Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, @Dvorak24.

When creating a journal entry, we need to make sure that the income/sales account used is the same as the income account of the sample product. Also, the amount will be the same as the invoice's sales amount.

To check, we can go to the invoice where the sample is created. Then, go to Transaction Journal.

You can refer to this resource for guidance with running financial reports and getting the details you need. It also has report features you may use moving forward: Run reports in QuickBooks Online.

Get back to me if there’s anything else I can help you with. I’ll be more than happy to assist you. Have a great day.

Hi Maybelle,

I have now corrected the sales account in the journal entry to match the invoice.

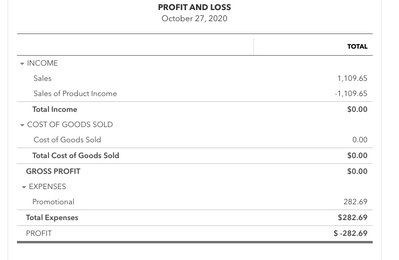

My next question is regarding the cost of goods sold entry. Should there not be a negative amount of $ 282.69 for this transaction? Please see attached screen shot. Thanks.

I have some questions too about this topic -

My first question is that I do not see where - on the invoice - you can access the journal entry.

Hello, @FlaMike.

I can share some information about invoices and journal entries.

You can't enter a journal entry on the invoices page. If you need to create and send invoices to your customers, you'll enter them into the Invoice page. For more information about invoices as well as where in your Balance Sheet and other financial reports these invoices will be posted, check out this article: Create invoices in QuickBooks Online.

To create a journal entry, you'll need to have a good understanding of debits and credits. You can have this option from the + New button. Refer to this article for detailed guidance: Create a journal entry in QuickBooks Online.

Here's more information on how to record customer payments you've received in your account: Record invoice payments in QuickBooks Online.

Let me know in the Reply section if you have further questions about invoices and journal entries. I'm here to answer them for you. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here