Not to worry, I'm here to make sure your account matches your credit card statement, @cbprint.

Your QuickBooks credit card balance is the total balance of all bank transactions you've added or matched to QuickBooks, while statement balance covers the balance for a specific period it indicates. There are several factors why bank register balance in QuickBooks Online doesn't match your actual bank balance. Often, they do not match because the actual account is constantly being updated, and there may be new transactions that are not yet on your record.

Duplicate transactions may also be the culprit. While there isn't a method for specifically searching for duplicate transactions, you can utilize Filter and Sorting tools to quickly spot these items.

Here's how:

- Click the Gear icon and select Chart of Accounts.

- Click View register next to the bank.

- In the Bank Register, click the Filter menu to open it. Narrow the list of transactions by searching for a single month or quarter.

- Click either the Payment or Deposit column to sort the list by their Amounts. They'll automatically be sub-sorted by their Date.

- Now you can search for duplicate Amounts/Dates to consider them for deleting.

We offer additional information on this in our guide on filtering or searching for transactions in QuickBooks Online.

Have you tried reconciling your account? I'd also suggest reconciling your account starting from the very first month or the first month you started recording. Then, go month by month until you reach the most recent statement.

Here's to start reconciling:

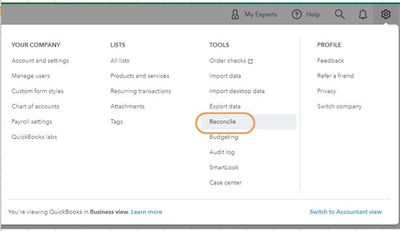

- In QuickBooks Online, select the Gear icon and then select Reconcile. If you're reconciling for the first time, select Get Started first and then Let's do it.

- From the Account drop-down menu, select the account you want to reconcile. Make sure it's the same one on your statement.

- Check the Last statement ending date. Make sure your bank statement starts the day after your last reconciliation.

- Review the Beginning balance. Make sure the beginning balance in QuickBooks matches the one on your bank statement. Here’s what to do if they don't match.

- Enter the Ending balance and Ending date as they're written on your bank statement. Some banks call the ending balance a "new balance."

- When you're ready to start, select Start reconciling.

- From there, you'll have to mark the transactions that appear on your statement.

- Once done, the difference between your statement and QuickBooks should be $0.00.

- Select Finish now and then select Done.

To learn more about the reconciliation workflow in QuickBooks, you can refer to the articles below. It contains complete information to keep your accounts accurate:

Please let me know how it goes. I'm determined to help you fix this banking issue. Have a good one!