Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

Could anyone help me with the following issue?

We need to send advance payments (prepayment) invoices to our customers

The service ''Advance payment'' was created in Product&Services

Instead of Income Account - a Liability type of account was used for the Service called "Unearned revenue''.

When the Service was used in our Advance payment invoice to Customer it created accounting records

Dr Accounts Receivable and Cr Unearned revenue

And it is totally fine.

We also tested Sales receipts (it created accounting records DR Checking account Cr Unearned revenue)

The issue is that this invoice (or Sales Receipt) is displayed in ALL SALES REPORTS but it, is not a sale (income, revenue) it is just a prepayment from our customer, our LIABILITY

Moreover, the system displays it correctly in Profit and Loss (NO income and this is correct) and in the Balance sheet (as short term liability and it also correct)

So when you have a look at reports they don't match.

P&L income section does not match to Sales reports

Sales reports display Unearned revenue as Sales (and this is NOT correct)

And Profit and loss displays NO Sales (and this is correct)

The same about using any other Quickbooks Sales forms with the Service.

(if we used Sales Receipt or Credit memo) the system displayed the transactions in the Sales report and it did not analyze that there are no sales, revenue accounting records associated with the forms

The system just analyzed that the sales form had been used (invoice, sales receipt, credit memo) and automatically included the transaction in Sales reports

But what forms should be used to handle customers' advance payments correctly then?

They should not be displayed in Sales reports!

Right now I tested the following approaches

Only if we used Journal entry form

Dr Accounts Receivable and Cr Unearned revenue then it was not displayed in Sales reports.

Because Jornal entry is not a Sales form

BUT this approach with Jornal entry also does not solve the issue 100%.

When we created an invoice for RENDERED services and would like to apply the advance payment to the invoice we had 2 options as Ituut usually advise.

1) Add the Service ''Advance payment'' with the negative amount to the invoice for Rendered services

OR

2) Create a credit memo with Service ''Advance payment' 'to the invoice.

Let's assume our Advance payment 1 000 USD in Jan 2022 and our invoice for Rendered Services is 3 000 USD in Feb 2022)

1st error the system included 1 000 USD in Sales reports in January 2022

2nd error the system included the negative 1 000 USD in the Sales report in February 2022

And as a result, our Sales were displayed as

1000 USD in Jan 2022

and 2000 USD in Feb 2022

But they must be displayed only as 3000 in Feb 2022. Because we rendered the in February.

This bug is so obvious, and it violates all accounting procedures and standards.

So, to solve it we needed to create the Invoice for 3 000 USD in Feb and again create a reversed Jornal entry for 1000 USD

Only then system created accounting records

Dr Accounts receivable Cr Revenue 3000 USD and

Dr Unearned revenue Cr Accounts receivable 1000 USD

And only then the Sales were displayed in Sales as 3000 USD as it should be

All other ways , when we used sales forms, displayed 1000 USD in January in Sales reports and 2000 USD in February in Sales report and IT is totally wrong!!!

Moreover, as you could notice from the example above we can not use the Invoice to send to our customer

The invoice should be for 3000 USD which is offset to 2000 USD in Feb 2022 (added a negative amount to the invoice or the credit memo used) . Because then all this will be displayed in Sales. As 2000 USD in February

But customer should pay only 2 000 in February. But our total Sales 3000 USD should be displayed in February.

The unearned revenue should NOT be displayed in any Revenue/income/sales reports.

It is not SALES, revenue, income.

Called QBO support yesterday and they promised to escalate the concern.

Because right now it does not work properly at all.

It is not some user's preferences or wishes. This is a system bug. When you include the Unearned revenue service to Sales forms then it is displayed in Sales reports without analyzing which accounting records associated with the sales forms (revenue or liability categories)

Again, what forms should be used then instead of Sales receipt or Invoices?

Journal entries as was described above?

But where should we create customer invoices then? In Excel :)

Thanks for sharing your detailed concern in the Community, @alchuikov. I’m here to help and impart some information about handling advance payments in QuickBooks.

The sales form you used for advance payments is correct. However, QuickBooks Online offers a specific way to handle prepayments, so your reports are accurate and balanced.

