Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI made a purchase on my business credit card for $34.92 and later returned that item. For whatever reason, the refund later posted at $38.03 with a difference of +$3.11.

How do I do a credit card refund when the amount is different than the original?

Thanks,

Matt

RE: How do I do a credit card refund when the amount is different than the original?

Why would it matter? I think just enter a Credit Card Credit for whatever your refund is.

Thanks for giving on-point details about your credit card refund concern, Matt554.

We can use the Credit card credit transaction to record a credit card refund. This way, it will be recorded to your credit card register in QuickBooks Online (QBO). Then, we'll need to create a separate line item for the $34.92 and the amount difference of +$3.11. In this case, I'd recommend consulting your accountant on what account you'll need to apply. See the screenshot below:

Here's how to create a refund:

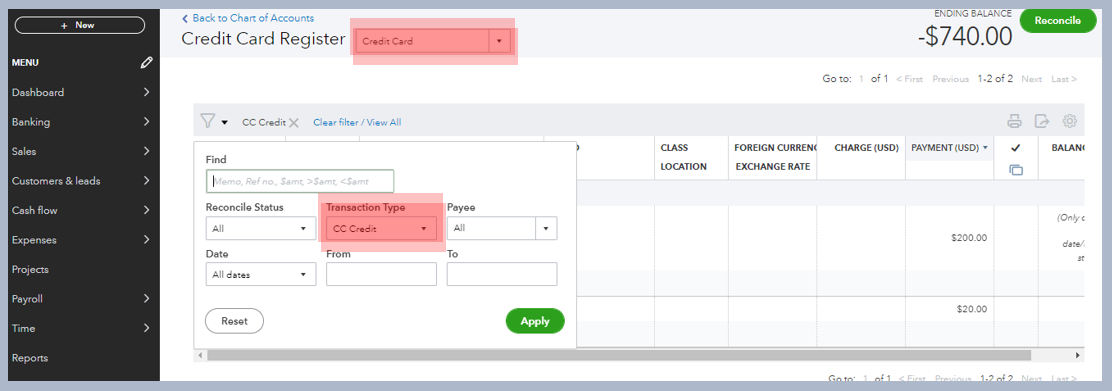

You'll want to run data to see Credit Card refund transactions. Just go to the Filter icon in the Credit Card register and choose CC Credit from the Transaction Type. Then tap Apply. Please take a look at the screenshot below:

I'm also adding here some articles that you can visit about entering a vendor credit and recording credit card payments:

Let me know if you have any clarifications or need further assistance when issuing a refund in QuickBooks. I'll make sure you're all set. You have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here