Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

What do you do if you're using QBO Pro and the class isn't available to use?

Thanks for joining this thread, @clarksautosalesky.

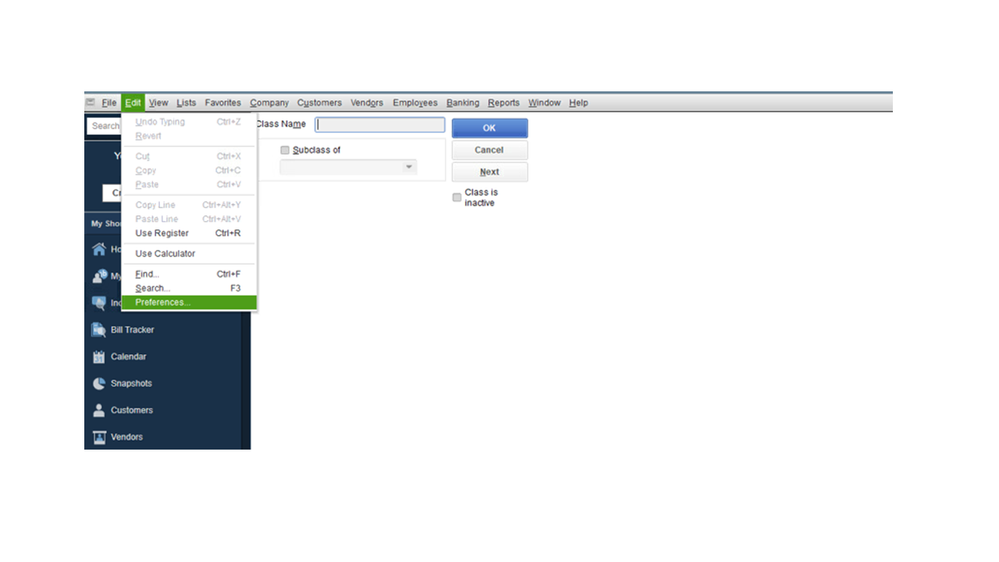

