Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHoping someone can help me. I found this quickbooks link about how to "Set up and track a line of credit in Quickbooks Online". It explains that I need a liability account for the principal portion of the line of credit/credit card and also an expense account for the interest.

My first question is... if activity is being tracked in two seperate accounts (interest expense and late fees in one account... and charges and payments in another account), how are you supposed to be able to reconcile the credit card statement? Neither account within quickbooks will match the statement. I currently have a "credit card" account where I can track everything for the credit card (charges made with the card, payments on the balance due, interest fees charged, late fees incurred) so that I can reconcile it to the statements. I then made another account of type "Current Liablity" and called it something like "Principal only on Chase credit card". In this account, I didn't include any interest or late fees charged.

The problem is, when I run a balance sheet report, BOTH accounts are showing up...

1: the credit card account (which includes interest and late fees). I use this to reconcile and make sure I'm not missing anything

2: the principal only account (which does not include interest or late fees and shows the TRUE liability).

I'm obviously missing something. What is the proper way to track a credit card as a line of credit?

I will include the link I referenced at the beginning of my post.

I can help you reconcile the Credit Card statement, FarmMomof4.

Let's answer your first question. Liability and expense accounts are used to track the payment you've made to the bank or creditor. As you can see in this article, Set up and track a line of credit in QuickBooks Online, there are two line items when recording the payment. And, there's also a field where you can choose a bank account when writing a check or expense.

If you already have an existing liability and expense account, you don't need to create a new one. I suggest using the accounts you've created. That way, the amounts will show correctly when running the Balance Sheet report.

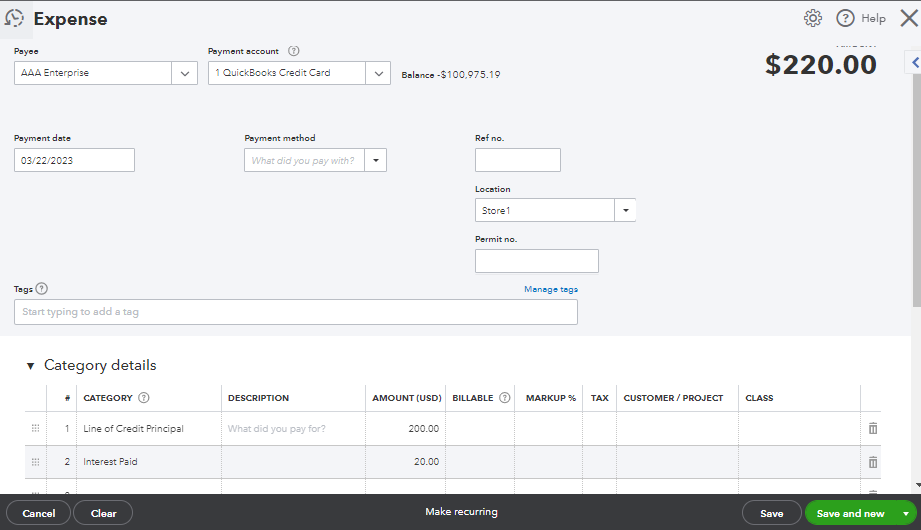

I'll show you a sample screenshot for a visual refence when recording the payment in QuickBooks.

Upon sharing this, I still suggest consulting an accountant. They can share more deeper insights about how to categorize the line of credit entry in QuickBooks. If you don't have an accountant, use this link to find a ProAdvisor near your place: https://quickbooks.intuit.com/find-an-accountant/.

When you have the bank statement in hand, start comparing each transaction with the ones entered into QuickBooks. If everything matches, you can reconcile the Credit Card account. Check out this complete guide: Learn the reconcile workflow in QuickBooks.

You can mention me in the comment section if you need more reconciliation tips. I'll be here to back you up always.

You shouldn't be using a liability account for a credit card - or track it like a line of credit, which is something else.

Instead, use a credit card account. It functions like a bank account, only it's a type of liability account, like a bank account is a type of asset account.

Thank you @MaryLandT

That is exactly the way I do it on an auto loan that my client has because the statement shows... of the payment made, how much is going towards principal and how much is going towards interest so I split it appropriately. However, the credit card statements that I'm dealing with don't show things that way. It has one line for the payment made (i.e $1000) and then it shows any charges (i.e. Doterra $42.19) and then it has a separate line for Interest Charged (i.e. $21.79). I enter these as all separate transactions/lines in the credit card register. The good news is... everything always balances. The bad news is... when I run a balance sheet report, the account balance (which includes any interest records that were entered into the register) shows up on the report (RATHER THAN JUST THE PRINCIPAL). The accountant told me that interest should not be included in the number that shows up on the balance sheet report (because that is supposed to be for principal only). Please see the example of the statement I am using. Do you have any suggestions as to how I should handle this?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here