Thank you for reaching out to us here on the Community page, @rhiannon-theurer.

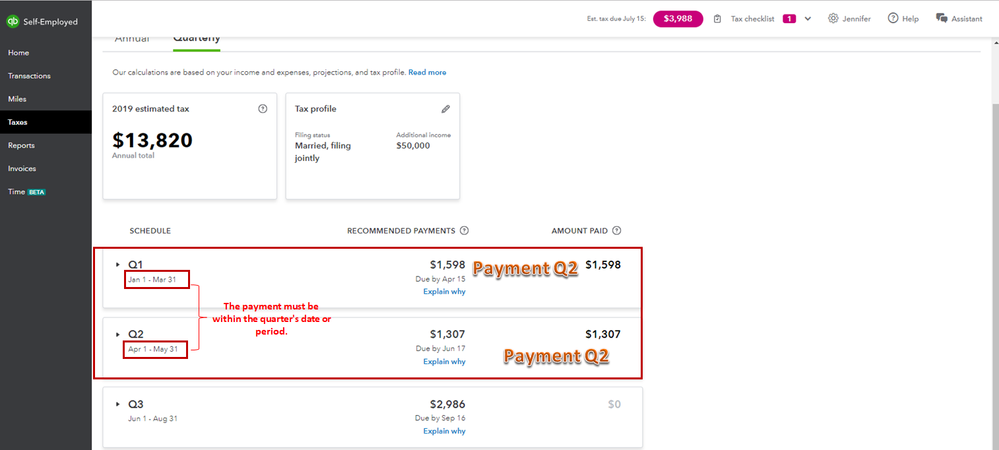

The date used when recording the payment must be within the quarter your paying so it'll show up under the Amount Paid column. If the date of the payment is incorrect, then you can edit it by following these steps:

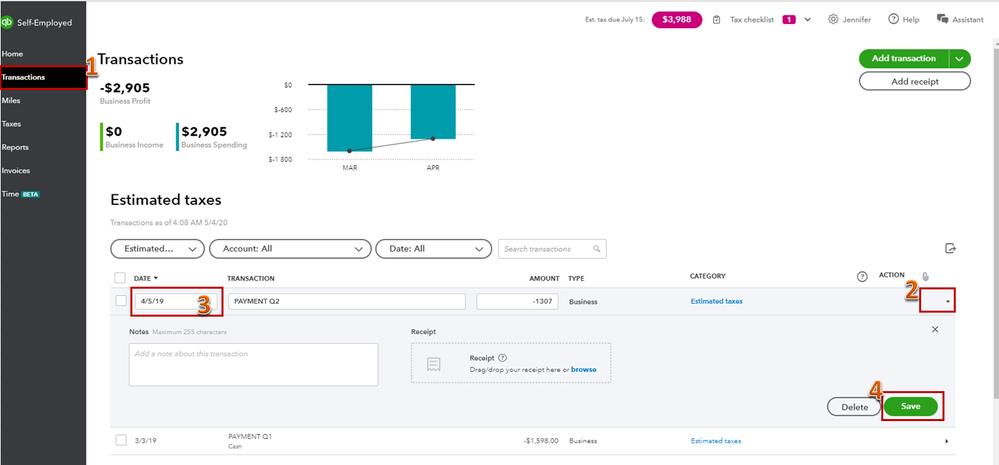

- Sign in to your QuickBooks Self-Employed account, then click on Transactions at the left pane.

- Look for the estimated taxes recorded, then click on the arrow under the Action column.

- Input the correct date under the Date column.

- Tap on Save to record the changes.

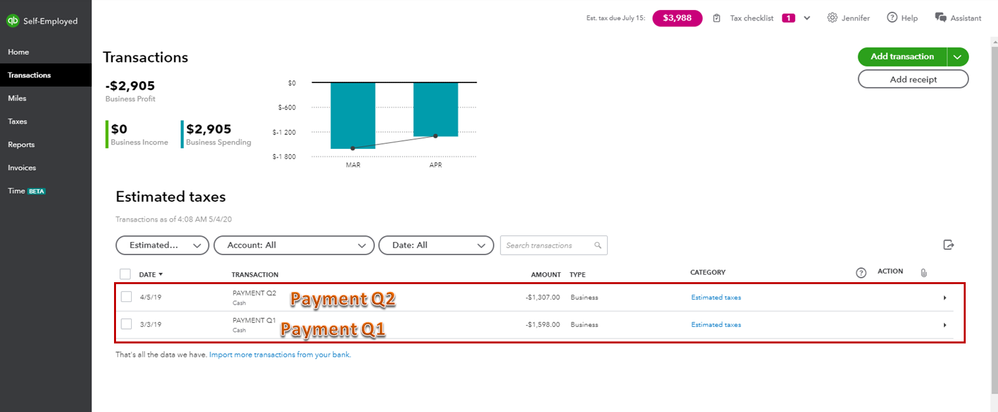

I've added these screenshots for your visual reference.

Also, check out this article for more information about estimated taxes.

Let me know if you have any other questions by adding a comment below. I'm always here to help. Have a good day!