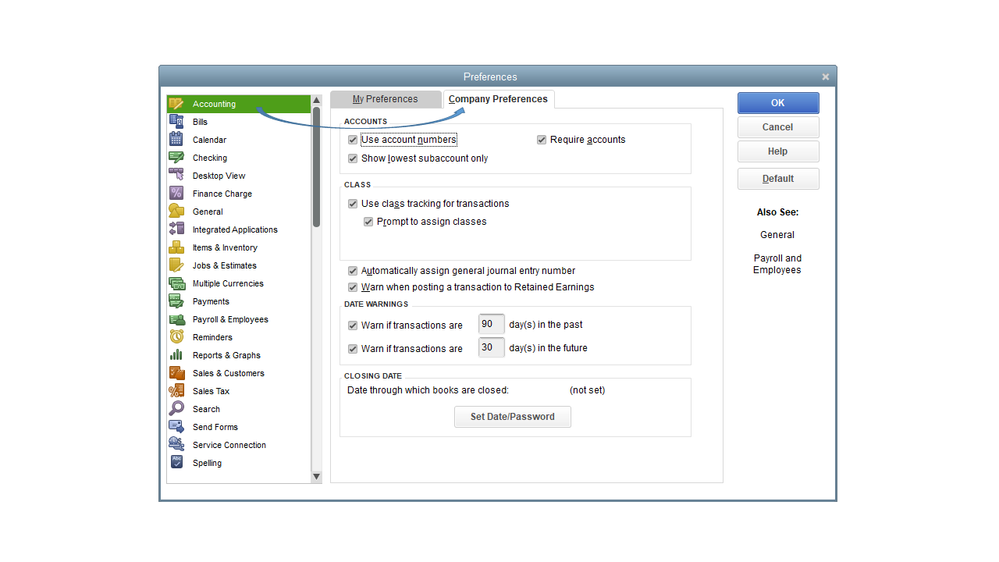

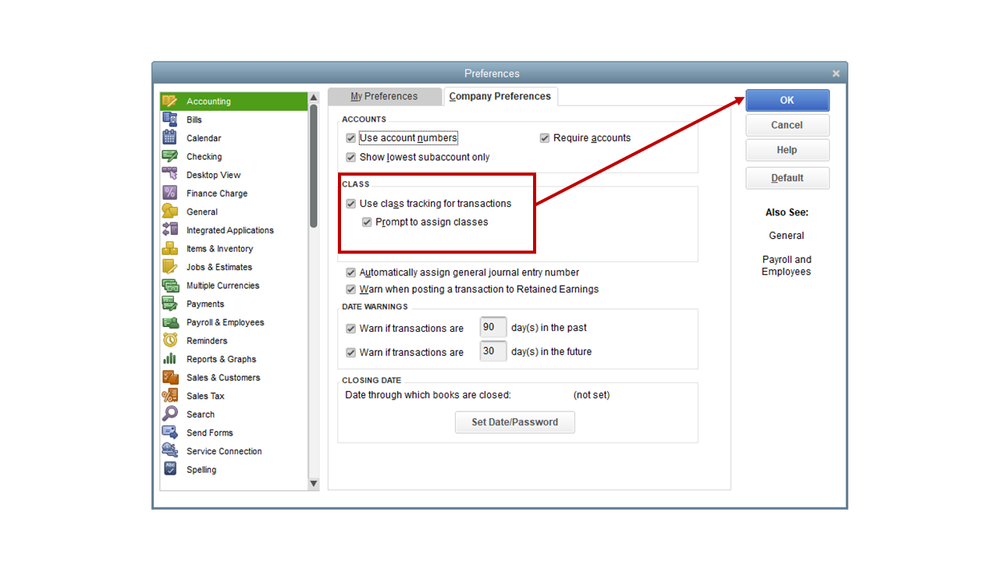

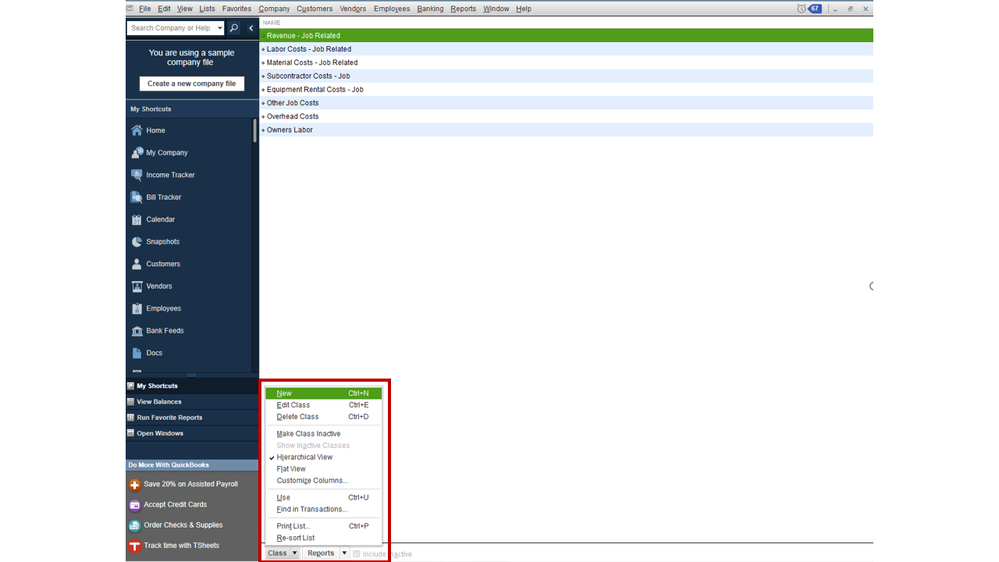

You should be able to use the Class feature since it's available to all desktop versions. Let’s go to the Preferences settings to turn it on.