You can set up a deposit or retainer. This option is treated as a liability to show that the amount you’re holding won’t belong to you until it's used to pay for services.

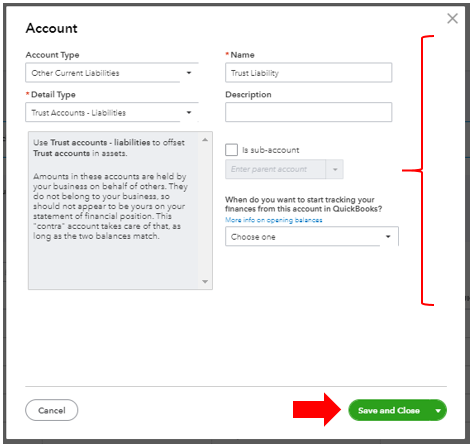

Before you create a retainer item, you need to make a liability account first to track the amount of the retainers you receive from your customers.

Here’s how:

Once done, you can now create an item in the program. I’m glad to show you the steps.

For the rest of the steps, check out this article: Record a retainer or deposit. Just proceed to Step 3-6.

You can also read this reference for more information on how to handle advance payments: Accepting advance payments.

I’ve added this link that contains topics about managing payments: Process customer payments with QuickBooks. I'm sure you'll find it helpful.

Don’t hold back to drop a comment below if you have any other questions or concerns about sales forms and reports. I’ll be here. Have a good day and always take care!

MadelynC,

Thanks for your answer

But is it not related to the issue i described.

The issue is-

any of these Sales forms (invoice, sales receipt, credit memo) created in the system with the Services you described (with the liability type of account instead of income) ARE included in all SALES reports.

It means that this Advance payment invoice (or retainer invoice) is displayed in Sales Reports (Sales by Customer, Sales by Location, etc)

And it is NOT correct.

Because the invoice is not related to revenue. Revenue for rendered services. It is just customer advance payment or Unearned revenue.

When this invoice is created the following accounting records are generated

Dr Accounts Receivable Cr Unearned revenue (Liability type) of account

So why the system includes the transaction which is not related to Sales (Revenue, Income) to Sales Reports?

Please note at the same time if you Run a Profit and Loss statement for the same period there won't be any Revenue in the statement.

And the transaction can be found only in Balance sheet.

And this is correct because A/R asset type and Unearned Revenue Liability type of accounts only categories associated with the transaction.

But why this is included in Sales reports then?? if there is not Revenue type on the transactions in the sales form?

Thanks for articles you provided but they don't answer the question i posted.

How to avoid the situation and avoid including customer retainers invoices in Sales reports.

They just give the guide how to create the invoices and that is all.

MadelynC,

Thanks for your answer

But is it not related to the issue i described.

The issue is-

any of these Sales forms (invoice, sales receipt, credit memo) created in the system with the Services you described (with the liability type of account instead of income) ARE included in all SALES reports.

It means that this Advance payment invoice (or retainer invoice) is displayed in Sales Reports (Sales by Customer, Sales by Location, etc)

And it is NOT correct.

Because the invoice is not related to revenue. Revenue for rendered services. It is just customer advance payment or Unearned revenue.

When this invoice is created the following accounting records are generated

Dr Accounts Receivable Cr Unearned revenue (Liability type) of account

So why the system includes the transaction which is not related to Sales (Revenue, Income) to Sales Reports?

Please note at the same time if you Run a Profit and Loss statement for the same period there won't be any Revenue in the statement.

And the transaction can be found only in Balance sheet.

And this is correct because A/R asset type and Unearned Revenue Liability type of accounts only categories associated with the transaction.

But why this is included in Sales reports then?? if there is not Revenue type on the transactions in the sales form?

Thanks for articles you provided but they don't answer the question i posted.

How to avoid the situation and avoid including customer retainers invoices in Sales reports.

They just give the guide how to create the invoices and that is all.

Thanks for coming back to the Community, alchuikov.

I’m here to help ensure that your reports will show the correct information, especially on the accounts related to the transactions. Let me route you to the right team who can properly address your concern.

