Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSome of my payments to sub-consultants for a particular job (project) are not being included in the P&L Report for the year the payments were made even though the sub-consultant's bills were assigned to the project when I entered them.

The Community has you covered, @Phil51.

The Profit and Loss report won't show the payments associated with a job if:

I can share the fixes needed to help resolve the issue you're having. First, let's ensure to use the correct date and report basis when running the said report. To achieve this, you can select one from the Dates and Report Basis drop-down, respectively.

Second, let's make sure to update QuickBooks Desktop to the latest release to have the latest features and needed patches.

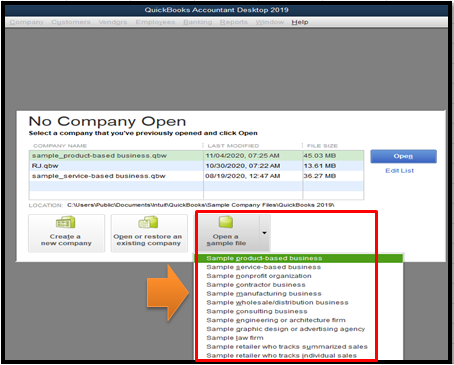

If the issue persists, you can open a sample file to test if you'll get the same outcome. Here's how:

If it works this time, then the original file may be damaged. In this case, I suggest running the QuickBooks Verify and Rebuild tool. This can help identify and repair data damage.

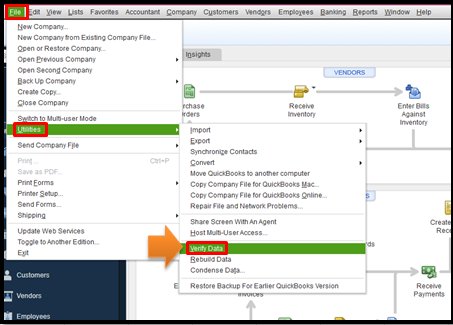

Here's how to Verify your data (original company file):

If the Verify data detects an issue, you can Rebuild your file. For the detailed steps, please refer to this article: Verify and Rebuild data in QBDT.

You can also personalize your reports to get the details that you need. Then, you can memorize them to keep a copy. This way, you'll be able to access them anytime for future use.

Keep me posted if you need more help with managing your reports. The Community is here to assist you.

Thank you for the thorough response. I checked further and found that by selecting 'Cash' as the Report Basis instead of 'Accrual', the missing expenses appear. Please note that I've always been confused on the difference.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here