Here's how:

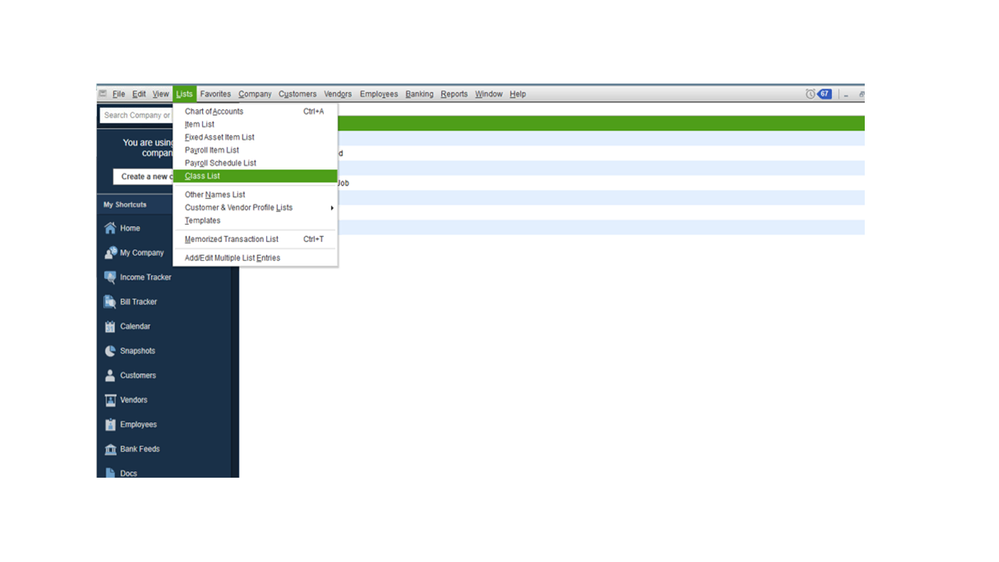

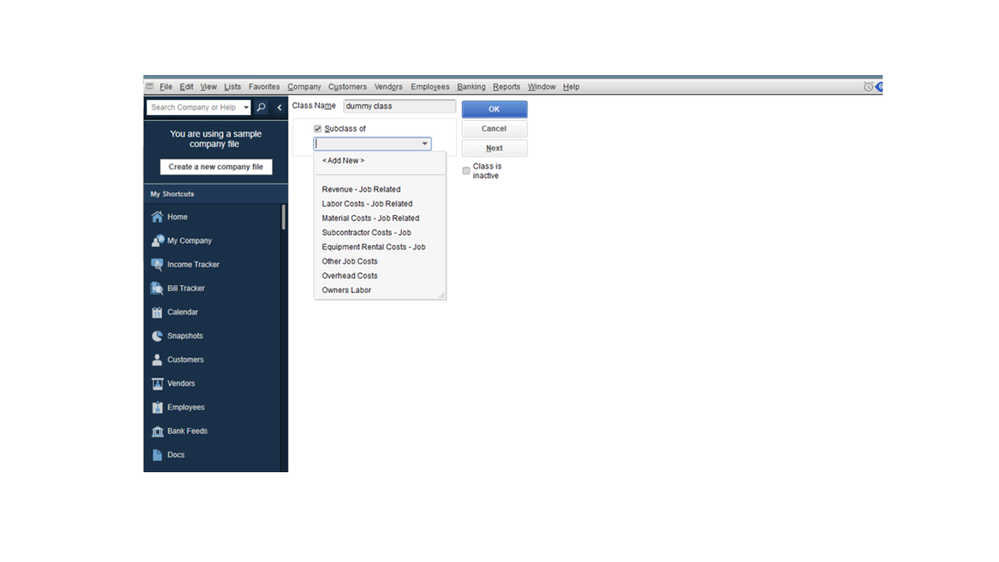

Next, create the classes that you assign to transactions. Here’s how:

Once done, QuickBooks adds a Class field to the windows where you enter transactions.

