Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowFor a construction business, how do I handle bank draws against the client's construction loan? Do I simply invoice the client and submit invoice to the bank and not even worry about the loan being recorded in qb? Or do I setup the loan as a credit card (as others have suggested) and just charge items to that account? Your advice is appreciated.

I can help you track this loan, @smith772.

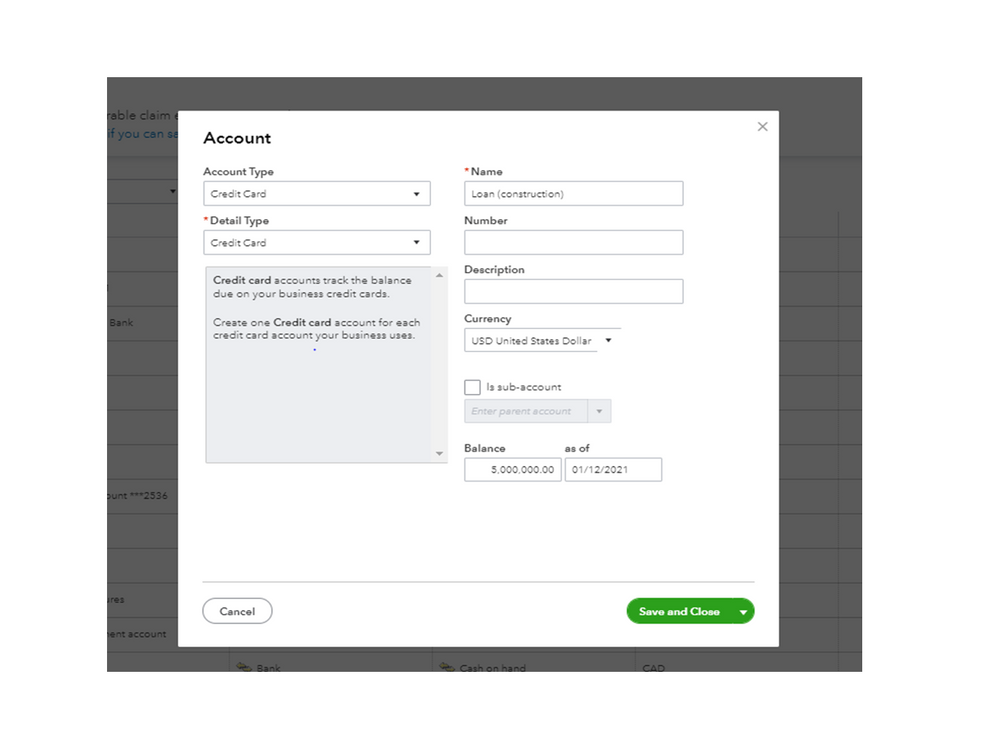

Yes, you can set up the construction loan account as a credit card type account and enter the money that you get from the bank as the balance. Then, any expenses for the construction shall be taken out of from that credit card account.

Here's how to create an account:

Here's how to record and manage your expenses in QuickBooks Online: Enter and manage expenses in QuickBooks Online. You can also record them directly to your register if there's a lot of them. See this manually add transactions to account registers in QuickBooks Online article for detailed guidance.

Let me know if you still have questions in tracking your loan and entering other transactions. I'm always glad to help in any way I can. Have a great rest of the day!

Thanks for your response. You said to set it up at a credit card account, but your screen shot shows it as an Asset account. Which should it be?

Also, is this the correct workflow? Invoices come in from the subcontractors, we invoice the client for the items and submit to the bank for the draw. We receive the draw money into qbo as a payment from the specific loan account we setup. We then pay the subcontractor invoices from the loan account.

Or do we setup the loan account with the entire loan amount and then just draw down with each subcontractor invoice?

Thanks for your help.

I appreciate your time getting back in here, @smith772.

You can set up a liability account to record a loan and its payments. This account tracks what you owe.

Here's how:

Follow these steps if you put all the loan money right into the bank:

For more info, feel free to check out this article: Set up a loan in QuickBooks Online.

I've included a couple of resources about working with loans that may come in handy moving forward:

Know that you're always welcome to post your reply here. I'll be around to assist you. Keep safe and healthy.

Now I am confused. @MJoy_D said to do it as a credit card "Other Current assets". Now @Rubielyn_J is saying to set it up as a "long term liability" even though the loan is the client's loan and not the company's loan? I need some more clarification on this please as to the preferred method because these two answers seem contradictory.

Thank you.

Thanks for coming back to the Community, smith772.

