Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe use full service intuit payroll and 2019 premier contractor's edition. I would like to run an unbilled cost on a job and see the pay allocation so that it could be invoiced to our customer.

For instance I know 50% of a superintendents time went to one job, 25% to another, and 25% to another. I made a journal entry moving the wage and taxes paid by the employer to the jobs according to the percentage above. I did create an item code for labor but the JE does not ask for an item number just an account. The JE does however ask for a job and whether it is billable or not billable, which I entered. If I run a unbilled expenses on the job it doesn't show up for billing. This has got to be a common issue.

I can help you get the report you need, @LisainKC.

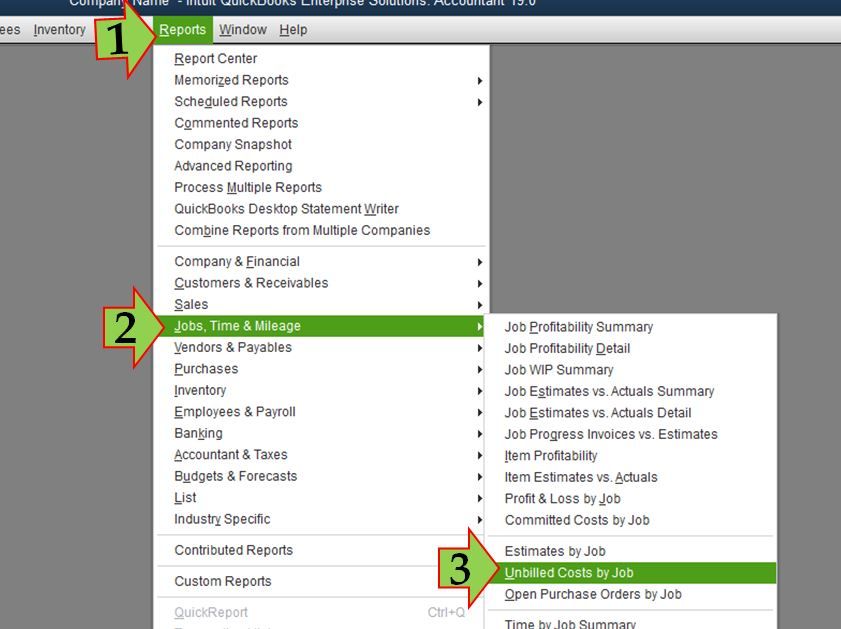

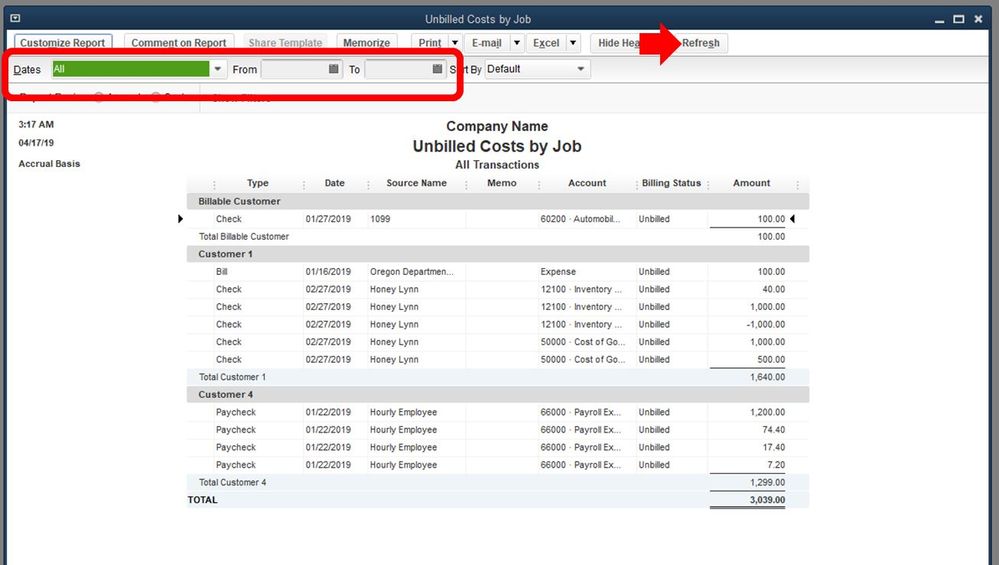

I appreciate the detailed information you've provided. You can run and customize the Unbilled Costs by Job report to get the unbilled cost on a job and its pay allocation. It also provides the posting account specific for each item.

For additional reference, I'm attaching here some related articles:

That should keep you going today, LisainKC. Keep me posted on how these steps work out for you. I'm still here to offer more help if you have further questions. Wishing you all the best!

Thank you for responding! I ran the report according to your instructions yet the journal entry is still not showing up. It has the job on the JE and it is marked as billable. Do you think it has anything to do with the account?

Hello again, LA4.

I appreciate you trying my suggestion and keeping me posted on its result.

I recorded a journal entry under a job and marked it as billable. It was added on my Unbilled Costs by Job report regardless of what account is associated. Please take note that only the credit transaction will show on the report and that the list of transactions is determined by the date range you select.

I advise checking the JE transaction and making sure the date is correct. I'll appreciate it too if you can add some screenshots of the JE and report. That way I can better understand your issue.

I'll be keeping an eye out for your response and look forward to getting to the bottom of this. Take care and have a good one.

Ok I messed around with it a little more. My JE debited 50% to job A, 25% to job B and 25% to job C. The unbilled job report showed the two 25% allocations but used job A as the source. However, it did not show the allocation for job A. This is a head scratcher. What it is telling me is in order to correctly record the allocation I will have to make 3 separate journal entries, which is less than ideal.

