Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy business sells shoes/clothing that is typically paid for about 6 months in advance from receipt. I also take orders & collect payment from my customers before placing the order with my supplier. I'm struggling to figure out how to properly build this into QuickBooks Desktop 2021.

Here is the most common scenario I have, what would be the best way to account for it?

Example: I order 100 pairs of shoes from my supplier, I pay my supplier up front and will receive the shoes in ~5-6 months. 50 pairs are for me and will be placed in inventory and sold by me after receipt, while the other 50 pairs were ordered by a customer of mine and prepaid for.

In addition to the accounting portion for both the vendor and customer, if I invoice my customer today my inventory will be negative for that SKU, but will zero out when it is received in the future. Is that the proper way of handling inventory?

Thanks,

N2L

Hello there, @Need2Learn. Welcome to QuickBooks Community!

I appreciate you for adding more and enough details of your concern. To handle the pre-payment for inventory, you can use Accounts Payable to record prepayment. You can write a check to the vendor and record it to your Accounts Payable (A/P) account. It'll decrease the balance. Here's how:

Create a check for the vendor by going to the Banking menu. Here's how:

Once done, enter a bill. Then, apply the prepayment to a bill. Here are the steps on how to do it:

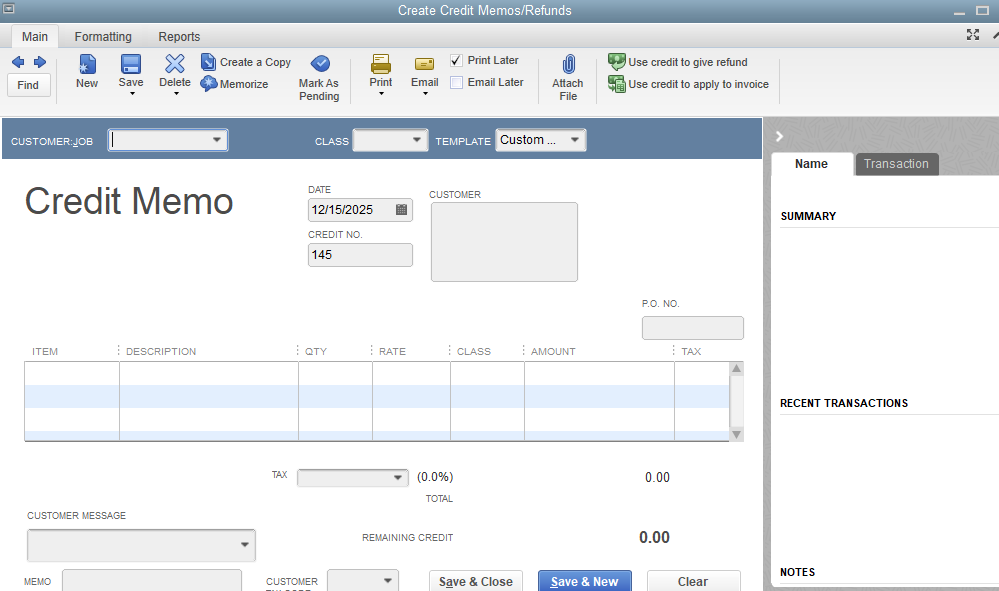

For the paid inventory from your customer, you can create a credit memo to be included in the inventory count.

You can refer to these articles if you have questions about the credit memo and recording prepayments:

Let me know if you need additional assistance. I'll be around to help with further. Take care always.

Hi Need2Learn,

Hope you’re doing great. I wanted to see how everything is going about handling pre-payment inventory items and the ones that are already paid by your customer. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here