Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I can help you handle this transaction, Jennifer.

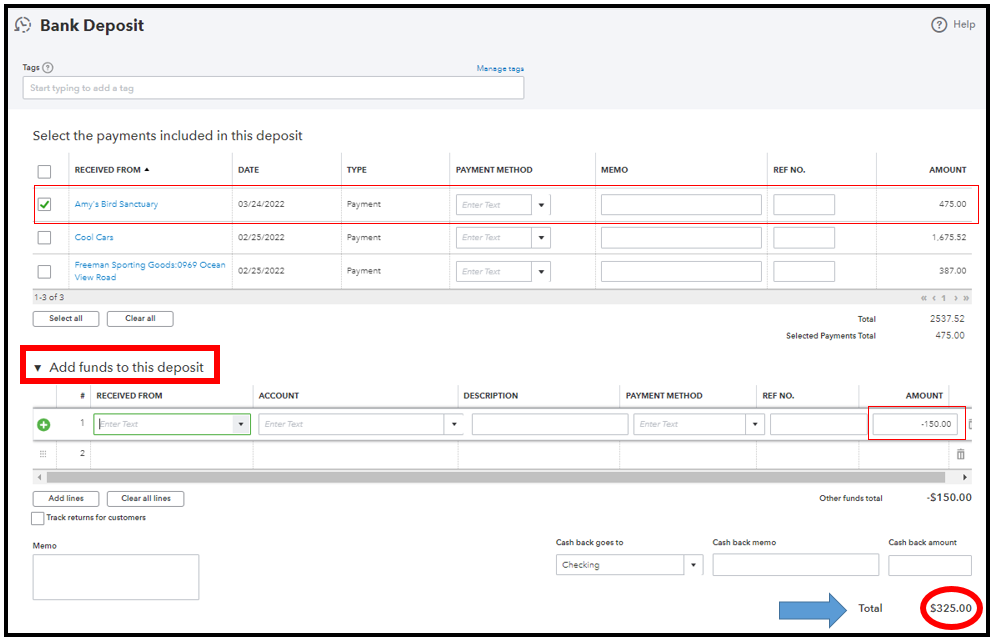

You can deduct the $150.00 when creating a bank deposit. This makes sure the actual amount deposited in your bank matches the record in QuickBooks.

Before that, create an invoice amounting to $475.00. Then, process the payment through the Receive payment option. Once done, follow the outlined steps below to settle the expense.

You can also use this method to track the expense paid by your renter: Refund a security deposit.

Once everything is good, you can now categorize and match your online bank transactions in the program. Then, use this reference to ensure your account are balanced and accurate: Reconcile an account in QuickBooks Online.

Don't hold back to drop a comment if you need further assistance about managing your transactions. I’ll be here to help. Have a good one and take care always!

Yes, you are correct. Just make sure the reimbursement item is mapped to the appropriate expense account and you're good to go.

My renter made a service call for his RV to be repaired. It was determined to be our electrical and not his RV at all. He kindly paid the repair in full for $300.00 if we agreed to split the cost by applying $150.00 to his next months rent. I attached a screen shot of an example I assume would be okay. I would have to create a product/service item possibly titled reimbursements and use a negative amount to show his reimbursement on his April rent receipt correct? I would sent his invoice to be paid using QB payments for April at $325.00.

Thanks for joining in this conversation, res@finisroadrvp. In your case, you'll want to create and apply delayed credit to track a customer's credit for future use.

Here's how:

Then, Apply the delayed credit to an invoice. Here's how:

Please know that adding a delayed credit to an invoice from a prior accounting period will affect that period's balances.

You can check out this link for your reference: Create and apply credit memos or delayed credits in QuickBooks Online.

Feel free to come by and post some more of your concerns if you have any. I'll be right up to help you again. Take care.

Yes. I think the delayed credit is the option to use. I do not see how this would be an expense since the renter was invoiced and not us. He agreed to pay the full amount and we agreed to pay half by applying the $150.00 toward his rent invoice for April. I read another option to just write the renter a check for $150.00.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here