We’ll have to review the sales transactions and other entries to determine the source of the issue. Thus, I recommend contacting your QuickBooks Online (QBO) Care Team. They have direct access to your account and a screen-sharing tool that helps them see what’s going on in your QuickBooks. Reaching out to them ensures you’ll get a real-time solution to the issue.

Here’s how:

You can go over to this article to learn more on how to handle prepayments: Record a retainer or deposit.

For future reference, this link contains topics on how to create and manage reports in QBO. The articles are grouped by topic, so you’ll be able to view each one right away.

Stay in touch if you need further assistance sending your prepayments or concerns about your reports. I’ll be right here to help and get this taken care of for you. Have a good one.

Hi Rasa-LilaM

Thank you for your reply. But

1) I have already had the screen sharing session with your team. The case # 1577883369. No reply from your team BUT they promised to contact me asap. No reply

2) I have asked Hector Garcia to clarify it on his Youtube channel. And his answer you can see in the comments . https://www.youtube.com/watch?v=qQnwuxi6EI8 and also attaching the screen here. This is a bug.

3) Please don't include the generic articles how to handle customers prepayments. I know how to do it and already followed them and spotted the issue.

One more time - the issue is that your system does not analyze accounting records/categories(Debit and Credits) associated with the Sales forms (Invoices, Sales receipts, Credit memo, etc)

So, the system only analyze the type of document and if it is a Sales form it is immediately recognizes the transition associated with the Sales form (invoice or sales receipt) as Revenue and include it to the set of your Sales reports (for example Sales by Customer, Sales by Location)

But - an invoice or sales receipt for a customer prepayment is not Revenue. It is our Liability by the moment we provide the customer with our services.

And your system creates correct accounting records

Debit Accounts Receivable & Credit Unearned Revenue (Liability type) for invoices

OR

Debit Cash & Credit Unearned Revenue (Liability type) for Sales receipts

AND it even does not display these transactions in Profit & Loss in the Revenue section

BUT

it displays them in Sales repots!!!

Please just explain me if the system does not displays Revenue in Profit & Loss WHY it displays Sales (Revenue)in Sales reports?

How can it work at the same time? :) We don't have Sales in P&L BUT we have Sales in Sales Reports???

Please let me help you and answer the question - i agree with Hector - this is a bug in your Sales Reports

I am not a developer but even for me the solutions is obvious and easy

Your system just should use a simple condition IF it is a Sales Form AND it has Income category in the accounting records (Credit Revenue category) THEN It should be displayed in Sales reports

ELSE if there is a Liability type of category used in accounting Credit THEN It should NOT be in Sales Reports

And because your system displays Profit and Loss correctly and this issue is only with Sales Reports it means that someone of your development team just forgot to add this analysis /condition to the process of creating/displaying Sales report.

Please could you fix it. I hope it won't take months or years for your development team to fix it

Or if you think this is correct Please give me a clear answer how to manage this situation.

ONE MORE your generic articles don't work in the case

Your support agent could not explain it to me during the screen sharing session and promised to escalate the concern wit the development team

PLEASE listen to your customers. We all want to improve the system. In particular in the case when the bug is obvious

Hi there, alchuikov.

I appreciate letting us know that you've already contacted our support team about the issue. The additional information and video you shared on this thread will help other customers who are experiencing the same issue.

We're continuously working to improve QuickBooks Online (QBO) features to ensure users have the best experience when using the program. I recommend you let our product engineers know that adding the mentioned accounts on the sales reports is beneficial to your business.

Here's how:

For tips and resources, you can go over to our self-help articles: QBO guide. It contains topics about taxes, payroll, banking, manage supplier or customers transactions, etc. You can view the complete details about the guide by clicking on the link.

Thank you for your reply Rasa

My main concern that i see on different forums a lot of negative feedback/reviews about the Intuit support

and that very often, the issues are not solved for months/years.

Intuit just promises to solve them and does not solve them.

What i described in my posts above it is the real issue and not my wishes or preferences as one of your customers.

It is a real system bug, when 2 reports in the system displays the same data (Revenue/Sales) differently in Sales Report and in P&L at the same time.

