Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowOkay, I am using QB Premier 2016 and have been trying to use the Profit and Loss Detail Report. I am finding that for the transaction type being displayed for Income that it is using "Invoice". I would like to show the report using Payments as there are many times that Invoice is not fully paid or paid at all. I see that I can filter on the Paid Status of an Invoice as being Open or Closed, but that still doesn't completely resolve the issue since if the Invoice is not completely paid, it is still considered to be Open.

I do see that I can set the Report basis to be based on Cash instead of Accrual, but was not sure if that is actually computing things as I want them to be. If that is all it takes, I'm fine with that.

I realize that I am probably not including enough information, so if you do need more, please let me know.

Thanks,

Merg

Solved! Go to Solution.

If you run your P&L on a cash basis then the invoices will show up but on the payment dates. Payments won't show up because they don't use income accounts.

If you run your P&L on a cash basis then the invoices will show up but on the payment dates. Payments won't show up because they don't use income accounts.

Gotcha. That might work for me still.

Okay, then, so is there a different report I should be using to view my "Profit" based on payments as opposed to Invoiced amount?

Thanks,

Merg

Different than a P&L on a cash basis? Why do you want something different?

Not that I want something different... Just asking if there is a better report than the Profit & Loss on Cash Basis that I should be using.

Basically, I just want to present to others what we have received in income during the past fiscal year. The fact that the Cash Basis report is based on when the payment was received should be fine as I am trying to show the amount we actually received and if it was invoiced before the fiscal year, it should not matter.

Thanks,

Merg

Hello, @TheMerg.

Please allow me to join the thread and help share additional information about running the Profit and Loss Detail report in QuickBooks Desktop (QBDT).

The Profit and Loss report summarizes your income and expenses for the year to know whether you're operating at a profit or loss. As mentioned by our Established Community Backer (BRC), payments won't show up on the report because they don't use income accounts.

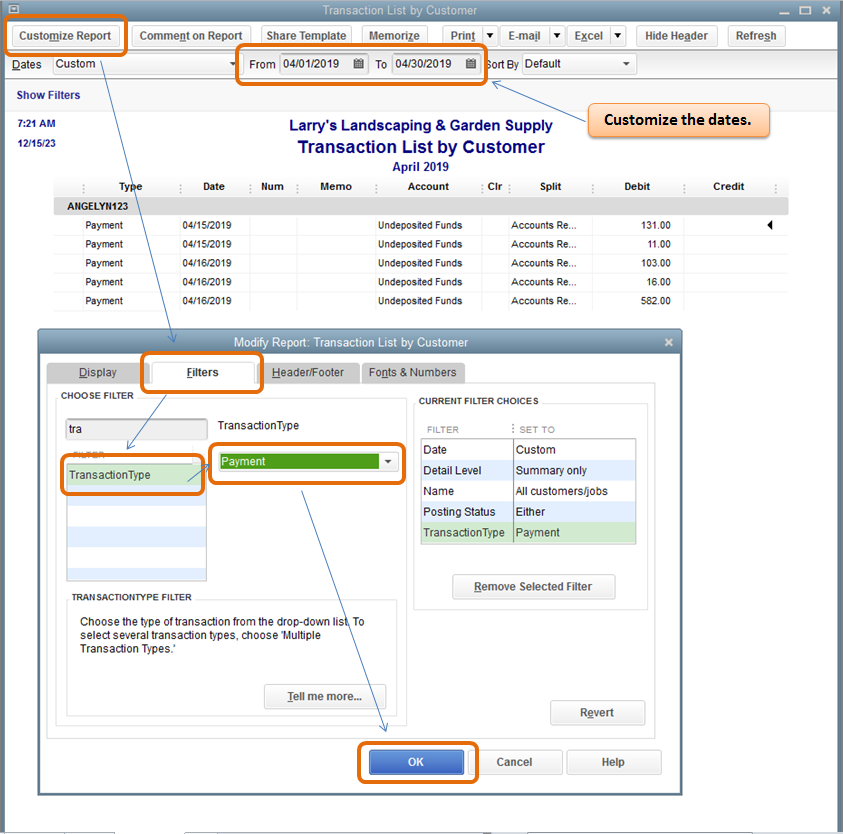

However, you can create/run a report which shows payments in QBDT. As of now, you can start opening the Transaction List by Customer report and make the necessary customization. Let me help guide you how.

To learn more about running and customizing reports in QBDT, you may check this article: Understand reports.

Please know that I'll be right here to help you if you have any other questions about running reports, just add a comment below. Wishing you the best!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here