Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Hello @Anonymous,

As of the moment, tracking your items with the unit of measure is only available for the following products listed below:

If you're not using these products, you may want to consider manually tracking your inventory items.

That being said, you'll need to create two sets of items, one for the inventory (pigs) and the other is for the invoice transaction (cuts). Since you're not tracking the quantity of the meat for invoices, you can consider it as a non-inventory item.

Further, you'll have to manually adjust the quantity of your items upon creating every transaction. Once the inventory (pigs) has been processed as meat and ready to be sold, it'll remove an item on the total quantity of your inventory.

To illustrate:

I've got you this helpful article to learn more about how you can manually track the quantity of your inventory: Set up Advanced Inventory.

If there's anything else that I can help you with, please let me know in the comment section down below. I'm always around happy to help.

I'm sorry. I realize that I misstated livestock as fixed assets. They are not; they are inventory assets unless they are for breeding.

We're unable to determine which account you need to use, PVOLLC.

If you're not sure on what account to use, I recommend reaching out to your accountant. The will be able to help you on that.

As for the individual cuts for sale, you can add them as a regular item. Here's how:

We can only guide you through setting up inventory items and accounts. Reach out to your accountant to make sure you're using the right account.

Here are some articles that can help:

I'll be around if you have more questions. Don't hesitate to leave a reply.

I'm sorry, I thought I clarified but my post was pretty jumbled. I don't need you to tell me what kind of account I need to assign to various things. Let me ask it this way...

I know that livestock for sale are Inventory Assets. How do I link my sales of individual cuts to the Inventory Asset account I have for my livestock?

For example, say I buy 10 pigs. I enter them into QuickBooks as Inventory Assets. I then take one pig to market and have it processed into individual cuts of meat. I then sell those cuts of meat to a customer. How do I set up QuickBooks so that both my COGS for the individual cuts and my income for the individual cuts properly debit the Inventory Asset account?

Thanks for adding more details about your concern, @Anonymous.