I really appreciate you trying to solve this with me, but it appears to be a bug.

Why would it just show a credit? If the original payroll entry is a

Dr. to wages

Cr. to Cash

To allocate the wage to a job you would then

Dr the job

Cr. Wages (see above)

The amount that would show up on the unbilled job report should be the Dr. to the job.

Hi there, LisainKC.

Cases like this, it would be best to consult your accountant to help you review the journal entry you've created for tracking the job cost. Then, verify with them the right account and job costing item you'll need to enter to reflect it in the Unbilled Costs by Job report. The details of your job item will determine the preciseness of your job reports.

On the other hand, you can use QuickBooks Desktop's Job Costing tools to have an accurate record of your job costs. For the steps and details, you can check out this article: Tracking job costs in QuickBooks Desktop.

You can always visit the Community if you need anything else.

Thank you very much for trying to help solve this issue. I am actually an accountant and not a bookkeeper. I've just not had much experience with this version of Quickbooks. I didn't know about the report you pointed out to me which is very helpful; however, I'm confident that this is a bug because all three of the allocation lines are using the same account. The fact that two of the three are showing up doesn't make sense. Also, I do know from other journal entries I've made on other versions that it is only programmed to pick up the description on the first line so I'm sure that this is the problem as well. It is a programming issue that really should be fixed. I will call them and hopefully get someone to talk to me.

Thank you again for helping QB users out on the community forum!!

Thanks for getting back to the QuickBooks Community, @LisainKC.

Allow me to join in this thread and help provide some additional information.

If you've already processed the recommended steps provided by my colleagues and the issue persist, let's rebuild and verify the data in QuickBooks Desktop to remove the empty or damaged information from the file.

Here's how to rebuild the data:

To verify the data in QuickBooks, you can follow the detailed steps in this article: Resolve data damage on your company file.

If the same thing happens, I encourage you to contact our QuickBooks Desktop Support Team. They have additional tools to pull up your account and do a remote session.

Here's how you can can contact our customer support:

Please let me know how it goes. If there's anything else I can do for you, please let me know. I'll be around to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here