Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI issued a P.O., received some of the items and a bill, and paid the bill.

But the cost does not show up in the right Cost of Goods sold account, or anywhere else as far as I can tell.

Why not?

Besides, the payment came out of the bank account, so there must be another entry somewhere. Where is it?

Glad to see you in the Community, byomtov.

I’m here to help clarify why the cost didn’t show up in the Cost of Goods Sold account. Then, provide a solution to find the cost for purchased items.

The Cost of Good Sold (COGS) will only be realized when the item is being sold out. That’s why the cost will not show on the COGS account.

The Purchases Reports in QuickBooks provide information about the business’s purchases from each vendor, item, and complete details of the transactions. Allow me to share some details for each one.

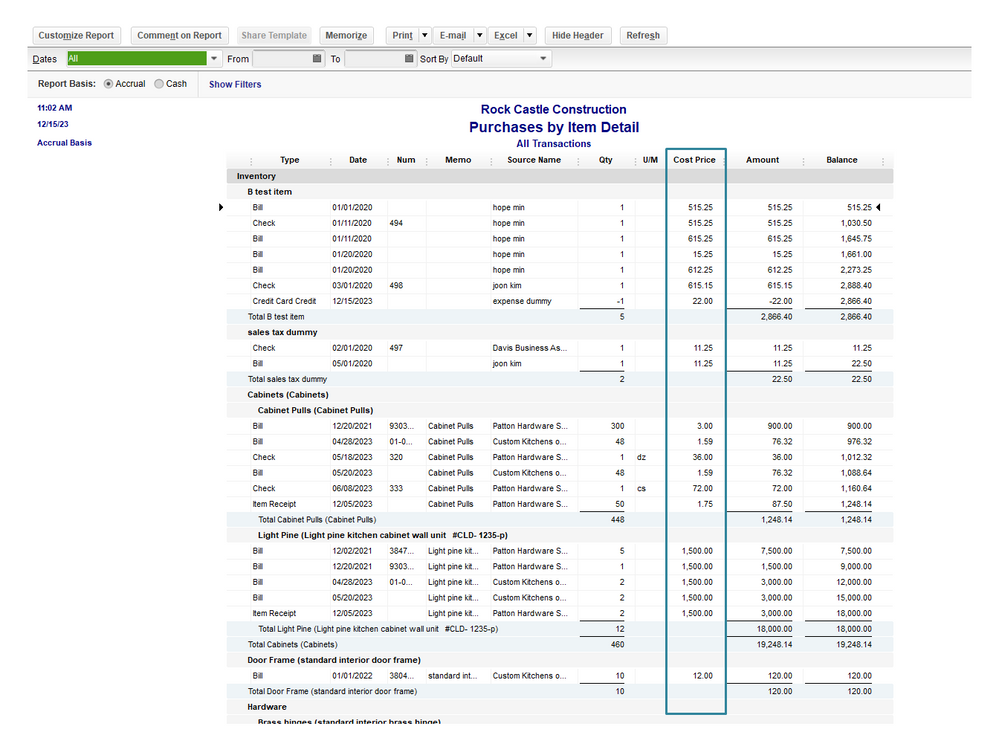

Let's try running the Purchases by Item Detail Report to check the cost of the products. From there, you'll see the transactions associated with the items. Here’s how:

If you want to build any of these reports, follow Step 1 above and then choose the right one you can to view. Check out the Understand inventory assets and the cost of goods sold tracking article for additional resources. It provides detailed information on how QuickBooks handles inventory assets, average cost, and Cost of Goods Sold (COGS).

Stay in touch if you have any clarifications or questions about QuickBooks. I’ll be right here to answer them for you. Have a good week.

Thank you, but I should have made clear that this is a non-inventory item. The expense should be charged to the account specified in the item description.

The system seems to have worked that way in the past.

Hi there, byomtov.

Generally, the bill (expense) will show in the Cost of Goods Sold account if you've selected COGS as the account for that particular non-inventory item. We can run the QuickReport option to view a report of transactions involving the COGS account.

Additionally, please make sure to clear all the filters and select the appropriate report basis or accounting method. It could be that a certain filter was applied to the report that's why the bill isn't showing.

Here's how to do it:

I encourage reading this article to know more about how COGS account and inventory assets work in QuickBooks Desktop: Understand the cost of goods sold tracking.

If you have a list of products or services you sell in a spreadsheet, you can also import that information into QuickBooks.

I'll be right here to keep helping if you have any other concerns or follow-up questions. Assistance is just a post away.

Yes.

I know it should show up there.