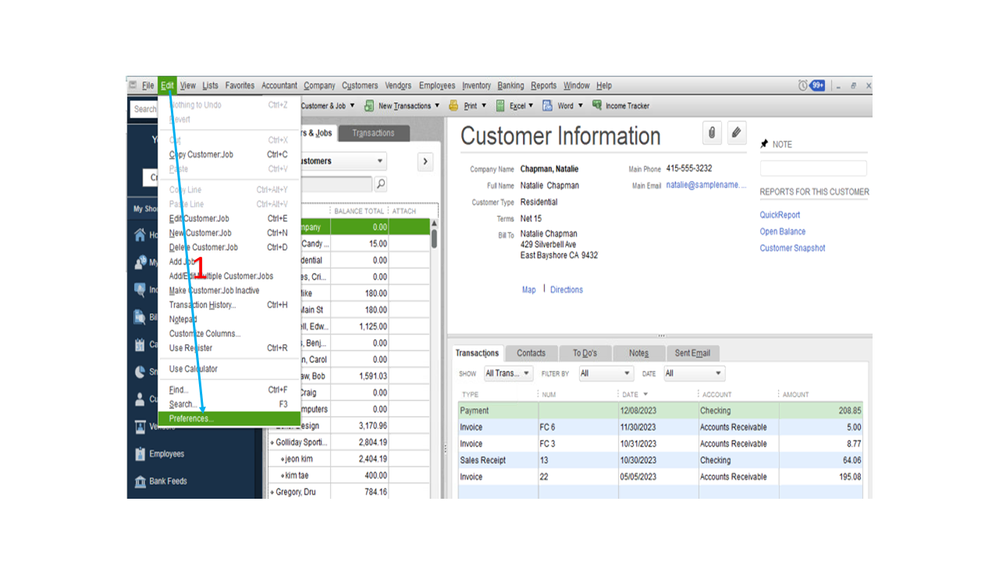

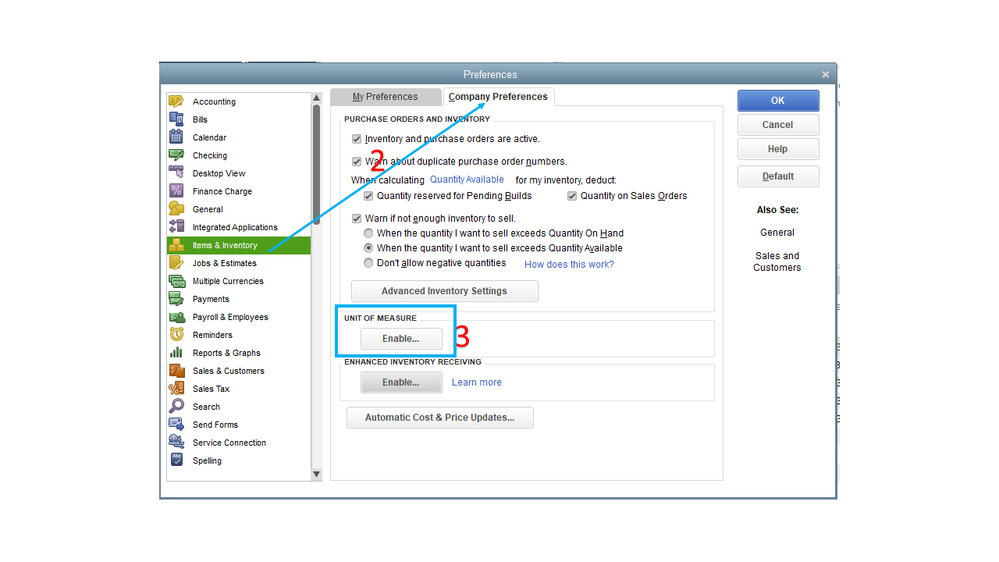

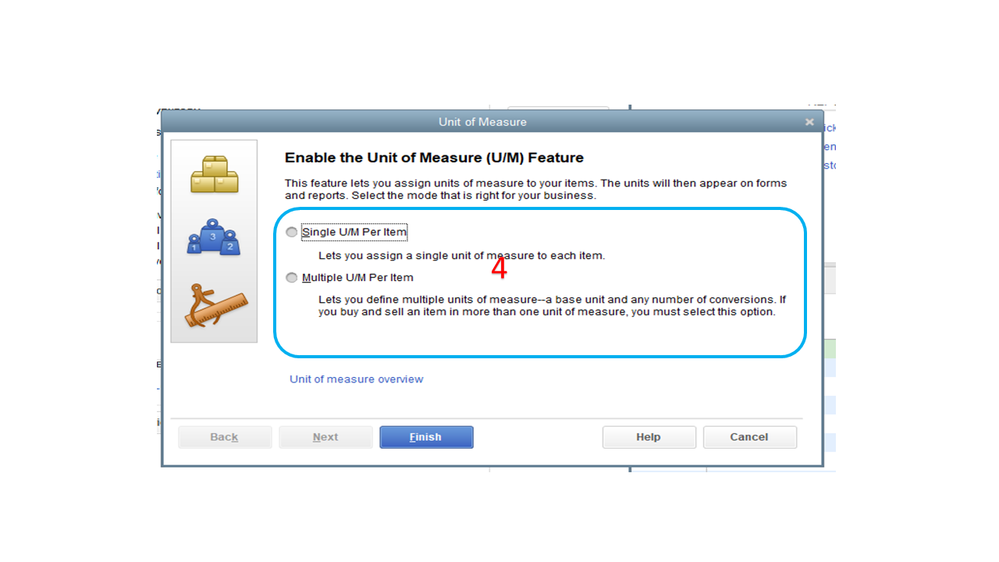

We’ll have to use the Unit of Measure feature to properly track the inventory items. Here’s how:

After adding it, let’s add the meat cuts as inventory items in QuickBooks.

When adding a product, QuickBooks automatically sets the Cost of Goods Sold and Inventory Asset accounts. The desktop program will debit the Inventory Asset account every time you create a transaction.

For more in-depth details about the Unit of Measure option and how it can help the business efficiently manage items, check out this article: How do I?

If there’s anything else I can help you with, leave a comment below. I’ll be right here to assist further. Have a good one.

Thank you for this. The Enable Unit of Measure Button is greyed-out.

Also, I should probably clarify a bit more about how my business works.

I raise a pig. I take it to the butcher. The butcher processes the pig into cuts. The cuts are then picked up and taken directly to my customer. I invoice my customer for them.

Because of this, I never actually carry the individual cuts as inventory. The inventory units are the pigs themselves; they're converted into cuts at the butcher.

So even though I'm billing my customer for the cuts (because they buy by the cut), I never have the cuts themselves as inventory. I would like to be able to track this conversion (Inventory=Pig to Invoice=Cuts).

Hello @Anonymous,

As of the moment, tracking your items with the unit of measure is only available for the following products listed below:

If you're not using these products, you may want to consider manually tracking your inventory items.

That being said, you'll need to create two sets of items, one for the inventory (pigs) and the other is for the invoice transaction (cuts). Since you're not tracking the quantity of the meat for invoices, you can consider it as a non-inventory item.

Further, you'll have to manually adjust the quantity of your items upon creating every transaction. Once the inventory (pigs) has been processed as meat and ready to be sold, it'll remove an item on the total quantity of your inventory.

To illustrate:

I've got you this helpful article to learn more about how you can manually track the quantity of your inventory: Set up Advanced Inventory.

If there's anything else that I can help you with, please let me know in the comment section down below. I'm always around happy to help.

Excellent explanation! Thanks everyone.

I work at a large butcher shop/processor that kills hundreds of hogs each week and cattle as well. There are several factors that need to be taken into consideration, and I don't know that QB has a solution. First off, pigs and cattle all weigh different weights. Even if you have two pigs of the same weight, the finished product or total sellable items will vary due to the customers' options on how they want the pig or beef broken down. The processor will bill you by the weight, regardless of how many pork chops or steaks you cut out of the carcass, unless some odd special cuts are requested. Either way, you can't really inventory each packaged item (pork steaks, pork chops, sliced or slab bacon, etc.

I personally believe that you will need to come up with a finished package or item that is billed by the pound, just as you are being billed. That is your cost of goods. You have your cost of purchasing the piglets, raising them, then the slaughter house processing fees. Then you have the finished items to sell by the whole or half hog processed.

The meat industry primarily works on pounds, as I mentioned, because no two animals are exactly the same. I hope this helps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here