Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi, mike-williams.

I would love to get to the bottom of this and lay down some solutions to help you add a negative adjustment.

Before anything else, I want to ask a few questions to verify what particular adjustment to Other you're referring to. Is it for the Inventory or Reconciliation? Can you provide a screenshot of the negative amount you're trying to add?

More details would definitely help us narrow down your concern about entering negative adjustment in the amount box. Looking forward to your reply.

Thank you for providing further information, Mike. I'm here to assist you in creating a negative adjustment to your sales tax due within QuickBooks Online (QBO).

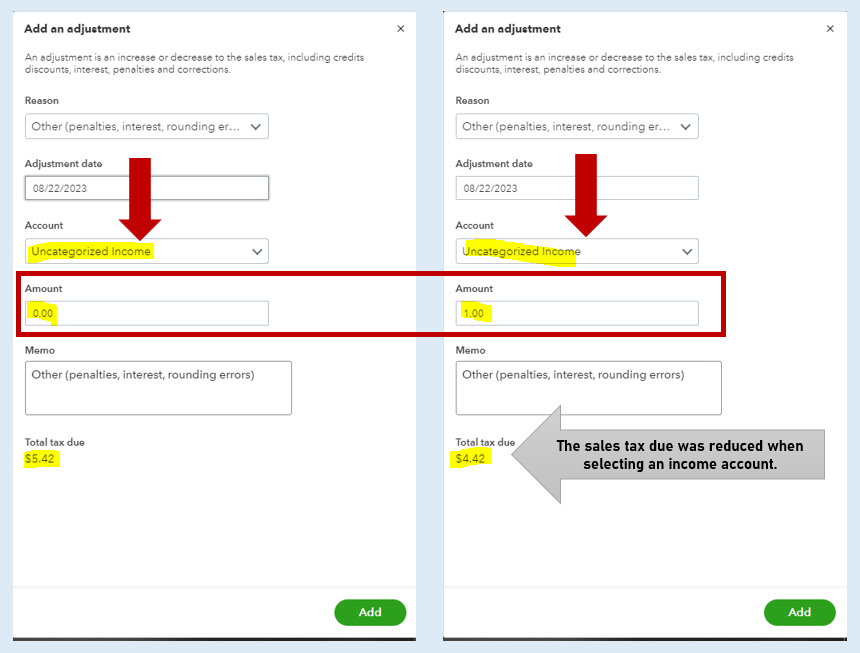

The system only allows you to input a positive value when making a sales tax adjustment. In order to reduce your sales tax due, you might need to choose an income account from the Account dropdown menu. If you haven't created an account yet, you can add one by following these steps:

Once done, you're now ready to process the adjustment.

For additional guidance while adjusting your sales tax due in our system, you can open this article: Create or delete a sales tax adjustment in QuickBooks Online. The same resource will give you instructions on how to delete a sales tax adjustment in our system.

I'm also including this website to explore and learn more about filing your sales tax return and recording tax payments:: File your sales tax return and record sales tax payments in QuickBooks Online.

If you have further questions while adjusting your tax returns in QuickBooks, please inform me by leaving a comment below. I'm always ready to assist you again. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here