Thanks for joining us here in the QuickBooks Community, @Tmlangpm.

Yes, you can pass the fee to the tenant by including it manually on the tenant's invoice. I can share the technical input on accomplishing this in QuickBooks Online (QBO).

For this, create a service line item in your tenant's invoice, add the service item to your tenant's invoice, and then receive the customer's payment. I've outlined the process below.

First, create a service line item fee:

- In the Products and services page, select New.

- Choose Service.

- Enter a name (e.g., Processing fee).

- Enter the amount of the fee in the Sales price/rate field.

- From the Income account drop-down menu, choose an appropriate expense account for recording fees.

- Select Save and close.

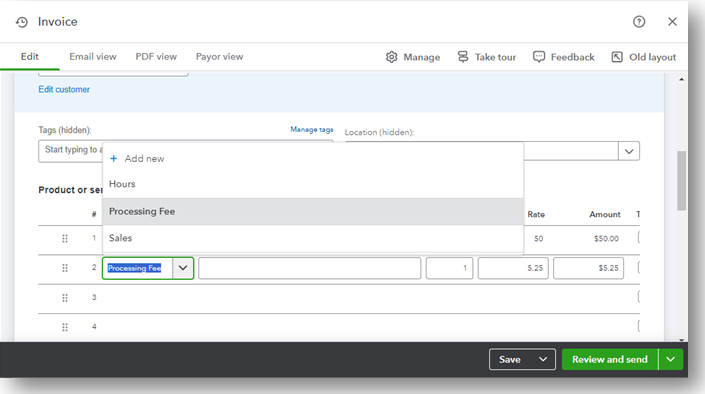

Next, add the service item to the tenant's invoice. You can refer to the image below for a visual guide.

After this, issue the invoice to your tenant and record the payment.

For future reference, let me add this article about categorizing your transactions after your customer's payments are cleared in your bank: Categorize online bank transactions in QuickBooks Online.

If you have any further questions about adding fees to invoices, feel free to reply to this post. We're here to help. Take care