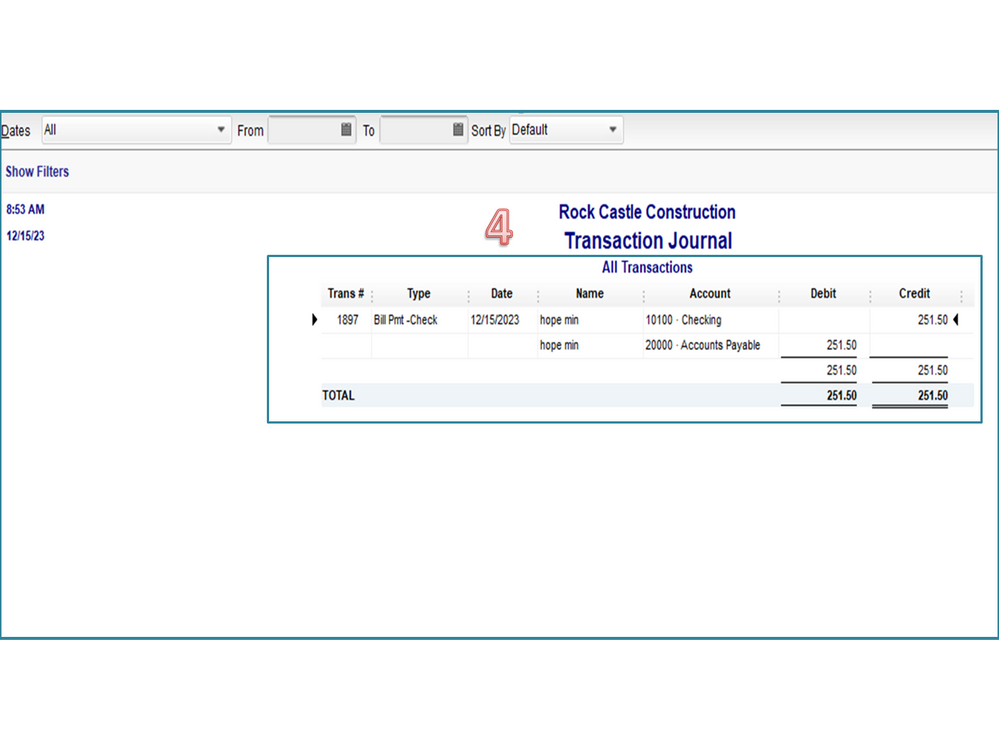

My problem is it's not showing up. Is there some way to find where it is. Since the payment shows up in my bank account there must be an offsetting entry somewhere.

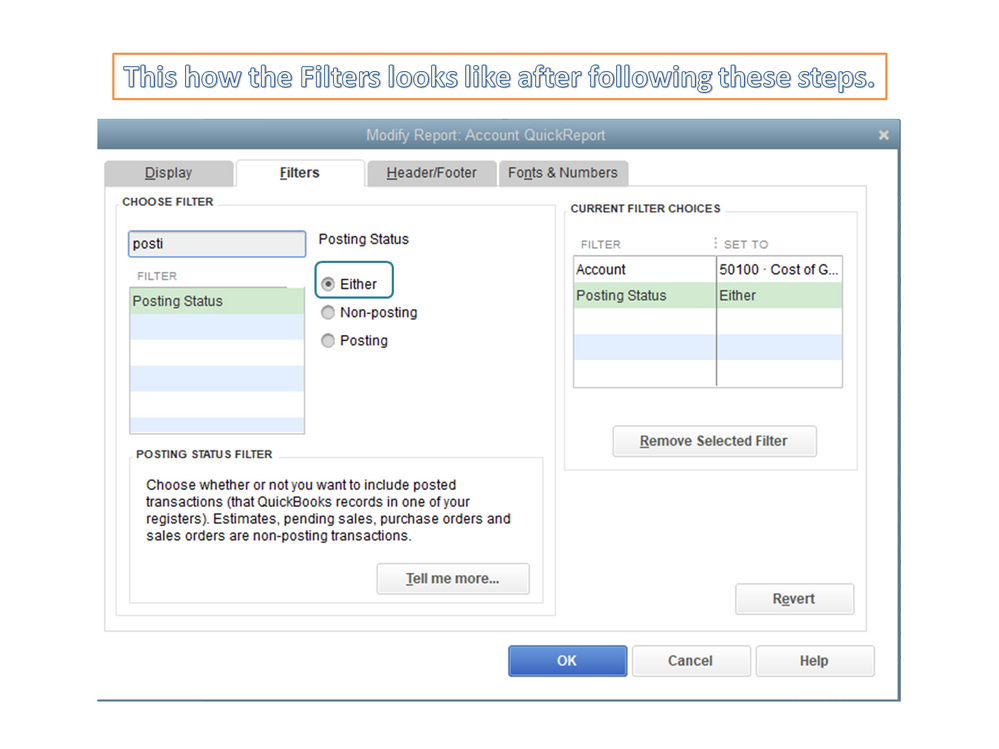

Could this have something to do with "posting" or "non-posting" status? What does that refer to?

I know it should work that way.

My problem is it doesn't always seem to.

Apparently, when I get the bill it goes into Accounts Payable, and then back out when I pay it.

But why doesn't it show up in my COGS account. There seems to be something about "posting" vs. "non-posting" involved, though I can find nothing about that in the manual or on the support site.

I appreciate you for adding more details about the issue, byomtov.

