all related payroll taxes (company paid). If the amount doesn’t show correctly, review the posting account used for the payroll items. This will affect how the data is shown on the financial report.

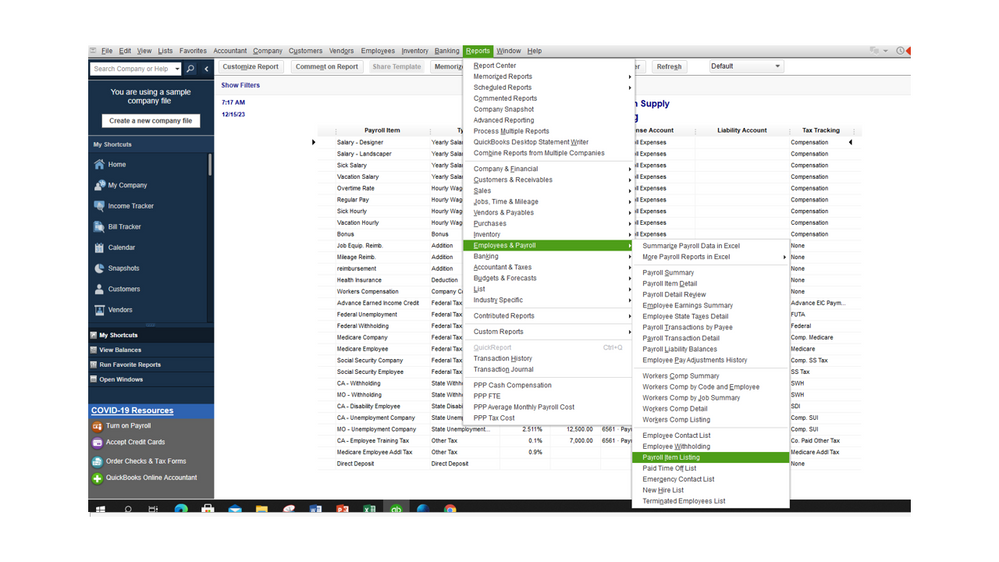

Let’s run the Payroll Item Listing statement to check the account associated with each pay type. I’m here to make sure the process is a breeze for you.

Here’s how:

If the payroll item is linked to the wrong category, I suggest changing it to the correct one. You may want to check your accountant first for further assistance. They can provide detailed information for the specific account to use.

Check this article for additional reference: Customize payroll and employee reports. It outlines the complete steps on how to build the report via payroll item, rate, total paid, and the sum of all expenses by employee broken down by month.

Also, this link contains resources that will guide you on how to open financial statements in QuickBooks Desktop (QBDT): Self-help articles. Includes videos for visual reference.

Feel free to reach us again if you need help with running financial reports or other QuickBooks concerns. I’m always ready to assist further. Have a great rest of your day.

From your description, it's not clear what's wrong.

Your payroll expenses are the sum of salaries paid plus company paid taxes, plus any other benefits the company pays for.

You should be able to confirm this by double-clicking the number on the P&L and seeing what's behind it. The resulting detail report should show line items for the things mentioned above.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here