It’s nice to see you in the Community, anixon.

When removing a sale that didn’t happen, the process depends on how the first transaction is recorded in QBO. The solution is scenario-based and I suggest following the one that fits your situation.

Let me share one of the resolution steps. For example, the customer made a prepayment for an order but canceled it before receiving the goods or services. Create a check or expense to record the refund for your customer.

Then, link it to the credit to reduce your bank's balance and offsets the client’s open credit, overpayment, or prepayment. Let me share the steps on how to accomplish these tasks.

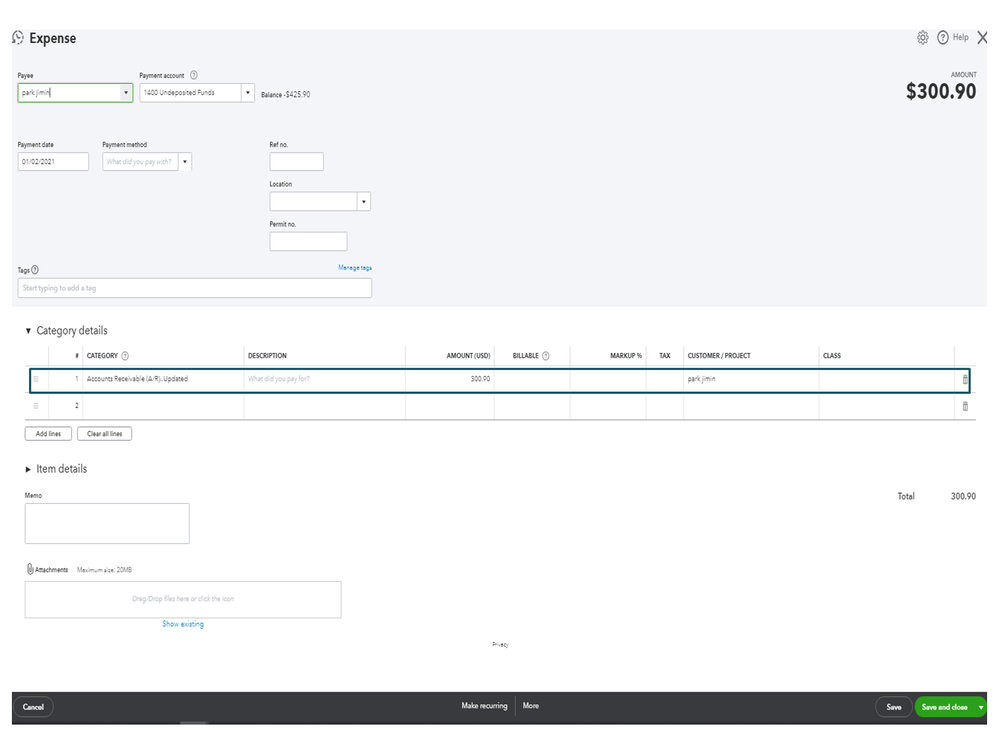

- In your QBO company, tap the New menu to choose Expense or Check under Vendors.

- In the Expense or Check page, click the Payee drop-down and pick the customer’s name.

- From the Payment account drop-down, select the bank account where you deposited the overpayment.

- In the Category details section, go to the first line and enter Accounts Receivable.

- Type how much you want to refund in the Amount field.

- Fill in the remaining field boxes and hit Save and close.

To associate your client’s credit:

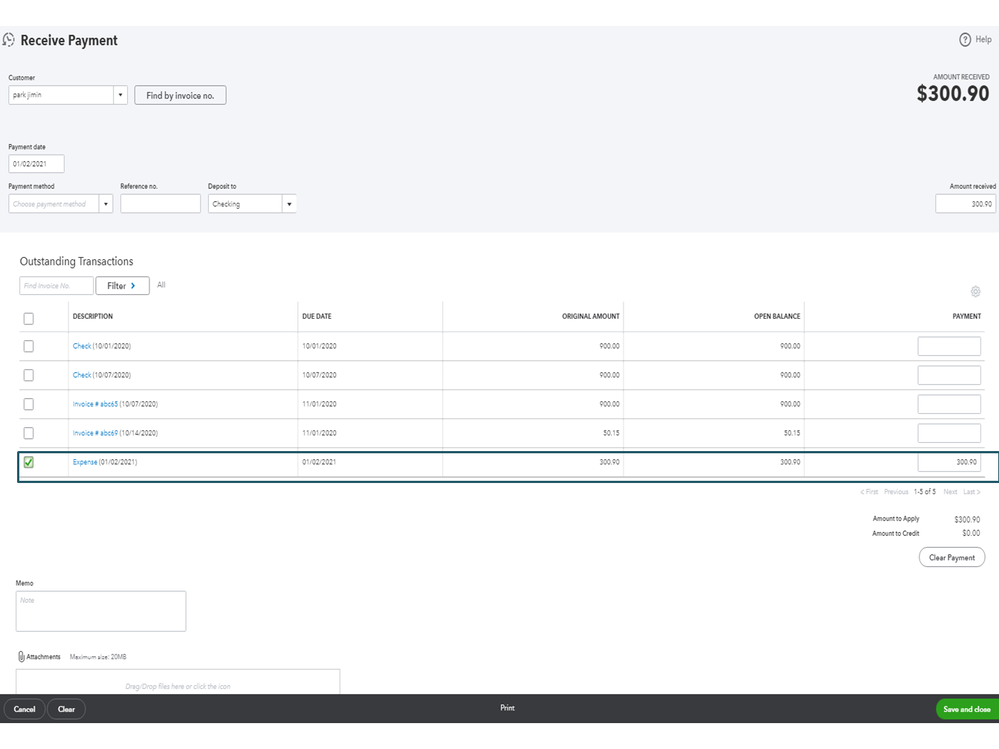

- Hit the New menu and pick Receive payment under Customers.

- Key in the correct client you used for the check or expense in the Customer field.

- Fill in the field boxes.

- Under the Outstanding Transaction section, tick the box for Expense or Check.

- Make sure the payment is equal to the open balance.

- Press Save and close.

However, if this isn’t what happened, choose the right solution found in this article: Record a customer refund in QuickBooks Online.

For future reference, these resources will guide you on how to manage the following processes.

Stay in touch if you have additional questions or concerns. I’ll pop right back in to answer them for you. Have a good one.