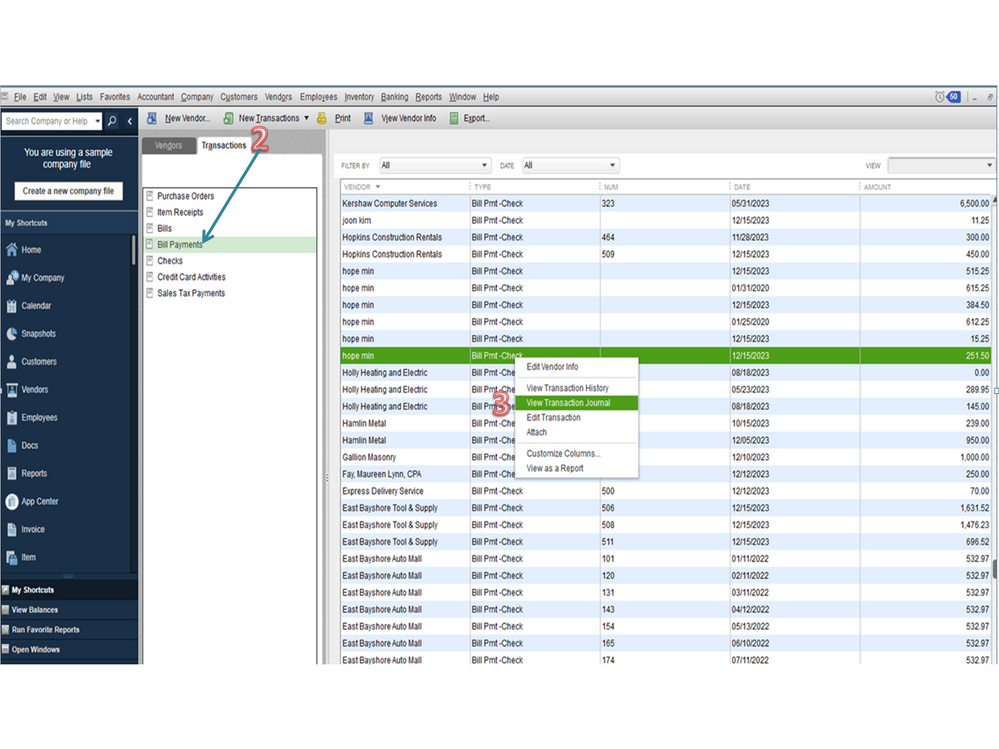

Let’s open the Filters tab to check the posting status. The option selected affects the data that will show on the report. If it’s correct, open the transaction journal to check the offsetting account.

Allow me to assist in performing this task in your company file. Here’s how to review the posting status.

To view the transaction journal:

For additional resources, let me share the Customize reports in QuickBooks Desktop for Mac guide. It provides detailed information on how to use the report filters, change font/colors, format a report, etc.

Additionally, the Keyboard shortcuts in QuickBooks Desktop article lists all shortcut keys to help easily navigate and perform any processes in your company file. Go to the QuickBooks Desktop for Mac section to view more information.

Stay in touch if you need help customizing the report or running the transaction journal. I’ll jump right back in to assist further. Have a good one.

Right clicking doesn't seem to do anything. Neither does control-clicking. (I'm on a Mac, remember).

I have two separate PO's that are having this problem. One shows up in my COGS act when I select "either," theater one not at all.

Can someone pleas explain what is going on here? I've looked at all these reports and they haven't been helpful.

Neither right-clicking nor control-clicking does anything.

Anyway, I've looked at these reports and haven't learned much.

Can someone please just tell me what's going on here.

What causes the purchase of a non-inventory item to show up in the COGS account? For what reason might one not show up?

Please.

Thanks for coming back, @byomtov. I'm here to add more information about why the purchase of the non-inventory item to show up in the COGS account.

The cost of goods sold is only calculated in the way you're expecting for inventory items. For non-inventory items, the cost is recognized as you purchase the item, by including it on a purchase transaction such as a bill or check or credit card charge, depending on how you paid for the item.

About the inability to right-click the transaction, we can use the Verify and rebuild data tool in QuickBooks Desktop for Mac. This is to help us identify the most common data issue in a company file and fixes it.

Here's how:

Verify your company file data

Rebuild your company file data

For future reference, read through this article: Understand Inventory Assets and COGS Tracking. It'll help you learn more about how QuickBooks handles inventory assets, average cost, and COGS. It also guides you on deciding which reports you'll need to run to effectively track your inventory.

Feel free to message again if you have additional questions. We're always delighted to assist.

Thank you.

You say, "For non-inventory items, the cost is recognized as you purchase the item, by including it on a purchase transaction such as a bill or check or credit card charge, depending on how you paid for the item."

This is exactly what I expect to happen, but is not happening. This is the problem I am trying to solve.

I have explained this repeatedly.

I appreciate your time getting back here, byomtov.

I'd like to point you in the right direction who can investigate more on the issue. You can reach out to our Customer Care Team by following the steps below. Before doing so, please check out our support hours here.

You can always here if you have additional questions or other concerns. I'm always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here