I can provide clarifications on how to handle bank draws against the client's construction loan.

As mentioned by @MaryJoyD, let’s set up the construction loan account as a credit card type. Then, charge items to the account.

Here’s how:

When recording your expenses, I still suggest following the articles shared by @MJoy_D. I’m also adding an article to help you in the future. It contains resources to guide on how to handle expenses and other vendor transactions: Self-help articles.

Don’t hesitate to let me know if you still have other QuickBooks concerns. I’ll be right here to answer them for you. Have a good one.

I have a client who obtained a $34m construction loan. We recorded the total loan as a liability and the reserve fund as an asset. When paying the construction costs, the client will charge a construction in process asset and reduce the reserve fund as costs are incurred. Is this an appropriate method?

How would you categorize the draw if the amount was already paid for by the builder and the company was being reimbursed by the draw with the monies coming through your bank that is sychronized with quick books online?

If the customer's construction loan has been set up on our books as a credit card and we have recorded the expenses that their bank has paid against it, how do we record the credit when the project is finished?

The credit card expenses were items paid by their bank, we did not use our cash to pay them. How do I clear out the card when the project is done? I'm not sure what to debit.

How do I do the same thing on Desktop for Contractors?

Where can I find instructions for the exact same scenario on desktop for contractors.

I understand the importance of handling bank draws against the client's construction loan, Dr_Kinu. I'm here to share insights about this in QuickBooks Desktop (QBDT).

You can set up accounts for your loans and manually track them in QBDT. To record a loan in QuickBooks, you'll need to select a liability account for it. Here's how:

Then, we can create a new vendor for the bank or company you need to pay for the loan.

For the complete process on how to track loans in QBDT, check out this article: Manually track loans in QuickBooks Desktop.

You may also be interested in using the QuickBooks Loan Manager feature. This helps calculate interest and payment schedules and handle different loan options: QuickBooks Loan Manager.

Don't hesitate to let me know if there's anything else you need help with while working on managing loans. Have a good one.

Thank you so much. Do I need to do anything in the GL?

Do I need to do anything to the GL?

Hi there, Dr_Kinu.

No, nothing needs to be done with your General Ledger (GL). The steps outlined above by my colleague @LeizylM allow you to handle bank draws by setting up an account and manually tracking your loans. This will also ensure that all amounts entered are posted in the correct type of account.

I'd also recommend reaching out to an accounting professional if you're not comfortable taking those recordings on your own. They can provide guidance and other ways of dealing with bank draws and loans. You can use this link to find an accountant near you: Find a QuickBooks Certified ProAdvisor.

I've included a resource for accounting terms that you might find useful in the future: Learn common accounting terms.

Keep responding in this thread if you still have other follow-up questions and other QuickBooks-related concerns. I'll be here to help.

Do you know if QB Desktop for Contractors will produce a WIP report? Work in Progress We desperately need one. If so how do I find it?

Hi there, Dr_Kinu.

Job Costing Work In Progress (WIP) Reports in QuickBooks Desktop are powerful tools that allow businesses to track the costs and progress of ongoing jobs or projects. These reports provide detailed insights into the expenses incurred, revenues generated, and the overall profitability of each job. By analyzing the WIP reports, businesses can monitor the financial health of their projects, compare actual costs to estimated costs, and make informed decisions to ensure projects stay on budget and schedule.

However, Job Costing Work In Progress (WIP) Reports are not included in QuickBooks Desktop Premier and Plus For Contractors. This specific feature is only accessible through QuickBooks Enterprise Solutions for Contractors (via Accountant).

But don't worry, In QuickBooks for Contractor Desktop, you will have access to an array of 14 unique reports specifically designed to cater to the needs of contractors. These reports are an essential tool for managing your business effectively and include detailed insights such as Job Profitability Summary and Detail, Job Estimates vs. Actual Summary and Detail, and Profit & Loss by Job, amongst others. With these reports, you can keep track of your job costs, project expenses, and overall profitability, allowing you to make informed business decisions.

You can refer to this article to learn about Using QuickBooks Desktop for Contractors to serve niche construction clients.

I've also added these articles about customizing reports and job costing:

If you have further queries about the reports that fit your business and customizing it. You can always reach out to me in the Community, and I will get back to you as soon as possible. Have a great day!

Although this question is several years old, I have to jump in because all the other recommendations complicate things.

You do NOT need to setup a liability or credit card for the loan and it isn’t your company’s loan, it’s your client’s liability/loan to track. Simply bill the client. You shouldn’t be paying costs until you receive client (bank) funding anyway.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here