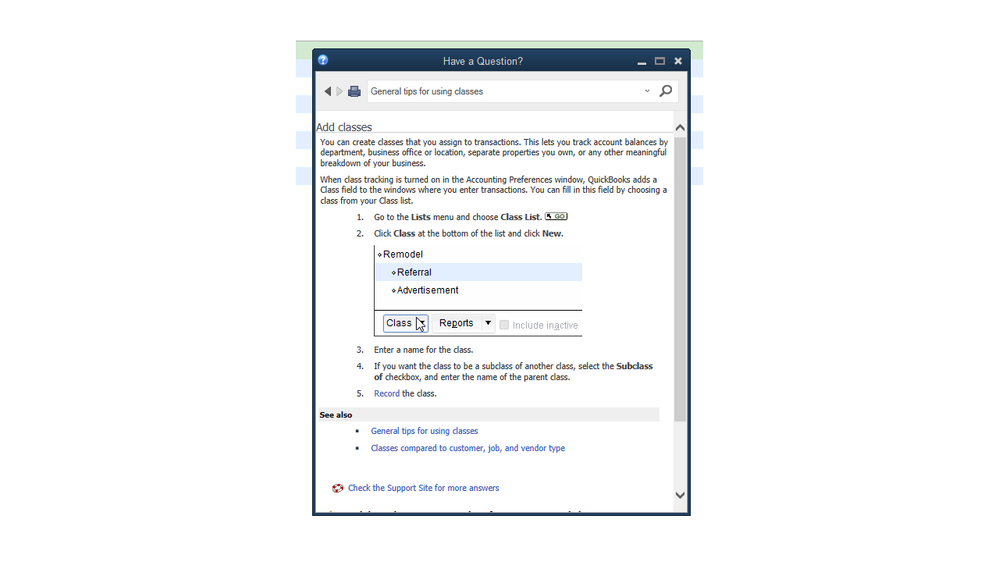

For further details on how to classify transactions using this feature as well as general tips, go to the Have a Question window. You'll have open your company file to access it.

However, if you're using the online version, the following article provides an overview of the Class and Location tracking. Additionally, there are instructions to create categories and edit/delete a class or location: Set up and use class and location tracking.

Let me know if you have follow-up questions or concerns. I’ll be right here to answer you. Have a great rest of your day.

I would like to have some help with this. I have a new client that wants to do this , she is just starting and I would like to set this up right. How do I contact you?

Annette

Marshall:

Watched your video on QB online used inventory, but you stated in a note that you would not recommend the method any longer (without using classes). Is there an alternative?

I've done this video tutorial for "QuickBooks Online Projects for Used Car Auto Dealership" if interested check it out on our QBO blog.

http://newqbo.com/quickbooks-online-projects-for-used-car-auto-dealership-used-car-inventory/

This is about 1-hour video, it will show you step-by-step instructions on how to use QBO Projects for used car auto dealership. You will need a Plus plan (or Advanced) plan. Remind you, QBO is a general accounting software program, not a custom program designed for any business type. So, this is a workaround you can do in QBO.

Hope it's educational and instructional for your business!

Thanks so much for the reply. I've been doing automotive for years with a regular DMS, plus qb desktop for a smaller store. They have switched to using "Dealer Center" which feeds all car sales and inventory into QBO and it's a mess. I'm assuming the setups are bad and at this point I'd rather turn the feed off and do this the old school way as it's still early in the game. I'll watch the video, thanks again.

I don't seem to have the option "sub-product / service" when setting up a vehicle under a parent account. Is this something I need to turn on? Using QBO Plus.

Hi EKH3,

You'll have to enter your product or service in the name field when creating a sub-account. Let me guide you how.

Please see attached screenshot.

You can refer to this article about organizing your accounts for more details.

I've also added our page about banking and bank feeds if you need some help articles for your future tasks.

Fill me in if you have other questions. I'll be around to help.

