I know a way on how you can send the donation details to your donors, @ahstdclubfootbal.

You can run the Sales by Donor Detail report in QBO and email it to your donors afterward. This way, you can send the details of their donations since the system isn't able to generate a donor's statement.

To do that:

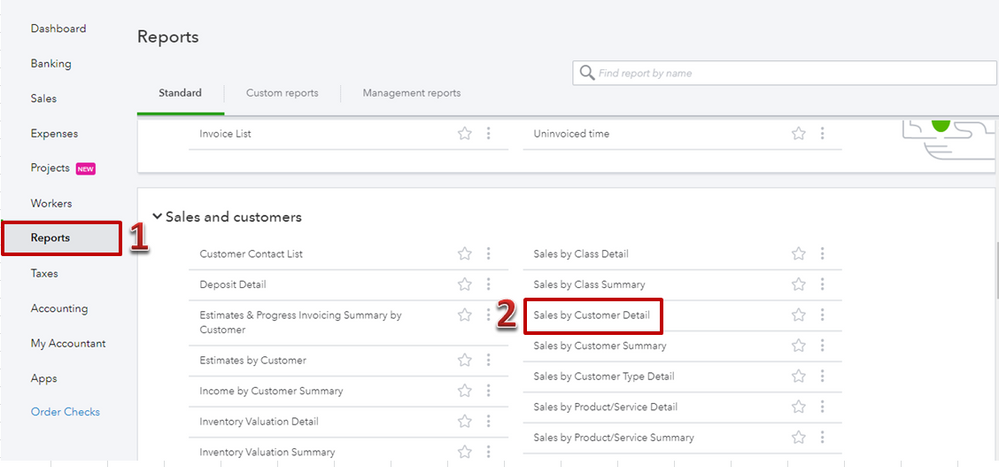

- Go to Reports from the left menu and enter the report name on the search bar to quickly locate it or browse the categories listed.

- Select the Sales by Donor report to open it.

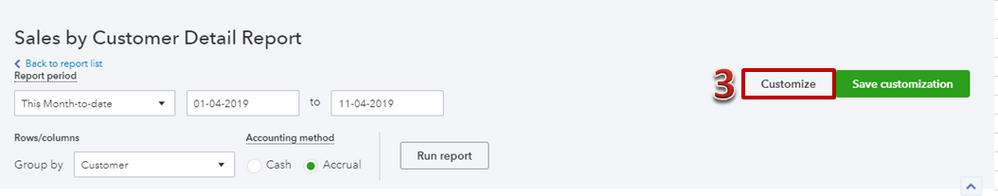

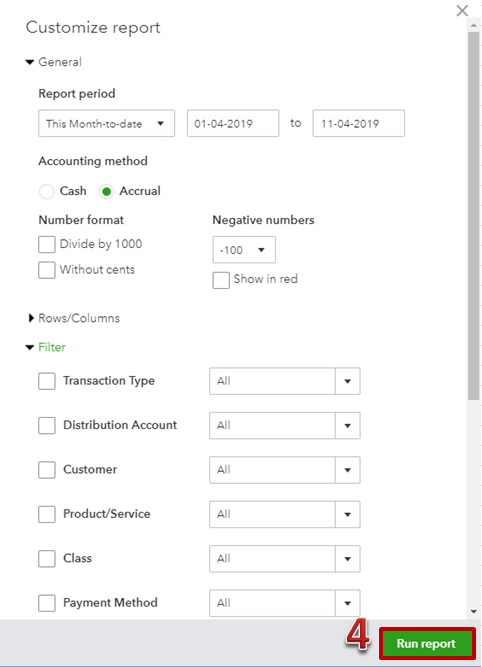

- Click Customize to only show the information you want.

- Hit Run report.

After that, you can hit the Email button at the top, then send it to your donors:

Here’s an article for more information: Run reports in QBO.

You can also export the report to Excel and send it from there. Let me show you how:

- Follow the steps above to run the report.

- Click the Export icon.

- Choose Export to Excel.

Check out the video tutorial on this article for visual reference: How to export reports to Excel.

Please let me know if there's anything else that I can help with QuickBooks. I'm always here to assist. Have a wonderful day.