At least i even can not explain my management team why they see one sum of Sales (Revenue) in Sales reports AND different in Profit and Loss

I can not just say them this is a bug of the software. Their next question can be why we are using it? And not Xero, Zoho, Odoo etc.

I am a huge fan of QuickBooks Online and try to popularize it but it is quite difficult to do if some crucial issues are not gonna be solved or gonna be solved for months/years.

I hope your development team can help with this.

Thank you

Hi Risa-LilaM,

As i expected no one from your team even TRIED to resolve the issue with the system.

As i can see your team approach is to post generic answers and forget the issue

My case # is 1577883369

Please could you update me Publicly about the status of the case. Just for all your other users to see what solution is expected for this BUG???

I already

1) Called your team several times

2) Had a screensharing session with your agent they promised to find a solution a week ago. No reply

3) Sent feedback to your team as it was advised.

What else can i do?

Why does your team just ignore our customers feedback?

IF the situation i described is NOT your system bug THEN please give me a solution how to handle the real life situation i described.

Step by step

The generic articles DON't work because of this bug.

How to fix it. ?

I'd also feel the same way if I were in this situation, alchuikov.

While I'm unable to access your account, I'd recommend contacting our Support Team again. They have the tools to access your account and give you real-time update about your case.

Here's how:

Check out this link for more details about the support hours.

Please click the Reply button for any follow up questions about it. I'll be in touch. Have a good one!

Hi @Archie_B Thanks for the reply I am not sure about what access issue you are talking about in the thread. Did you see the name of the article and and were able to read the discussion thread.

QBO Team please ,

i am asking about the case # 1577883369.

1) I called you regarding the bug in the Sales reports

End i SHOWED the issue to your Agent during the screens haring session

He could not find a solution (for about 1 hour - i waited on phone) for me and registered the case more than 1 week ago. And promised to call back asap. And it should have this case # 1577883369 in your ticket system

2) I posted the issue in on this forum

3) I contacted Hector Garcia on his Youtube channel and he CONFIRMED that this is the BUG of your system

4) I sent FEEDBACK to your development team

NO RESPONSE

What should i do next to get attention of your development team to this rude and obvious system error/bug in your system&

What i received for this time -jJust generic answers about nothing

It seems like you are trying to avoid the question and instead of fixing the bug OR just give me (as your customer) a step by step solution how to deal in the situation i described - you just ignore me or give me fully unrelated answers

It seems like you are tying to make some vision that your team is responsible

One more time- I am asking about The Bug in Sales report.

The case # is 1577883369

Also described in the details in the thread

You agents PROMISED to contact me when they can find solution. How much time do you need? Months or Years to fix the BUG?

It is a bug not my wishes or preferences.

And i can show Reports and Dashboards with such bugs to my investors and owners

PLESE fix it. Do you care about your customers.?

Hi @Archie_B Thanks for the reply I am not sure about what access issue you are talking about in the thread. Did you see the name of the article and and were able to read the discussion thread.

QBO Team please ,

i am asking about the case # 1577883369.

1) I called you regarding the bug in the Sales reports

End i SHOWED the issue to your Agent during the screens haring session

He could not find a solution (for about 1 hour - i waited on phone) for me and registered the case more than 1 week ago. And promised to call back asap. And it should have this case # 1577883369 in your ticket system

2) I posted the issue in on this forum

3) I contacted Hector Garcia on his Youtube channel and he CONFIRMED that this is the BUG of your system

4) I sent FEEDBACK to your development team

NO RESPONSE

What should i do next to get attention of your development team to this rude and obvious system error/bug in your system&

What i received for this time -jJust generic answers about nothing

It seems like you are trying to avoid the question and instead of fixing the bug OR just give me (as your customer) a step by step solution how to deal in the situation i described - you just ignore me or give me fully unrelated answers

It seems like you are tying to make some vision that your team is responsible

One more time- I am asking about The Bug in Sales report.

The case # is 1577883369

Also described in the details in the thread

You agents PROMISED to contact me when they can find solution. How much time do you need? Months or Years to fix the BUG?

It is a bug not my wishes or preferences.

And i can show Reports and Dashboards with such bugs to my investors and owners

PLESE fix it. Do you care about your customers.?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here