Here is a YouTube video I posted with the step by step instructions for the QuickBooks Plus plan (or Advanced):

You can also download the Chart of Accounts (COA) template if interested.

Thoughts on closing every sale to to an asset account like "car deal receivables" or "cash on hand" and then flipping to an A/R account by journal entry (in the customer's name of course). I have to be able to keep track of payments like contracts and down payments received on each deal.

That may work, EKH3.

You can do it with journal entry but it's advisable to do the receive payment. This way, it's easier for you to keep an accurate and up-to-date accounts receivable balance. When we receive a payment, we let QuickBooks know that a particular transaction (invoice) was paid so that it will not stay open and unpaid in your reports. I encourage you to read this article that will guide you in this process: Record payments in QuickBooks Online.

If you want to do it with a journal entry, I recommend reaching out to your account so that you will be guided in entering the debits and credits.

You can pull and customize the Sales by Customer Summary Report to track the payments you received.

Feel free to shoot comments below if you have any other questions or require further assistance in completing your task in with QuickBooks. I'll be right here to keep helping.

QuickBooks Online (QBO): Cost of Goods accounting for Used Car Dealership

Here is a YouTube video I posted with the step by step instructions for the QuickBooks Plus plan (or Advanced):

You can also download the Chart of Accounts (COA) template from here if interested.

https://newqbo.com/quickbooks-online-projects-for-used-car-auto-dealership-used-car-inventory/

Hello, We have QB Self Employed as we are a very small car dealership just starting out. Any recommendations for this version?

Thanks for joining us here in the Community, @knapsakee.

I've got insights to share regarding tracking the Cost of Goods Sold in QuickBooks Self-Employed.

QuickBooks Self-Employed provides categories that are aligned to the Schedule C Form 1040 . Thus, the system doesn't have a specific option to record COGS.

However, to keep track of these transactions you may enter them as a personal expense and tag it as COGS using the tag feature that can be turned on from the Labs section. This is an option that allows you to create custom tags for your transactions.

Furthermore, the COGS data needs to be itemized when filing the annual taxes since they're not calculated in the quarterly estimated taxes. This way, you can generate a list of entries that include details that are COGS-related that you can utilize when filing taxes.

To help you in choosing the right category for your transaction, I recommend consulting your accountant. They'll be able to provide you the best course of action in this situation.

Lastly, you can visit this link attached to learn more about the information needed for the Form 1040: Instructions for small business owners and the self-employed.

I got you covered if you have any other concerns with QuickBooks. Just let me know by leaving a reply below. Take care!

Question - What if you trade in a car to purchase another one. The trade in is added to our inventory as a debit but what other account is used as a credit to offset the books. Looking for the right way to enter trade in vehicles in our inventory.

Thanks for joining us here today, @pr1mebooks.

I have some information about trading a car. You'll want to create a trade or barter account when recording trade transactions in QBO. However, it is best to consult with an accountant to correctly account your car trade transactions.

You can check out this link to look for an accountant: https://quickbooks.intuit.com/find-an-accountant/.

I'm also attaching this article for more information about recording a barter transaction.

If you need help with other tasks in QBO, browse this link to go to our general topics with article.

Please know that you're always welcome to message me if you still have questions or concerns with inventory or accounts. Stay safe and have a good one.

Hello @DesertMarshall ,

I know this is an older post so I hope you don't mind me picking your brain a bit. I am advising someone on this very thing right now and would like to know how you would go about allocating the value of an employee's repair time to the cost of said vehicle. Being that QB does not allow Classes on individual lines on time sheets or in the Pay Cheques themselves, I can't think of a good way to get that expense for a mechanic's time to show up on the P & L by Class report. Do you have any brilliant ideas?

I'm thinking it will mean some type of internal, clearing entry that would have a $0.00 affect but which would post to the Class. e.g. Create a Bill, enter the COGS account in the first line with the desired $ amount, enter the vehicle class. Enter the second line to the same COGS account, but with a negative value and do not enter the vehicle class. A net $0.00 Tx, but with the expense line going to the Class thus showing up on the report. It's a bit convoluted, and doesn't address the issue of not being automated directly from an Employee's cheque.

