Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Are you running the P&L report on cash basis? On cash basis, COGS will get booked when you pay the bill, just as you describe.

Welcome to the Community space, Holbren.

I appreciate you providing details about your concern for today. Let me help you properly account for your transactions in QuickBooks Online.

Normally, inventory Cost of Goods Sold(COGS) is only affected when you sell inventory items on invoices or sales receipts. If the inventory sold doesn't have any purchase transaction, then this will post as zero COGS when you used it on the invoice. This article will provide a deeper explanation of how COGS works in QuickBooks: Understand inventory assets and cost of goods sold tracking.

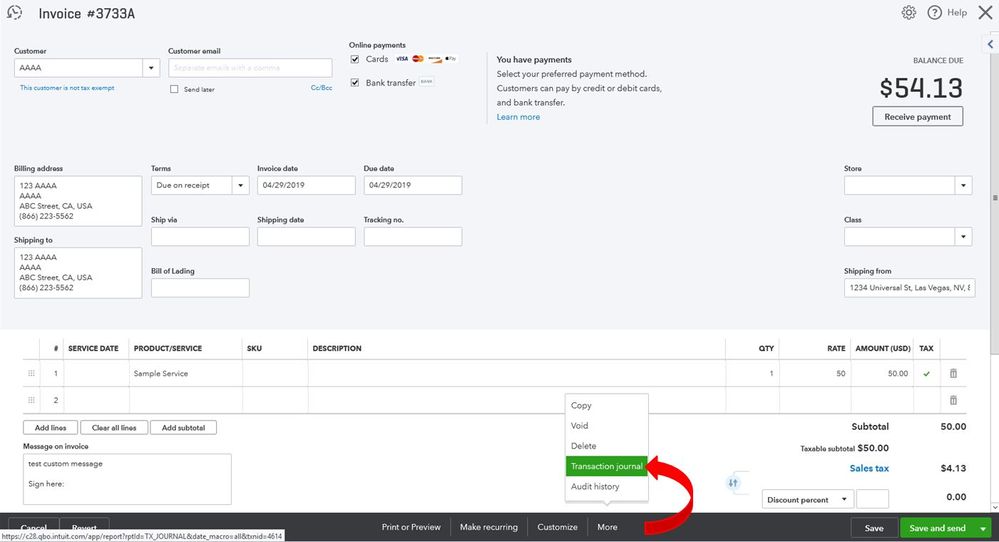

To better isolate this, we can check the transaction history of those invoices that don't post to the COGS. This way, we can verify if the posting is correct. You can also run the Transaction Journal report to track the posting accounts of the invoice/bill transaction. Here's how:

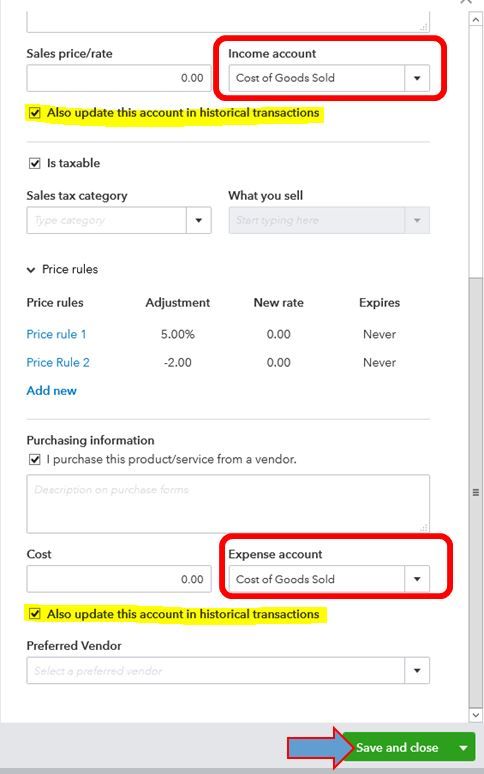

You can assign a specific account on your service items. That way, you can easily track their posting account when creating transactions. Follow the steps below to edit the service item.

That should keep you going today. To give more information about managing inventory and what reports are available in QuickBooks Online, check out the following articles:

I'll be right here if you have further questions while working with inventory. Keep safe and have a good one.

Thanks for the information, I'll take am ore in depth look. My products are set up properly as far as the cost of goods sold account in the production information. I sell hard goods, not services. Each item obviously has a cost and resale. What I find odd is when I run a P&L and click on cost of goods sold, which is very inflated, all transactions are from bill payments. Not one Invoice showing up in that data, all bills.

Are you running the P&L report on cash basis? On cash basis, COGS will get booked when you pay the bill, just as you describe.

Thank you, that fixed my issue. My account years ago said to use cash basis but I was running QB Desktop so maybe there was a difference.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here