Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood afternoon.

Our company have QuickBooks for years but only used it to write checks.

Our bank accounts and credit cards are linked to QuickBooks, but none of the transactions were matched.

We need to close the year in order to start 2021 with the correct information.

What steps should I precede to get this done?

Hi @Luisa Nogueira,

Welcome to the Community. Let me help you close your books in QuickBooks Online.

Closing your books for the year prevent unwanted changes to your accounting data. Before doing so, I recommend reviewing your accounts and making sure the information is accurate.

For the linked accounts, I suggest matching them to the transactions in QuickBooks. It will help ensure your data matches what you have in the actual bank account.

Here's how:

After matching transactions and making sure everything is in QuickBooks, you can proceed with reconciling your accounts up to your closing date. I recommend downloading the statements from your bank to compare transactions easily during the process.

Also, make some adjustments to your inventory quantity on hand if necessary. Once done, you can close your books directly from the settings of your account.

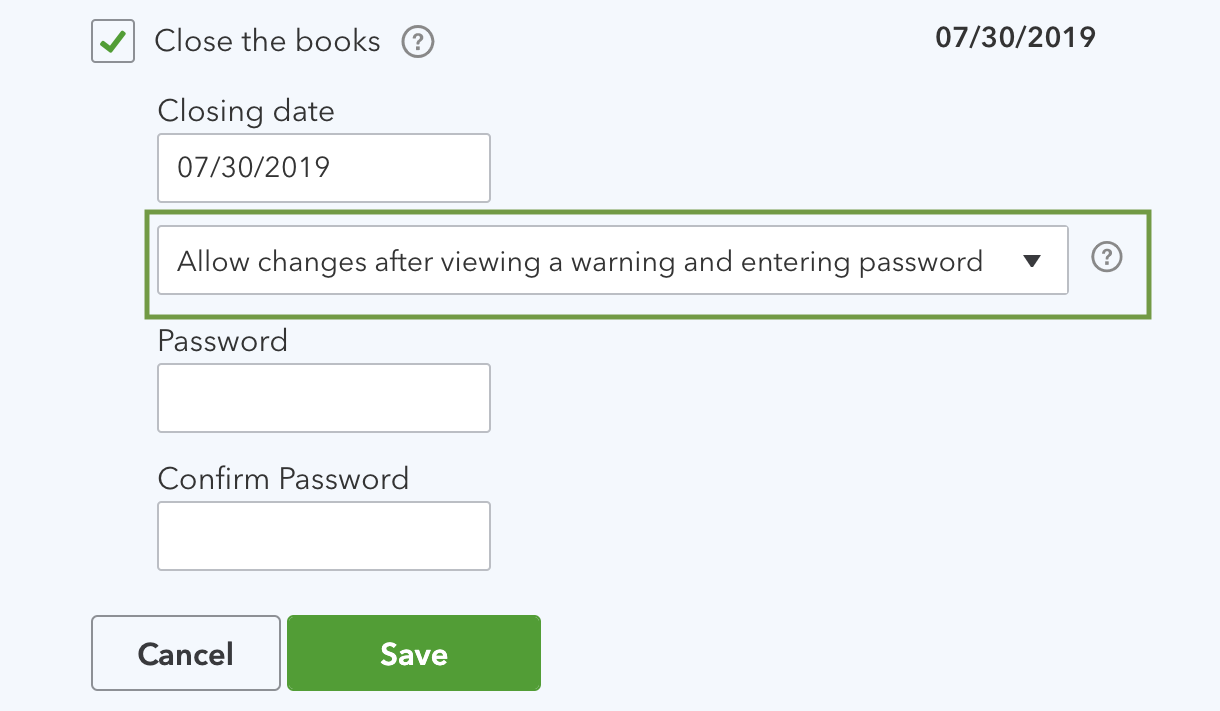

You'll need an admin access to perform the action. Follow these steps:

For additional reference, you can use the following article to make changes to your closed books in QuickBooks: Edit your closed books.

Drop me a comment below if you have any other questions related to closing books. I'll be happy to help you some more.

Thank you so much for your help.

So in order to proceed to the next year, I should match all the previous years transactions and reconcile the bank statements?

I have transactions since 2017.

Hi there, @Luisa Nogueira.

Yes. You'll have to review your transactions by matching and reconciling them. Although there are other ways to close your books, one example is by using Journal Entry. With this, I'd suggest contacting your accountant to ensure your books are accurate and to avoid issues in the future.

To know more about the reconciliation process, you can check out this article: Learn the reconcile workflow in QuickBooks.

I've added this article to help you with your future tasks with QuickBooks: QuickBooks Online year-end guide and checklist. This contains sub-articles to give more insights into the different types of processes.

Please let me know if you have other questions. I'd be happy to answer them for you. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here