The only way I could see that working would be to set up each vehicle as a Job, and then allocate all expenses to the job, including mechanic's time. Then the job can be allocated in the pay cheque line by line. A P & L by Job report would give you all the costs for that job (vehicle), then you can make an invoice or sales receipt to the same job, overwriting the name and address with the actual name of the customer.

I like the idea of class tracking much better but it is just so damned annoying that you can't use different classes on an employee's cheque.

If you have a any better ideas, I'm all ears. Thanks!

Hello there, @Rochelley.

Thank you for reaching out to us with your concern about using classes. I will provide you the same answer as mentioned by my colleague Rasa-LilaM.

You should be able to use the Class feature since it's available to all desktop versions. Let’s go to the Preferences settings to turn it on.

Here's how:

Once done, QuickBooks adds a Class field to the windows where you enter transactions.

For further details on how to classify transactions using this feature as well as general tips, go to the Have a Question window. You'll have to open your company file to access it.

However, if you're using the online version, the following article provides an overview of the Class and Location tracking. Additionally, there are instructions to create categories and edit/delete a class or location: Set up and use class and location tracking.

Feel free to reach back out to me if I can be of more help with setting up classes. I'll make sure to get back to you as soon as I can.

I am in the process of setting up a new client who is a used cars dealer.

I will highly appreciate if you can shed some more light on setting up the inventory accounts and class for vehicles to record the COGS and other expenses appropriately.

My email ID is - [email address removed]

I just ran across your article and want to make sure I understand. I am also setting up a used car dealership.

Currently I am receiving an item and entering a bill to get the vehicles into inventory. In order to track COGS are you suggesting that each vehicle also have a class? If this works this would be great. I'm currently doing an Excel spreadsheet to track costs associated with each vehicle.

Thanks for your help

I am also setting up a used car dealership. Are you saying that each vehicle should have a class assigned to it in order to track COGS? I create inventory items using the last 5 digits of the VIN# for each car. Not quite sure how this would work. Would I create a class for using that same VIN#?

I currently receive an item & enter a bill for each vehicle we purchase, then I create an Excel spreadsheet to track COG per vehicle.

Thanks for your help

Hello, pwstill.

Class tracking in QuickBooks is an opt-in feature that allows users to group expenses or invoices by location, department, or any other meaningful segment of your business. You can assign a class to many types of transactions, including:

Costs of Goods Sold (COGS), tracks all of the costs associated with the items you sell, which allows you to calculate gross profits accurately. Additionally, Cost of Goods Sold (COGS) is used to successfully track inventory.

For more information about these features, check out the following articles:

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success. Stay safe!

Can you send me a walkthrough for this please? Thank you

[email address removed]

Hello there, KathleenMG.

In QuickBooks Online, tracking your income and expenses for different departments is made easier using the Class or Location tracking. These two features let's you run through account balances by department, business office or location, separate properties, or any other meaningful breakdown of your business, and other segments you want to keep a close eye on.

To turn these features on, follow the steps below:

Meanwhile, your company has multiple branches so the Location/Class tracking feature is also application to your scenario. You can use these links as your guide:

If you have additional questions about class tracking, please don't hesitate to ask. I'm here to help however I can. Have a good one.

@DesertMarshall wrote:When you purchase the vehicle, enter an Expense that shows you paid a certain amount for the vehicle from the auto auction or whoever sold you the vehicle. Make sure you also select the class for the vehicle in the expense transaction for purchasing the vehicle. This will increase your inventory by 1 for that vehicle and increase your inventory asset account.

Hi,

I cannot achieve this. It's exactly what I need but my inventory quantity will not increase by 1, nor does it update the Vehicle Stock Inventory (Asset Account) I have selected in my product. Been scratching my head for hours!

Any help would be appreciated!

Thanks,

John.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here